On October 16, 2023, Bitcoin’s difficulty impressively crossed the 61 trillion mark at block height 812,448, setting a fresh benchmark for the network. This ascent marked the fourth-largest rise in difficulty for the year. Yet, in the face of this increase, the hashrate has steadily and unflinchingly risen.

Bitcoin’s Difficulty Explodes to 61 Trillion, Hashrate Unyieldingly Marches Onward

On the heels of a 6.47% leap on Monday, Bitcoin’s difficulty peaked at an unprecedented 61.03 trillion, signifying the year’s fourth most significant spike. Miners previously navigated two back-to-back hikes: a 5.48% rise on September 19, followed by a slight 0.35% nudge upward on October 3.

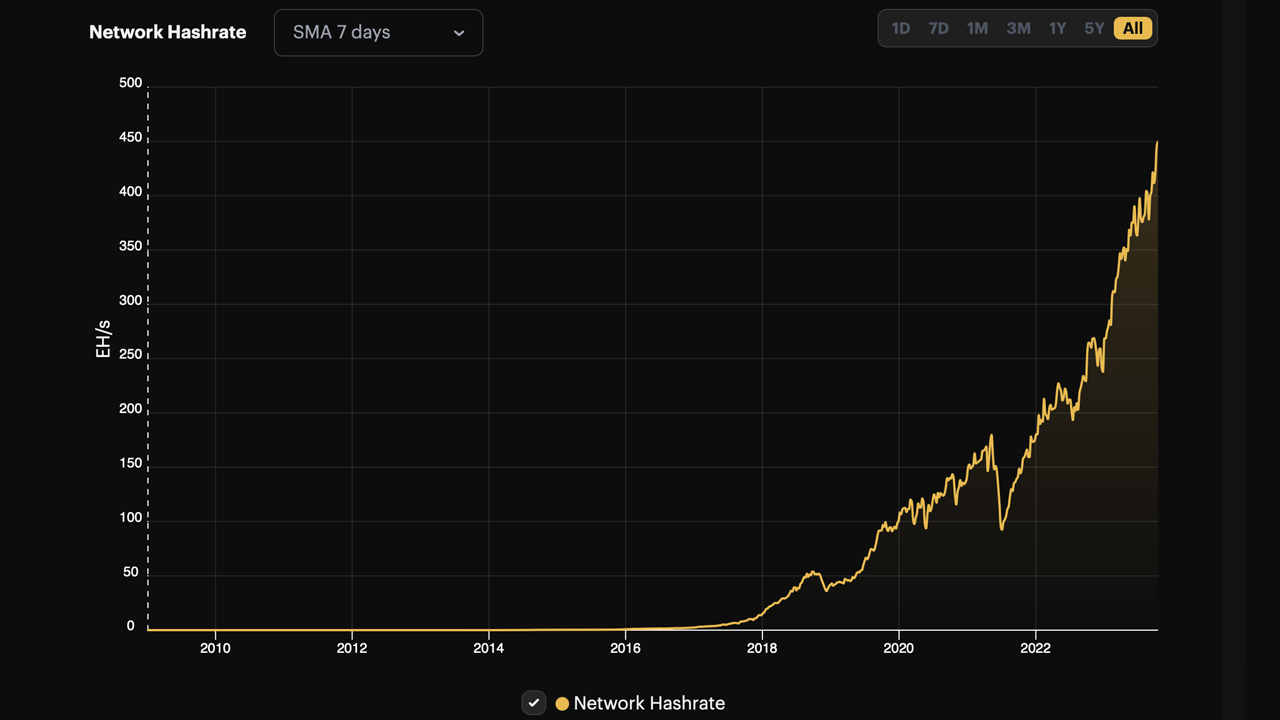

Yet, despite these challenges, the hashrate is approaching its zenith, closely mirroring the high seen on October 12, 2023. By Tuesday, October 17, post the 6.47% surge in difficulty, the hashrate gracefully sails at 444 exahash per second (EH/s).

About 42 mining coalitions are pouring their hashrate into the Bitcoin chain, with the top five being Foundry USA, Antpool, Viabtc, F2pool, and Binance Pool. Over the last three days, Foundry has taken the lead, contributing 133.25 EH/s or 30.15% of the overall network’s hashrate, while Antpool churned out 116.95 EH/s, constituting 26.46% of the collective hashrate.

Come October 29, 2023, the next anticipated shift in difficulty is set to roll out after over 1,800 blocks are discovered. Notably, block intervals have consistently fallen short of the typical ten-minute mark, ranging between 9 minutes and 13 seconds and 9 minutes and 37 seconds.

The current block times suggest (unless things change) that if the hashrate persists in its vigor and block durations linger below the ten-minute threshold, we might see another hike. Projections currently hint at a potential increase anywhere between 0.18% to 4.2%.

What do you think about Bitcoin’s latest difficulty increase? Share your thoughts and opinions about this subject in the comments section below.