Leading cryptocurrency Bitcoin has experienced volatile movements over the last few weeks. Despite its volatility, staunch holders of the asset recently added about $1.7 billion worth of Bitcoin to wallet addresses used for accumulation. The holdlers of the asset made these significant deposits in a day when the asset saw a decline to trade under $63,000.

Bitcoin records boost in accumulator wallet deposits

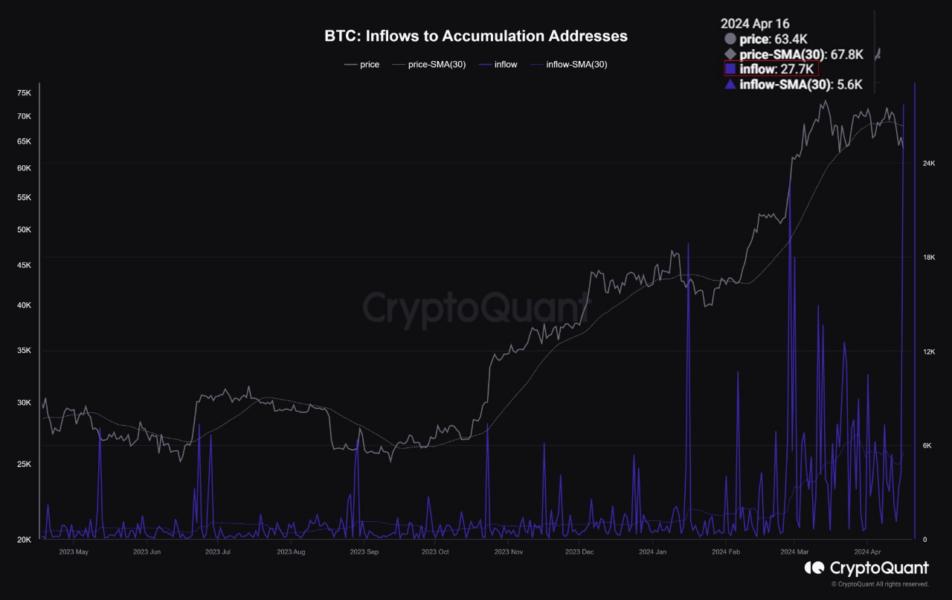

According to data from CryptoQuant, the $1.7 billion worth of the asset is around 27,000 BTC in the present market. The transactions were made from April 16 to 17, setting a new daily record for Bitcoin.

The previous record, 25,000 BTC was also made on March 23 when the price of the digital asset was around $63,500. This data proves that traders have been buying the asset when the price is close to that range. It also suggests that long-time holders of the asset are not panicking due to the volatility.

An accumulation address is a Bitcoin wallet with only a history of deposits and holds about 10 BTC. Addresses that belong to exchanges and miners have been removed from the list of these accumulation addresses. The addresses were also active in the market at a point over the last seven years. With the halving event coming up, there has been a lot of discussion in that regard.

Analyst predicts positive posts-halving rally

According to pseudonymous trader Rekt, this is the last period that traders can buy a lot of the asset before its post-halving rally. The trader noted that the asset is presently experiencing the same cycle that it has undergone across its previous halvings.

Rekt noted that the recent price correction is a pre-halving ritual as he expects the asset to push back up significantly. Noticeably, Bitcoin suffered a 14% dip after it recently touched an all-time high figure on March 13.

With the upcoming halving set for April 20, Rekt feels that Bitcoin could be set for a re-accumulation phase. The trader noted that once Bitcoin leaves the re-accumulation stage, it will start a parabolic uptrend. “Historically, this phase has lasted just over a year (~385 days) however with a potential Accelerated Cycle occurring right now, this figure may get cut in half in this market cycle,” he said.