The total assets managed by crypto exchange traded notes have eclipsed $100 billion.

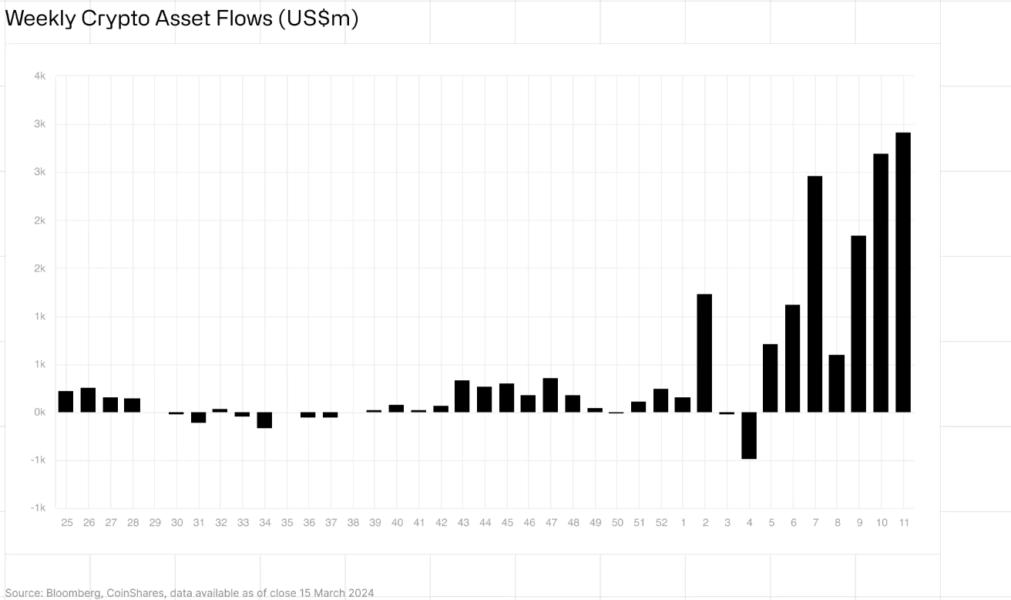

U.S. spot Bitcoin (BTC) investment products had another record weekly inflow, with $2.9 billion in new assets added.

According to a March 18 report by digital asset investment company CoinShares, year-to-date, a total of $13.2 billion in new capital has flowed into investment products such as spot Bitcoin ETFs, with $74.61 billion worth of Bitcoin now under custody. Bitcoin products accounted for 97% of the total inflows. "Digital asset investment products saw record weekly inflows totaling US$2.9bn, beating the prior week's all-time record of US$2.7bn," wrote CoinShares analyst James Butterfill.

Interestingly, Ether (ETH) and other altcoin investment products have not been as popular with investors, with their year-to-date inflows combined amounting to a tiny fraction of the total that has gone into Bitcoin. Furthermore, despite an all-time high ETF inflow, the price of Bitcoin has tumbled by 7% in the past week and now trades at $67,418 at the time of publication.