Bitcoin is in the middle of the harshest correction we’ve seen since 2022 when SBF took us all down with him. Though it broke all-time highs, the crypto diva has been stalling for months now.

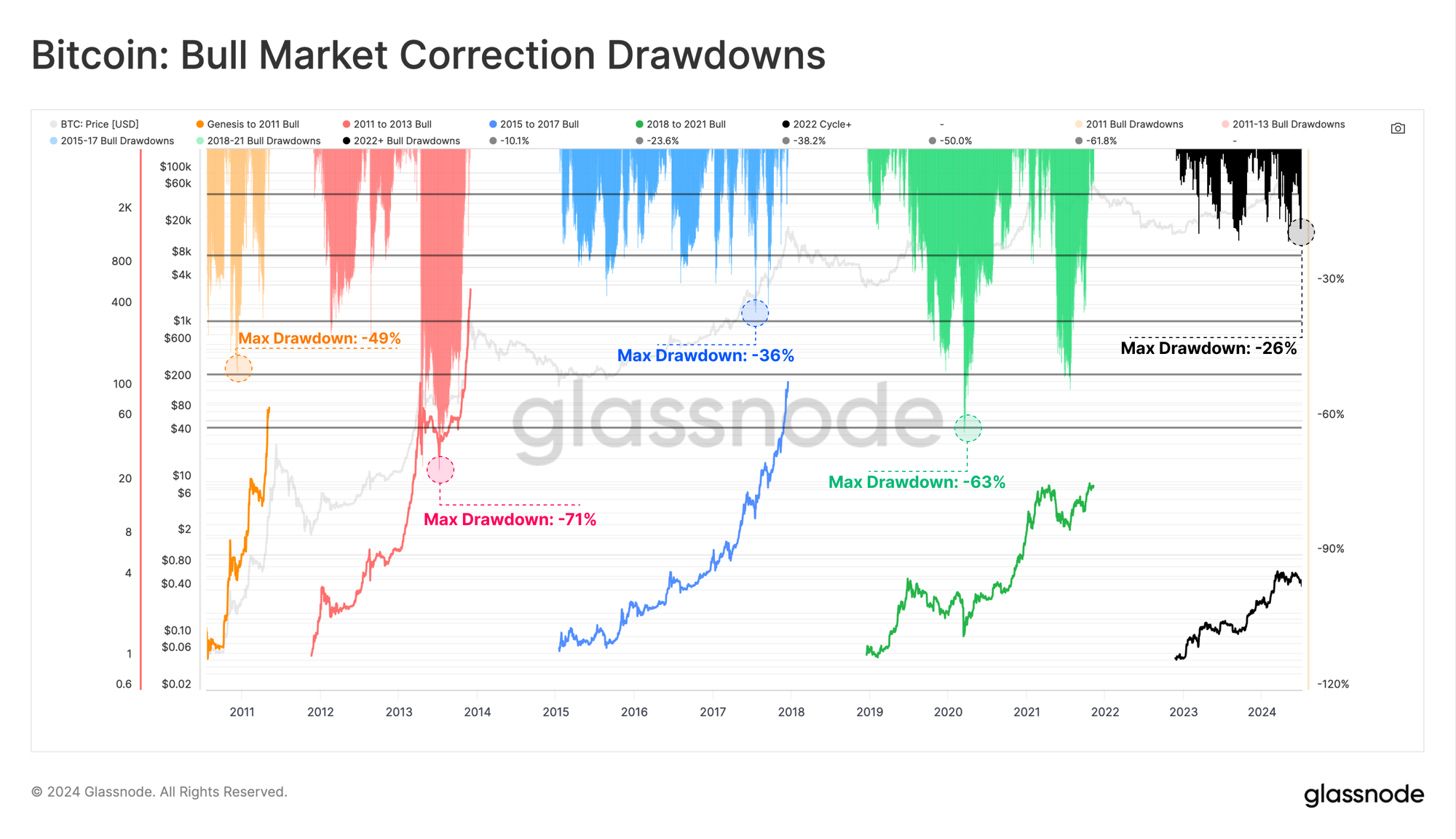

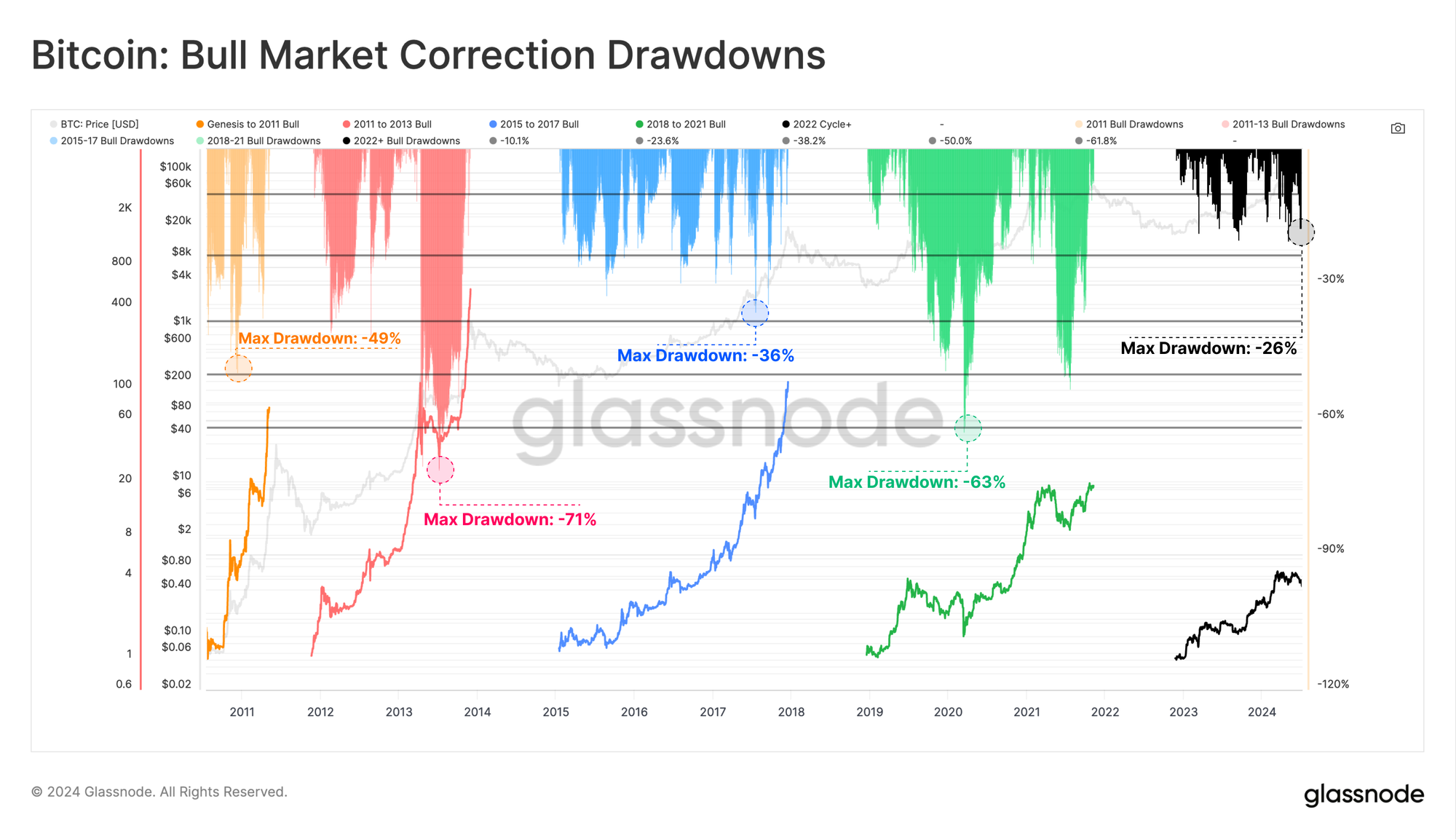

The 2023 to 2024 Bitcoin cycle has seen around 18 months of steady price increases, followed by a sudden plunge of over 26% from ATH between May and July, according to Glassnode.

Interestingly enough, the correction isn’t so bad when you compare it to previous cycles. It has way more stability now. Glassnode noted that:

“If we assess price performance relative to each cycle low, the 2023-24 market has behaved eerily similar to the last two cycles (2018-21 and 2015-17).”

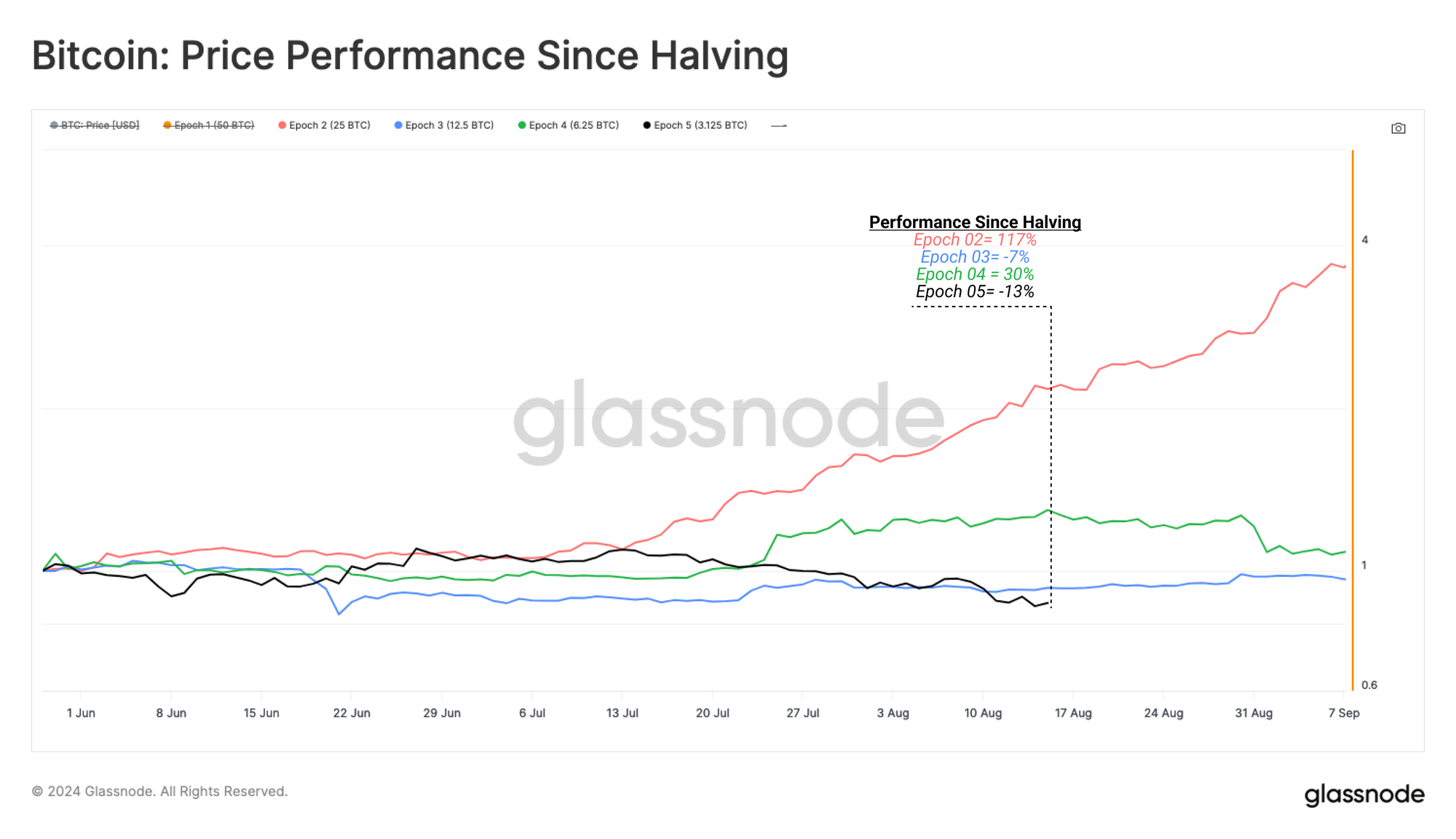

Still though. When performance is indexed to the Bitcoin halving dates, the current cycle appears to be one of the worst. The data shows mixed results from different epochs, as you can see on Glassnode’s chart below.

The amount of major daily drawdowns exceeding 1 standard deviation below the long-term mean is lower in this cycle. Previous cycles had more frequent sell-offs.

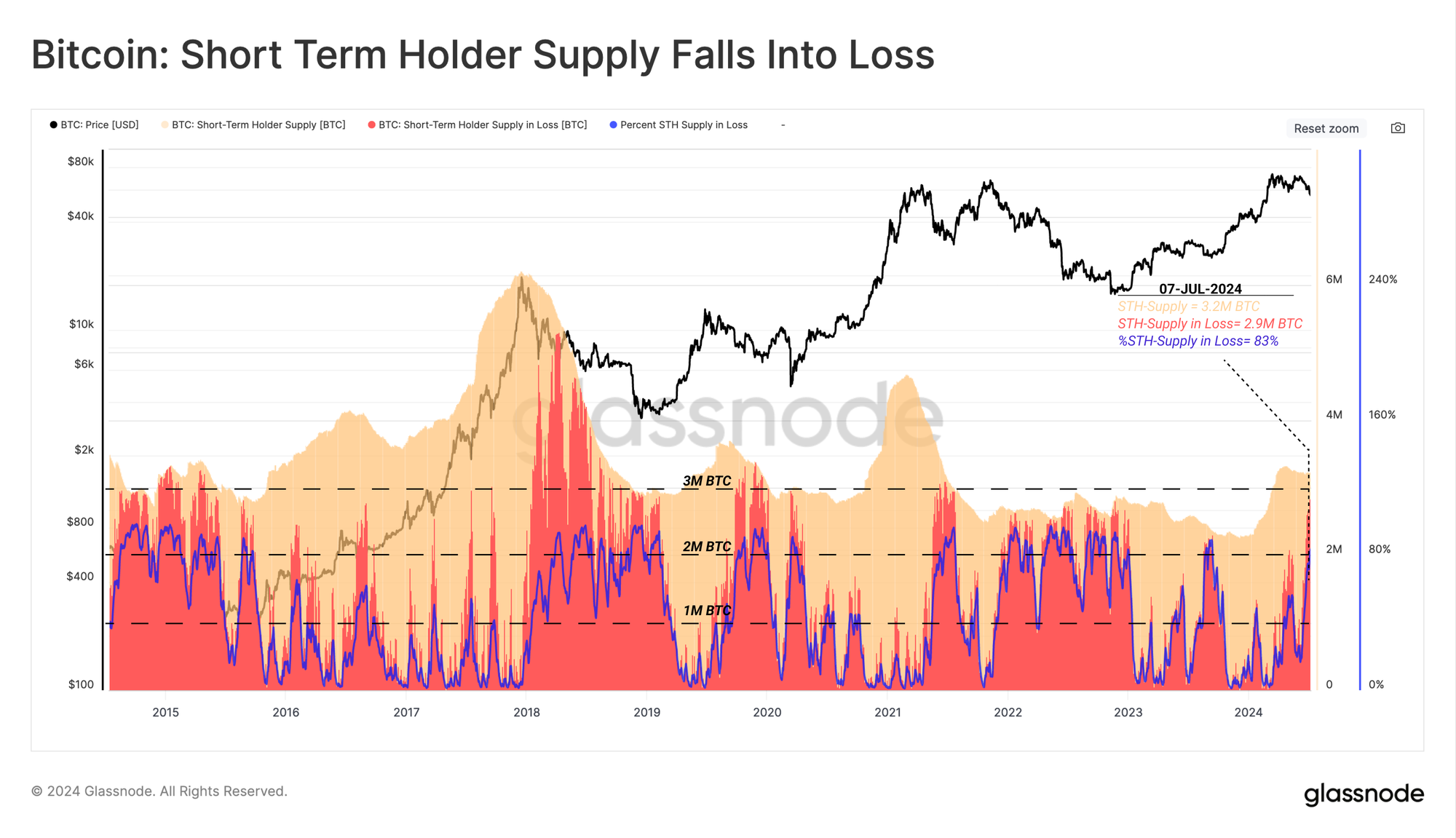

New investors have taken most of the hit from the correction. The volume of Bitcoin held by Short-Term Holders has surged since January, thanks to Gary’s approval of those spot ETFs.

But now supply and demand have tumbled hand-in-hand. Glassnode explained that:

“This demand profile has reached a plateau in growth over recent months, suggesting an equilibrium had formed between supply and demand in Q2-2024.”

Also, way fewer Long-Term Holders are taking profits, and the new buyers have become scarce. Local bottoms in bull markets are usually set when Short-Term Holder supply held in loss saturates around 1M to 2M BTC.

Then the Germany sell-off that dragged Bitcoin to $53,700 pushed the short-term holder volume below cost to over 2.8M BTC. This is the second time in 12 months, by the way, with August 2023 seeing similar levels.

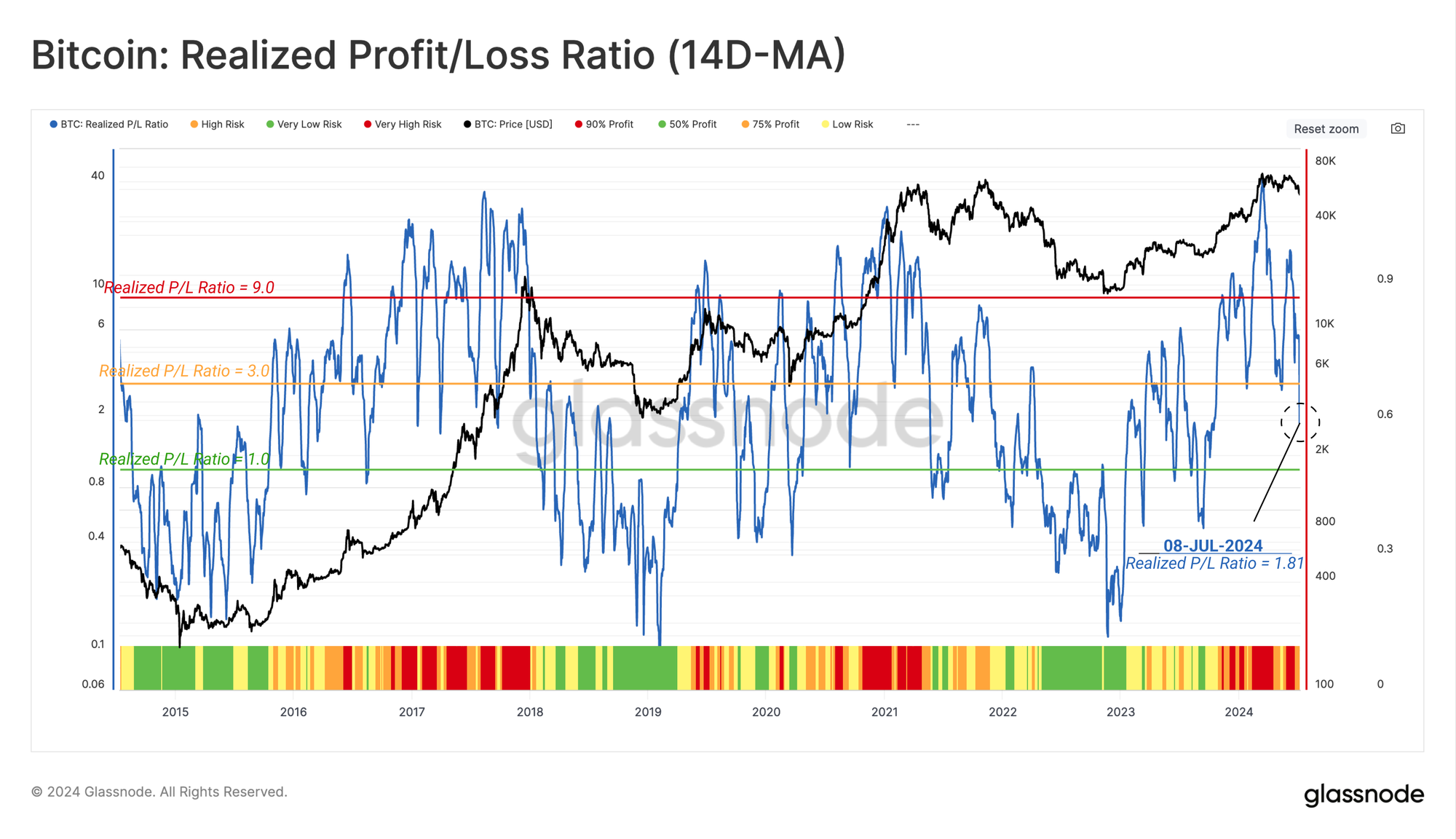

The contraction in Bitcoin’s spot price has also reduced the ratio between Realized Profit and Realized Loss. It now sits in the 0.50 to 0.75 range, but that is actually the neutral level seen in bull market corrections.

Only 52 out of 5655 trading days have recorded larger daily losses, so again, the correction isn’t all that severe. However, Glassnode pointed out that:

“The loss-taking events this week account for less than 36% of the total capital flows across the Bitcoin network.”

The capitulation events in September 2019, March 2020, and May 2021 had losses spiking above 60% of capital flows over so many weeks, with massive contributions from both the Long-Term and Short-Term Holders.

The current market contraction looks a lot like the one in Q1-2021. Yet, the market needs a really strong demand to reverse the bearish reign, or investor profitability will continue to decline.

Reporting by Jai Hamid