The crypto analytics firm Glassnode believes Bitcoin (BTC) is now entering a period of market correction and price volatility after a massive rally this year.

In a new YouTube video, the analytics firm says key indicators suggest Bitcoin is “taking a breather” as holders are selling off for profits after the crypto king soared 175% this year and put in a new all-time high this month.

“When I look at the overall market structure in these different phases, whilst we don’t know whether the top is in, we shouldn’t be surprised that the market hit some kind of a correction here. It does make sense because we’ve got enough green in everyone’s portfolio that people historically speaking have started to take profits.

We can then see that in the long-term holder supply, which is in fact taking profits at a fairly substantial rate. Over seven days, we’ve seen long-term holder supply declining, and realized profits have hit a new all-time high, $3.5 billion per day.

So that really means that we need $3.5 billion worth of inflows into the asset to acquire those new coins. Now, these are fairly substantial numbers, but we’re also talking about a post-ETF [Bitcoin exchange-traded fund] world. We’re talking about hundreds of millions to billions of dollars at the moment.”

The firm says two key indicators point to a Bitcoin correction.

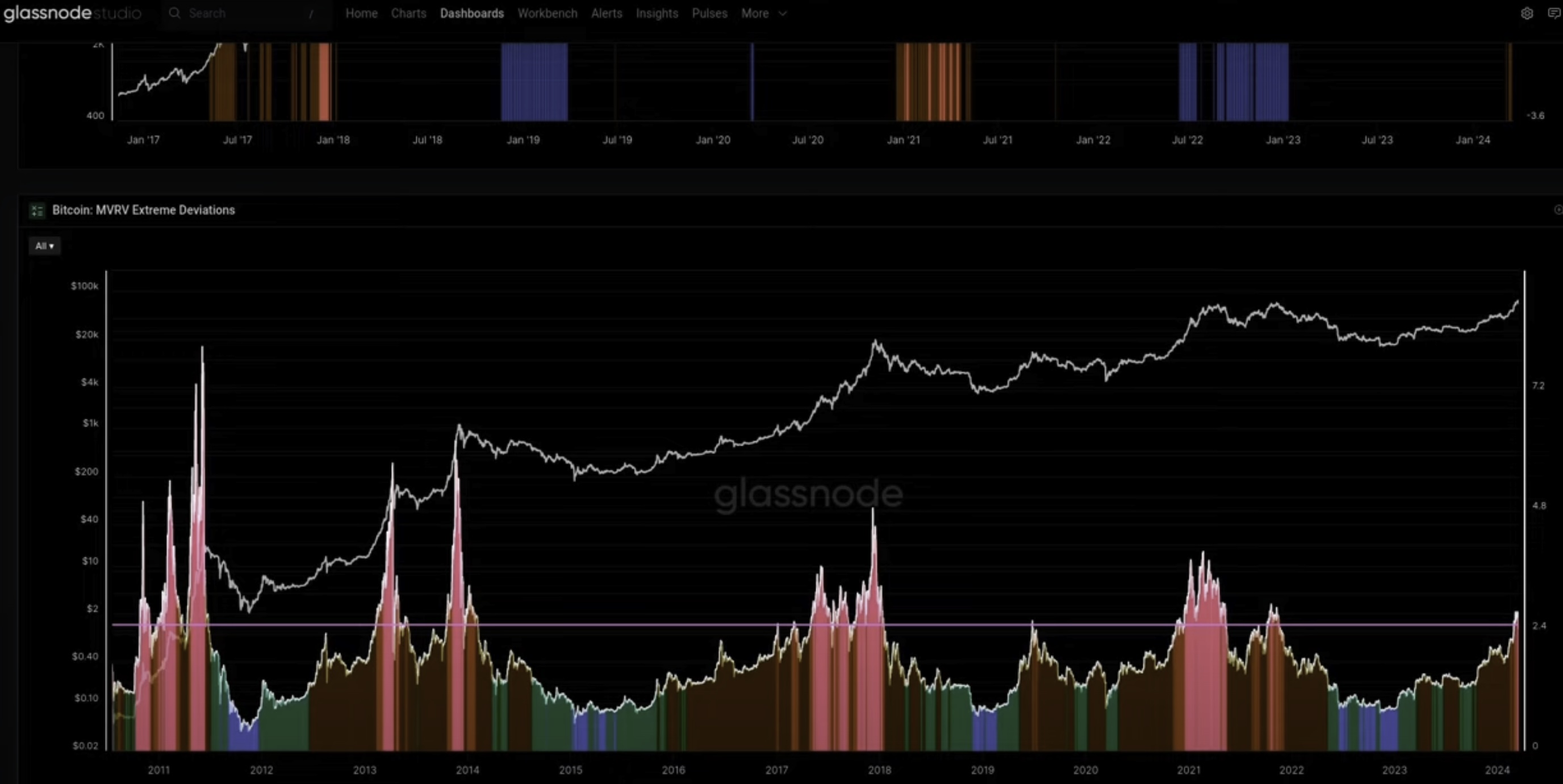

According to the firm, Bitcoin’s market-value-to-realized-value (MVRV) indicator, which is the ratio of Bitcoin’s market capitalization relative to its realized capitalization (the value of all BTC at the price they were bought at), is flashing possible overvalued market conditions.

The firm also uses the Active-Value-to-Investor-Value (AVIV) Ratio, which is similar to the realized price but excludes inactive coins such as those lost. When Bitcoin’s price action takes moves far off the metric’s mid-point it indicates a correction is likely.

“It makes sense for us to bump our head at this point and we’re also moving into as you can see in the AVIV ratio a more volatile period. Historically speaking, the market can go up quite sharply, but then also correct almost as sharply as we saw… in our MVRV and AVIV ratio. So just something to keep in mind and using that to kind of frame up where we are in the cycle when we can start to expect resistance to kick in.”

Bitcoin is trading for $67,672 at time of writing, up 7.5% in the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post Bitcoin Likely Entering Volatile Corrective Period, According to On-Chain Analytics Firm Glassnode appeared first on The Daily Hodl.