Key Takeaways

- A proposed 30% tax on crypto mining appears to have been cut as part of US debt ceiling negotiations

- Decision a win for crypto miners, who are struggling amid rising hash rate and increased electricity costs

- Miners also held onto Bitcoin reserves through pandemic bull market, a mistake which proved fateful

When you break down the Bitcoin mining business into simple terms, like any business, you get revenue and costs. Revenue comes in the form of Bitcoin, earned via the block subsidy reward and transaction fees. Costs, on the other hand, are mainly derived from electricity.

Firstly, revenue: in the last couple of years, the Bitcoin price has fallen precipitously, thus hitting miners where it hurts. While 2023 has seen a bounceback, with Bitcoin currently trading up 68% on the year at $28,000, the asset remains 60% off its peak in late 2021.

This spike in revenue also led a lot of miners to increase their investments across the space, scaling up their operations and adding new equipment. With the surge in demand, hardware prices spiked. Since then, demand has fallen off in line with the Bitcoin price, meaning not only is the revenue down, but many miners are in the red on their hardware investments. This is particularly painful for mining companies who levered up through increased debt in order to make these investments, getting hit twice as hard as interest rates have also been hiked.

The other side of the equation has also gone against miners: cost. Russia invading Ukraine triggered an energy crisis, while inflation is rampant globally, even if it has come down since the peak last year. This has sent miners’ biggest expense, electricity, vertical – at the same time that the price of Bitcoin has fallen.

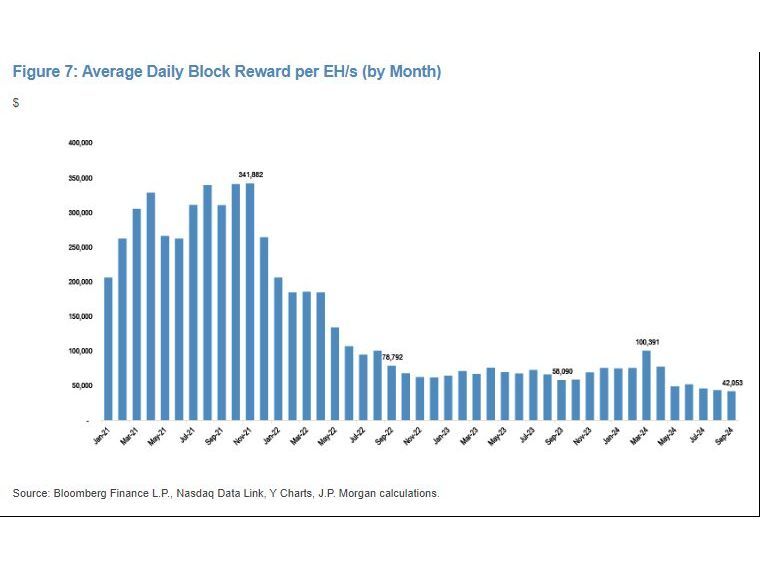

Exacerbating this effect is the increase in hash power, which refers to the computing power on the Bitcoin network. This increases as more miners join the network, meaning there is greater competition and greater dollar outlay required of miners to fight for revenue. The hash rate is currently at all-time highs, putting a further squeeze on miners.

The below chart shows how miners’s reserves jumped significantly during the bull market in USD terms, yet in BTC terms, not much was sold. In other words, miners were betting on Bitcoin continuing to rise – a fateful mistake given their ongoing revenue was already so tightly tied to the volatile asset.

Ordinals protocol sees Bitcoin fees jump

Things picked up for miners this month when the emergence of the Ordinals protocol put Bitcoin block space at a premium, with Bitcoin fees jumping up as a result. The increased activity as a result of BRC-20 tokens launched within the Ordinals protocol, as discussed last week, was a welcome result for miners.

Since then, however, fees have fallen back down.

It wasn’t all bad news for miners, however. While fees were falling back down the earth, debt ceiling negotiations were ongoing in the US – and miners have been an unexpected benefactor. The US debt ceiling is an arbitrary number which limits US borrowing. If the ceiling is not raised, a default could be on the cards. In order to raise it, Democrats and Republicans must strike a deal, which means give and take on both sides. In other words, it has become a political game. As part of the continued negotiations, it appears that the proposed 30% tax on mining will be dropped.

“One of the victories is blocking proposed taxes”, Republican Representative Warren Davidson tweeted in response to a question over whether the mining tax would be chopped.

Earlier this month, the US administration proposed a tax on electricity used by crypto miners called the Digital Assets Mining Energy (DAME) excise act. A 10% tax on miners’ electricity usage would be introduced next year, slated to step up to 30% by 2026. The move came amid mainstream concern around the prohibitive energy use of mining and its impact on the environment.

It also came as the US continues to clamp down on the crypto industry as a whole, with an aggressive line taken by lawmakers since the start of 2023. High profile cases since the start of the year include Coinbase getting served with a Wells notice, the Binance-branded BUSD stablecoin being shut down, and Binance getting charged by the CFTC for a raft of allegations, including a failure to implement money laundering and anti-terrorist financing laws.

Thus, the removal of the mining tax represents a small win for crypto amid what has been a raging storm, both within regulation and elsewhere. However, the road ahead remains perilous for miners. Bitcoin prices are still 60% off their highs, fees have normalised and hash power is at an all-time high.

The post Bitcoin miners lament falling fees, but debt ceiling negotiations cut 30% tax appeared first on CoinJournal.