Coinspeaker

Bitcoin Mining Profitability Rebounds in June after Halving Impact

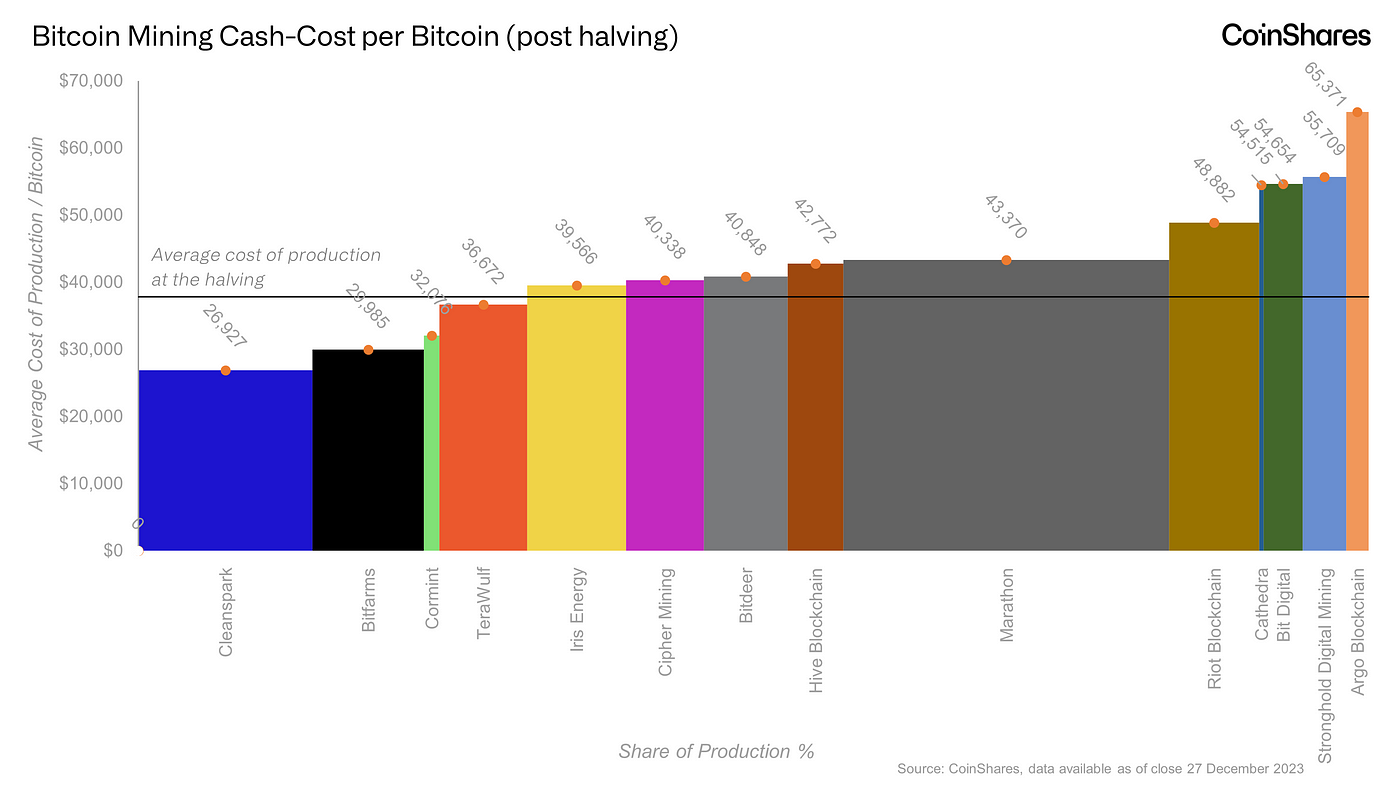

Bitcoin (BTC) mining profitability took a positive turn in June after a rough May, according to a recent report by investment bank Jefferies. This uptick coincides with a 2% rise in Bitcoin’s price and a 5% drop in network hashrate, indicating the market is adapting to the effects of the April halving.

“June was a month of modest recovery from the immediate impacts of the halving that were most pronounced in May,” stated analyst Jonathan Petersen in the Jefferies report.

Hashrate, a measure of the combined computational power dedicated to mining Bitcoin, serves as a proxy for competition within the industry and mining difficulty. The quadrennial halving event in April sliced the rate at which new Bitcoins are generated in half, effectively reducing miners’ rewards by 50%.

Jefferies Adjusts Bitcoin Miner Targets

Jefferies took the opportunity to adjust its price targets for several publicly traded Bitcoin mining companies. Marathon Digital (MARA), previously rated as “hold,” saw its target price decrease from $24 to $22. The bank also lowered its target for Argo Blockchain’s ADRs (ARBK) from $1.50 to $1.20, and for its UK-listed shares (ARB) from 11.90p to 9.5p (roughly 12 cents).

However, Jefferies maintained its “hold” rating for Argo Blockchain. It’s important to remember that one ADR is equivalent to 10 shares.

The report highlights a noteworthy trend: several Bitcoin miners are pivoting towards high-performance computing (HPC) and artificial intelligence (AI) hosting. This strategic shift aims to diversify their revenue streams and capitalize on the growing demand for AI and cloud computing infrastructure.

“This strategic shift has been driven by the declining profitability of bitcoin mining, particularly after the recent halving events,” explained Petersen in the report.

US Mining Companies Gain Share

Jefferies also noted that US-listed mining companies captured a larger share of newly minted Bitcoin in June compared to May. Their share increased from 19.1% to 20.8% of the total network production, likely due to the addition of new mining capacity and the network hashrate decline.

The report further reveals that Marathon Digital mined the most Bitcoin in June, at 590 tokens, despite a 4% decrease from May’s production. CleanSpark (CLSK) also saw a 7% increase, mining 445 tokens in June.

Additionally, Marathon retained its position as the leader in installed hashrate among US-listed miners, boasting 31.5 exahashes per second (EH/s). Riot Platforms (RIOT) followed closely behind with 22 EH/s.

While Bitcoin mining profitability remains a concern, especially after the halving, June’s positive signs suggest the market is adjusting. The strategic shift towards HPC and AI hosting by some miners shows their efforts to diversify their revenue streams and adapt to the changing landscape.

Bitcoin Mining Profitability Rebounds in June after Halving Impact