Bitcoin’s network difficulty saw its first increase in 2024 on January 5, reaching an unprecedented peak of 73.2 trillion at block height 824,544—an uptick of 1.65%. This adjustment followed 27 dynamic shifts in 2023, with a total of 20 increases. The latest record-breaking figure reflects the challenge of discovering a Bitcoin block reward, with the difficulty level changing approximately every two weeks to maintain a consistent block time of around 10 minutes.

Bitcoin network difficulty experiences an uptick

Fundamentally, Bitcoin’s difficulty metric signifies the challenge of identifying a block subsidy to add a new block to the blockchain. The recent figure of 73.2 trillion represents the upper limit of the hash of a block required for it to be considered valid. A lower target makes it harder to find a valid block, as the hash must be less than or equal to this specific target. Over the past year, the difficulty target has consistently broken records, reaching 73.2 trillion due to a significant increase in hashrate, now standing at 545 exahash per second (EH/s) according to Luxor’s hashrateindex.com.

Despite the frequent difficulty increases, bitcoin miners and the escalating hashrate remain resilient. Block times have quickened beyond the typical 10-minute average, leading to adjustments after every 2,016 mined block. Throughout 2023, the network added over 300 EH/s, maintaining a pace that accelerated towards the end of the year. Manufacturers of Application-Specific Integrated Circuits (ASIC) have released next-generation devices with elevated terahash capacities and improved efficiency measured in joules per terahash (J/T).

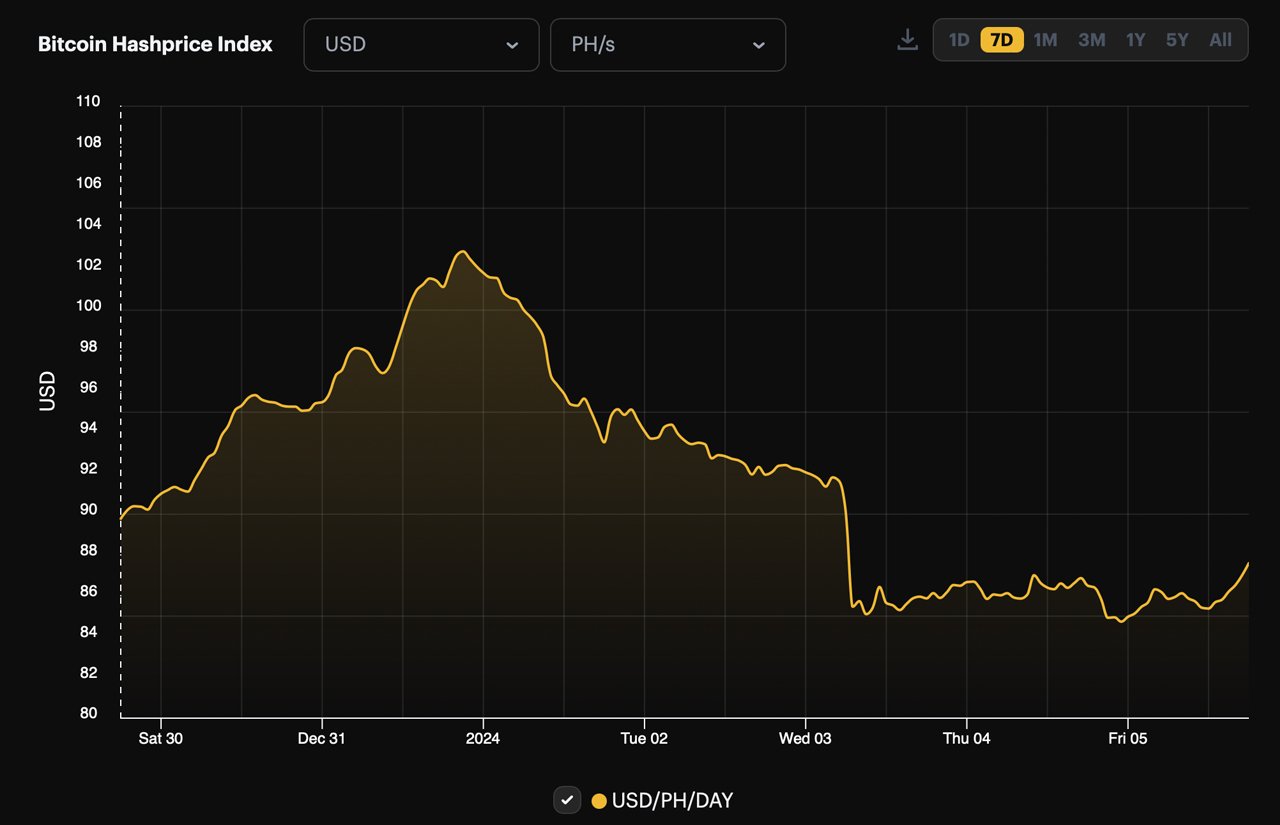

Mining enterprises have procured tens of thousands of these advanced units, with delivery scheduled for 2024. Anticipated increases in hashrate are expected to align with difficulty hikes, barring unforeseen developments. However, Bitcoin’s hash price, the daily expected value per one petahash per second (PH/s) of hashing power, has declined from $102.88 per PH/s on December 31, 2023, to the current rate of $87.60. The next difficulty retarget is scheduled for around January 19, 2024. The surge in hashrate and difficulty reflects the ongoing competition among miners, driven by advancements in ASIC technology.

Navigating challenges in a dynamic environment

This competition has led to a consistent acceleration in difficulty, as miners strive to secure new blocks. The increased difficulty also aligns with a higher level of security for the Bitcoin network. Bitcoin miners have responded to the rising difficulty by investing in next-generation ASIC devices with increased terahash capacities and improved energy efficiency. These advanced units are expected to contribute to further increases in hashrate, maintaining the upward trajectory witnessed over the past year.

The consistent growth in hashrate and difficulty has not deterred miners, as the network experienced 20 difficulty increases in 2023 alone. The mining community’s resilience is evident in the face of these challenges, supported by the continual acquisition of advanced mining equipment. The anticipated continuation of this trend is underlined by the expected delivery of tens of thousands of advanced ASIC units throughout 2024. This influx of powerful mining hardware is poised to further bolster the network’s hashrate, contributing to the ongoing rise in difficulty levels.

Despite the impressive growth in hashrate and difficulty, the hash price of Bitcoin has experienced a decline from $102.88 per PH/s on December 31, 2023, to the current rate of $87.60. This decline in hash price could be attributed to various factors, including fluctuations in market conditions and changes in the overall mining landscape. As Bitcoin miners navigate the evolving landscape of difficulty adjustments and hashrate increases, the industry remains dynamic and responsive to technological advancements.

The upcoming difficulty retarget on or around January 19, 2024, is poised to provide further insights into the ongoing trends shaping the Bitcoin mining ecosystem. The recent increase in Bitcoin’s network difficulty to an unprecedented 73.2 trillion reflects the ongoing competition and advancements in mining technology. The resilience of miners, coupled with the continuous growth in hashrate, paints a picture of a robust and dynamic Bitcoin network. The industry’s response to difficulty adjustments and the expected delivery of advanced mining equipment in 2024 further highlights the evolving nature of Bitcoin mining.