Mike McGlone, Bloomberg’s senior macro strategist, says Bitcoin (BTC) is “poised to come out ahead” after the current bear market, but it could take a serious price dip first.

McGlone notes in a new analysis that the potential for a global recession this year could be the top factor in determining Bitcoin’s price.

“Our bias is that Bitcoin is more likely to come out ahead in most scenarios, but if the inverted yield curve is an indication, economic growth will ebb sharply, with implications for all assets. The benchmark crypto could revisit good support at around $10,000-$12,000 before resuming its enduring upward price trajectory.

A key difference from a year ago is the Federal Reserve and most central banks might be forced to start easing on the back of deflationary forces from declining asset prices.”

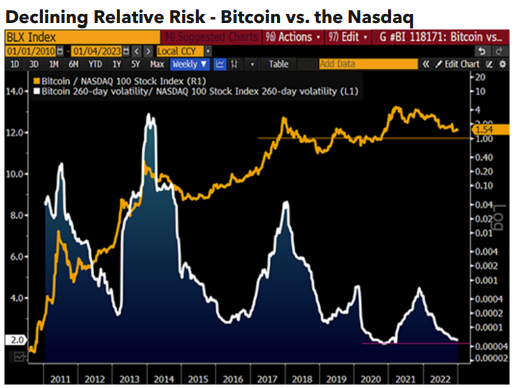

McGlone also argues that Bitcoin is “maturing into the mainstream” and could be undervalued. He cites BTC’s annual volatility, which is primed to drop to a new low versus the Nasdaq 100 Stock Index in 2023.

BTC is trading at $16,841 at time of writing. The top-ranked crypto asset by market cap is up 0.17% in the past 24 hours and about 1.3% in the past week. It remains more than 75% down from its all-time high of more than $69,000, which it hit in November 2021.

Don't Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Bitcoin ‘Poised To Come Out Ahead’ After Bear Market, but Could Drop to This Level First: Top Bloomberg Analyst appeared first on The Daily Hodl.