Bitcoin price analysis is newly bullish today, as the price underwent a 1.21 percent rise over the past 8 hours to move into touching distance with the $16,899 mark. Price is expected to reach as high as $17,012 which is the resistance level and if it breaks past this point, it is likely to continue its uptrend. The support level is set at $16,398, which is the previous low.

The 24-hour trading volume has risen by 74 percent over the past few hours, indicating that there is strong bullish sentiment in the market as it is currently at a $24,241,799,806 high. Market capitalization is also up by 1.09 percent, indicating that investors are beginning to take a more positive approach toward Bitcoin.

The bearish started today’s session with a strong dip which was followed by an uptrend. It is not yet certain whether this will be a sustained rally or just another false breakout, however, if the bullish momentum continues and the price breaks past the current resistance, it is likely that continued gains are possible in the near future.

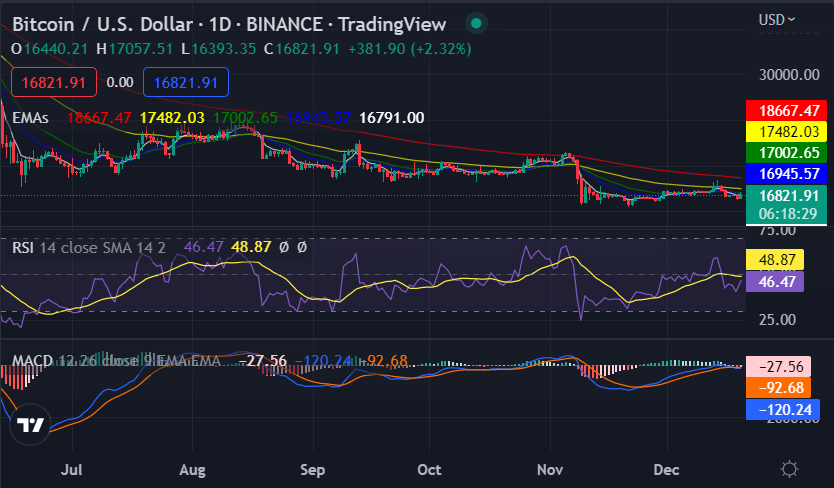

Bitcoin price analysis: Bullish indicators all around on the daily chart

On the 24-hour candlestick chart for Bitcoin price analysis, the price can be seen forming an upturn to take the price up to $16,899. In the past few days, a considerable level of depreciation in the coin’s value has been reported as the price has decreased notably over the past week. The losses have been considerable, but now a chance for recovery has arisen.

The indicators on the daily chart are all pointing towards a bullish trend, with the Relative Strength Index (RSI) climbing up to 48.87 which indicates that the bulls are beginning to take control of the market. The Moving Average Convergence Divergence (MACD) is also showing a positive trend, with the MACD line continuing to rise above the signal line. BTC forms an ascending triangle on the daily chart, taking the price past the crucial 25-day exponential moving average (EMA) at $16,706.

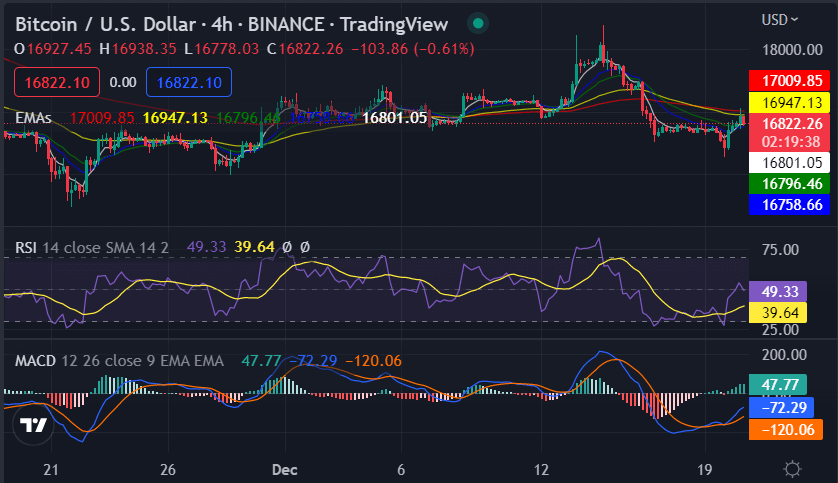

Bitcoin price analysis 4-hour price chart: BTC/USD retraces from highs as bulls take a breather

The 4-hour price chart for Bitcoin price analysis shows the other side of the picture, as the uptrend seen on the 1-day price chart has undergone a reversal, as a downturn in price has been observed during the last 24 hours. The bears have made a comeback again at the start of today’s trading section and have been degrading the coin value continuously. The cryptocurrency has been devalued back to $16,398 after the trends underwent a different shift recently. However, the balance of power is still on the bullish side as the price is still trading on the upper side.

The RSI on the 4-hour chart is currently at 39.64 and is showing a positive trend, indicating that the coin’s momentum is still strong. The MACD line is still above the signal line and is continuing to rise, meaning that the bulls are still in control of the market. Despite the retracement, the bulls are still firmly in control and if Bitcoin price analysis breaks above the 25-EMA at $16,706, then we could see a further rise in the price. The EMA crossover will be a major indicator that the uptrend is still intact.

Bitcoin price conclusion

Overall, Bitcoin price analysis is moving in a positive direction and the bulls are still firmly in control. However, it can be observed that the price has been trading in the lower price envelope of the last previous days, which has affected the coin’s value adversely. The recovery reported today is nominal, and the 24-hour chart shows that the price is still under correction. Therefore, it remains to be seen if BTC/USD can break above the $17,012 level in the coming hours.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Cardano, and Curve