The latest Bitcoin price analysis shows that the market is recovering after a brief pullback, with bulls gaining control of the market today. The buying volume is picking up, and the sellers seem to be taking a backseat, allowing BTC to test $20,276. The bearish pressure has been accumulating in the BTC market for the past few days, but today’s rally is a sign that it’s time for the bulls to take back control.

The selling pressure was strong, which led to a sharp sell-off in the cryptocurrency markets on March 9 as the woes at Silvergate Bank and Silicon Valley Bank dented investor sentiment. However, the bulls were quick to take back control and have pushed BTC up since then.

The recent rally has been driven by institutional buying, with many large funds and investors increasing their cryptocurrency holdings. Retail investors are also investing in Bitcoin as the asset continues to gain attention from the public.

The current price of Bitcoin is $20,276, and this level has become an important psychological barrier for bulls and bears alike. If BTC can break through the resistance at $20,792, then the bulls can take back control and push prices higher. However, if BTC fails to break through this level, then it could pull back and retest lower levels of support.

Bitcoin price movement in the last 24 hours: Bitcoin formed consolidation around $20,276

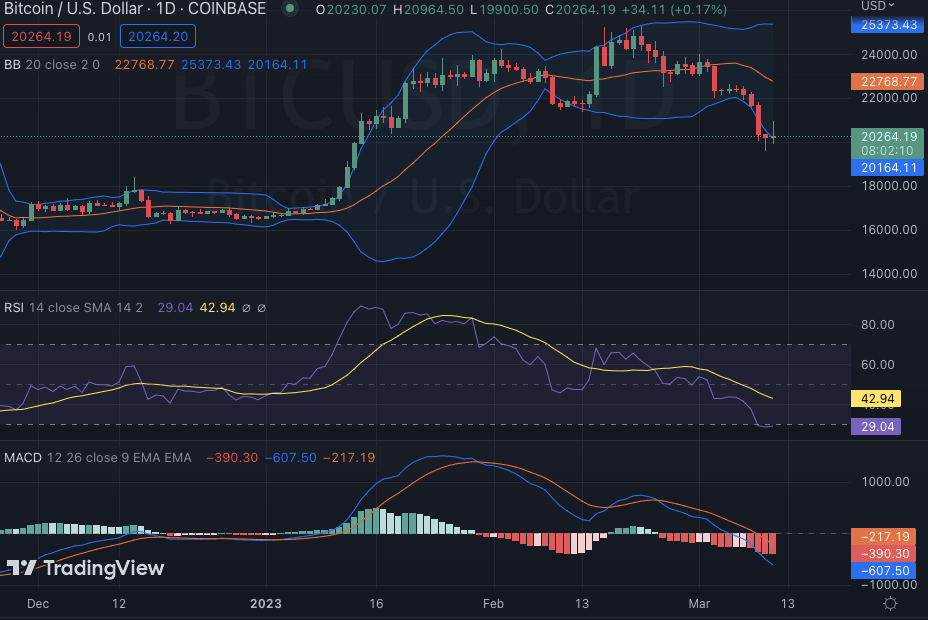

The daily Bitcoin Price Analysis reveals that BTC has been consolidating around $20,276 for the past 24 hours as bulls and bears battle it out. The buyers have taken charge in the last few hours, with strong buying pressure pushing prices up to $20,792. The BTC/USD has increased by 1.39%, with more and more investors coming into the market. The market capitalization of Bitcoin is currently at $390 billion, and its market dominance stands at 40.75%, while the trading volume of BTC has decreased to $32 billion in the last 24 hours.

The MACD is currently bullish, as expressed in the green color of the histogram. On the other hand, the indicator shows low bullish momentum, as expressed in the shallow height of the indicator. Moreover, the lighter shade of the indicator suggests an increasing bullish activity as the price approaches the $20,776 resistance level. The RSI indicator is in the overbought region and is currently indicating a trend reversal for Bitcoin’s price. The Bollinger Bands are widening, and this suggests more volatility in the market.

Bitcoin price analysis 4-hour chart: BTC prepares to continue higher?

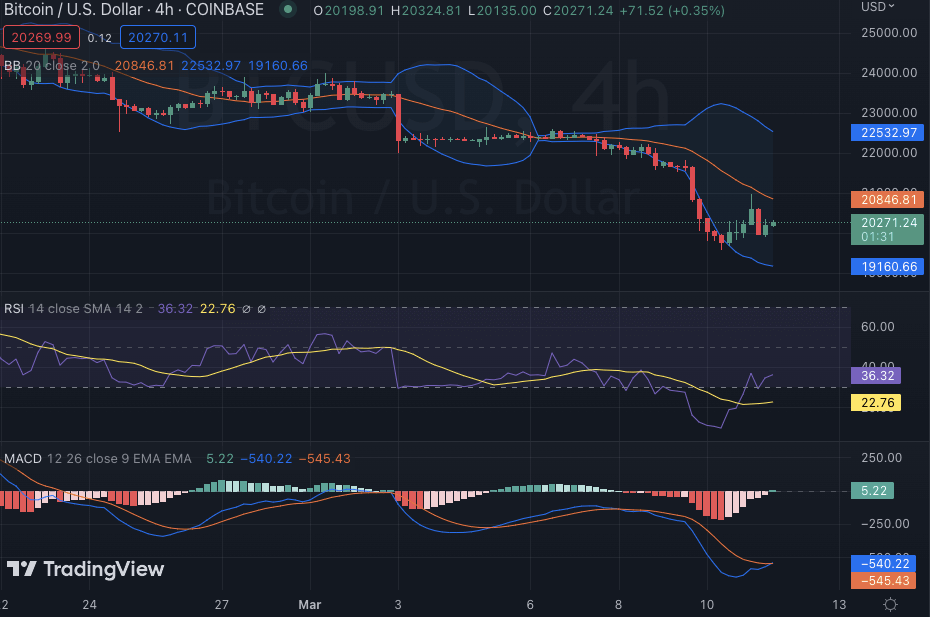

The green candle on the 4-hour chart suggests that the buyers are in control of the market and may push prices higher. The market has been trading in a range between $20,000 and $20,700 for the past few hours and looks set to break higher. The market opened trading in a bearish trend, but the bulls have managed to push BTC back into a bullish trend.

The hourly technical indicator shows that the RSI is currently in the overbought region, suggesting a trend reversal for Bitcoin’s price. On the other hand, the MACD is still bullish, as the signal line and histogram bars are in the green zone. The Stochastic Oscillator has just crossed from bearish to bullish territory, indicating that bulls may take over the market in the near future. The Bollinger bands are also widening, with upper and lower bands currently at $22,632 and $19,160, respectively.

Bitcoin price analysis conclusion

To sum up the current BTC price analysis, Bitcoin’s price has been consolidating around $20,276 for the past 24 hours. The bulls have taken back control of the market and are pushing prices higher. The technical indicators suggest that BTC is preparing to continue its bullish trend and break through resistance at $20,792. The selling pressure is still low, and this suggests that the bulls may take back control of the market in the near future.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Polkadot, and Curve