Bitcoin price analysis shows a decline in price today. The day started with selling pressure building up in the market, and the price dropped from $22,115 to $20,870. The BTC/USD pair has been under consolidation since yesterday, and a breakout is yet to be observed in the coming days as the coin is still maintaining its price level. Selling pressure is bringing the price down toward the support level of $20,837.

The decrease in price has also been attributed to Short-term holders of bitcoin cashing out their profits as the profit ratio rose above 5%, and some miners are also selling their bitcoin as the mining difficulty has dropped significantly, making it difficult to cover up expenses.

The BTC/USD pair has lost around 5.51 percent since the start of the current session. The trading volume for Bitcoin price is seen to be relatively low at the moment, indicating a lack of buyers in the market. Currently, it stands at $26 million, with a market cap of $401 million.

Bitcoin price movement in the last 24 hours: Bitcoin fails to break $22,000

The 1-day price chart for Bitcoin price analysis also demonstrates bearish momentum because the bears are successfully maintaining their advantage. The BTC value has somewhat declined over the last couple of hours. The BTC/USD traded in a range of $20,837-$22,115 in the last 24 hours.

The daily chart for BTC indicates a bearish crossover with the MACD, indicating more losses in the near term. The Relative Strength Index (RSI) is still trending lower and is currently positioned at 30.15. Any further downside pressure could take it even lower.

The 50-day Exponential Moving Average (EMA) is currently noted at $20,540, while the 200-day EMA is seen at around the $20,543 mark indicating that bulls need to take control of the market soon and bring in some buying pressure, or else prices could continue lower from here.

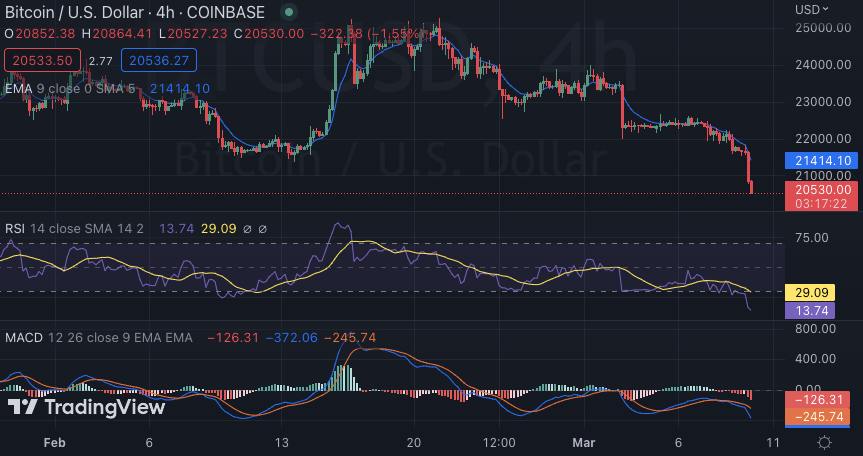

Bitcoin price analysis 4-hour chart: Recent developments and further technical indications

The 4-hour Bitcoin price analysis shows that the price level will continue to drop as long as bears maintain their dominance. The BTC value is fluctuating around $20,870 after going through some degree of fall in recent hours.

The hourly technical indicators display that the 9-EMA and the 21-EMA are also bearish and indicate a downward trend for the pair. The relative strength index (RSI) has sunk down to an index of 13.74 on the hourly charts. It is now in the direction of the oversold region.

The MACD levels are also showing bearish momentum in the market, with the orange line below the blue line. The MACD histogram also appears to be in negative territory, indicating a bearish market for BTC.

Bitcoin price analysis conclusion

Overall, Bitcoin price analysis shows that bears are still in control of the market and will maintain their dominance if no bullish momentum is seen in the near term. The support level for the token is present at the $20,837 level, which, if broken, could signal further losses for BTC. For the upside, resistance is present at the $22,115 level, which, if broken, could signal an uptrend in prices.