Bitcoin price analysis shows the bullish momentum is strengthening as the price has managed to close above the upper trend line of a large symmetrical triangle pattern. The upcoming session is expected to see a continuation of this move higher, with confirmation that bitcoin will break through the $17,200 resistance handle and test its next major hurdle at $18,000.

Bitcoin has been on a continuous uptrend in the last week, gaining by over 2 percent. This shows that there is strong buying pressure in the market, which could push bitcoin higher as we head into the last month of 2022. One key level to watch out for is $16,330, which is a firm support zone for bitcoin. A break below this level could signal a reversal in price action, so traders should be on alert for potential selling opportunities in the near term.

Bitcoin is trading at $16,987.19 after attempting to flip $17,000 to support on Dec. 1, sealing its lowest monthly close in two years.

Looking ahead, we can expect Bitcoin price to continue gaining strength in the short term as it pushes higher toward its next major resistance level at $18,000. The Fibonacci retracement tool, which measures the length of a move in terms of price and time, shows that bitcoin could test this level before pulling back.

Despite this, the overall outlook for bitcoin remains bullish as we head into December. The entire crypto market seems to be recovering from the lost ground as the contagion risks associated with FTX’s collapse begin to look resolvable. Although the market capitalization increased by 2% in the past week and an ascending channel was established on Nov. 20, people remain pessimistic about the year-to-date losses of 63.5 percent. November 2022 crypto winter is the worst since 2019 as the digital asset has lost over 16 percent.

Bitcoin price analysis on a daily chart: Bulls continue to dominate the market

Bitcoin price analysis shows that Bitcoin is continuing to trend higher, fueled by strong bullish momentum. The 100-day moving average has crossed above the 50-day moving average, indicating that the upward trend is likely to continue in the near term.

There are several key levels to watch for on the chart, including support at $16,330 and resistance at $18,000. A move above this level could open the door for a test of the $20,000 handle.

The Relative Strength Index (RSI), which measures the strength of a given asset’s momentum, is currently trending lower but still holds in overbought territory. This indicates that we can expect Bitcoin price to pull back before pushing higher again, potentially retesting the $16,330 support level as it has in recent days.

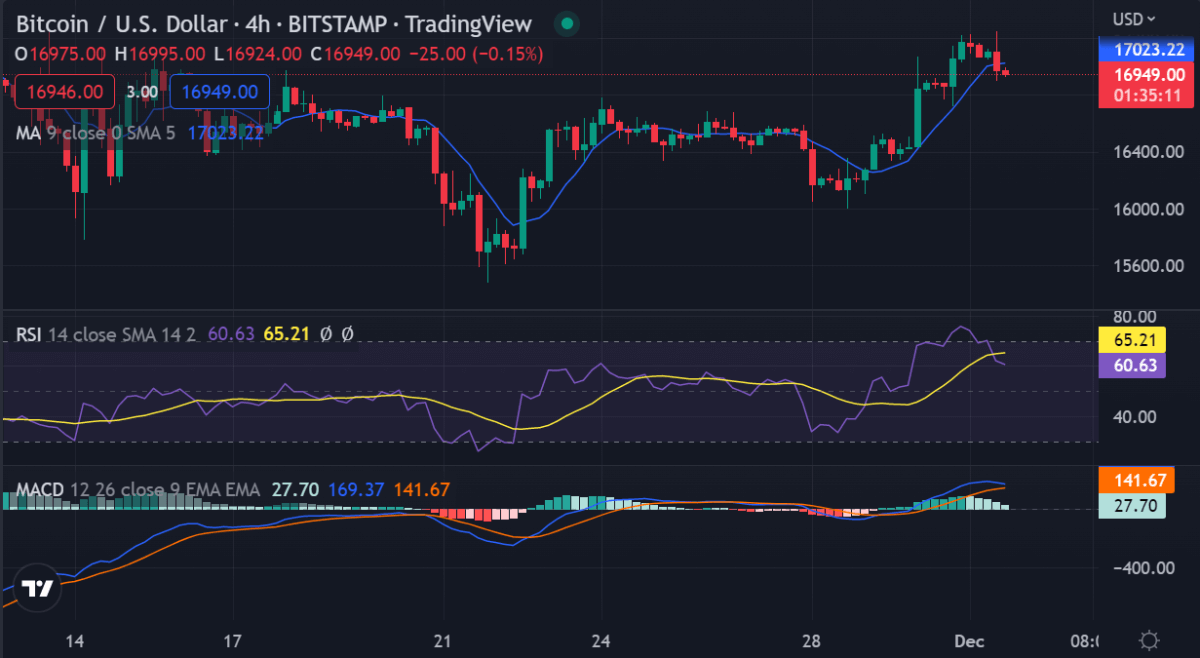

Bitcoin price analysis on a 4-hour chart: BTC consolidates around $17,000

Bitcoin price analysis shows that BTC has been trading in an upward trajectory, touching a high of $17,197.50 on Dec 1. However, price action is seen consolidating slightly below this level as traders look to build up momentum for a move higher.

The 4-hour RSI has pulled back from overbought levels and currently sits in neutral territory. This suggests that we may see some rangebound price action in the near term, with a break above $17,200 likely to signal another leg up for bitcoin.

The moving average lines are also pointing to a potential breakout as the 100-day moving average has crossed above the 200-day moving average, which is typically seen as a bullish sign.

Bitcoin price analysis conclusion

Bitcoin price analysis shows that bulls are still in control of this market even though we have seen some consolidation over recent days and weeks. The ascending channel on the daily chart and breakout in the price action on the 4-hour charts suggest that bitcoin is poised for further gains, with a potential test of $18,000 in the cards before we see a larger pullback.

While waiting for Bitcoin to move further, see our long-term price predictions on Chainlink, VeChain, and Axie Infinity.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.