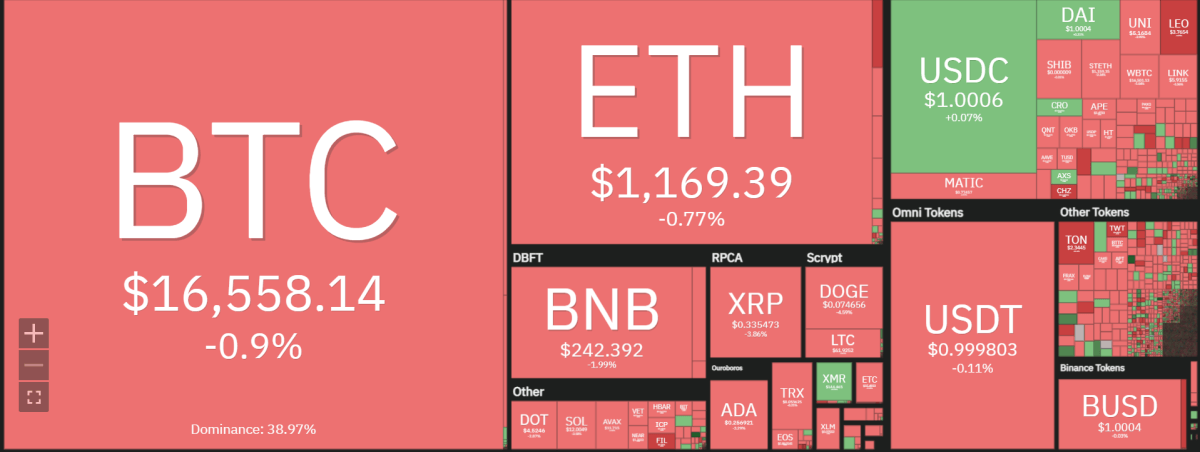

Bitcoin price analysis indicates Bitcoin bulls are feeling the pressure as BTC continues to bounce between lower highs and higher lows within a falling wedge pattern. Despite strong resistance at $18,000, the leading cryptocurrency has been unable to break through in recent days, which could signal a slowing of bullish momentum. Bitcoin is trading at $16,625.32 at the moment of writing, down by 0.45 percent in the last 24 hours.

This week, the crypto market soared as investors reacted enthusiastically to a “positive” Consumer Price Index (CPI) report; however, upon hearing Federal Reserve Chair Jerome Powell’s hawkish remarks at his post-rate-hike press conference, much of those gains were quickly erased.

The Federal Reserve’s recent interest rate hike of 0.50 percent was within the expected range for most market participants, however, what raised eyebrows is that their consensus suggests a requirement to reach the 5-5.5+ percent range in order to potentially settle at their desired inflation target of 2 percent.

The news of the Fed policy shift delay doused traders’ anticipations of a mid-2023 move, resulting in an overall decrease in sentiment across crypto and equities markets.

Despite this news, Bitcoin has managed to remain above the $16,500 support level indicating that investors may still be more bullish than bearish on BTC in the near term. Furthermore, a strong bounce from this level could indicate a potential breakout of the falling wedge pattern which could signal further upside potential and a possible rally.

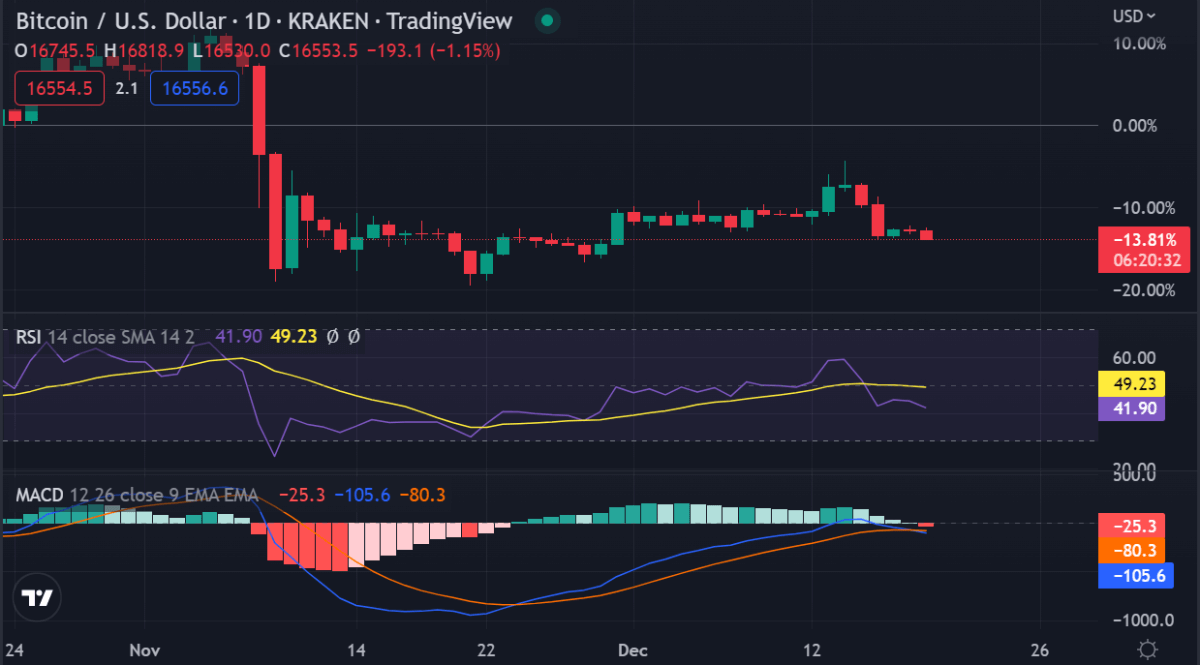

Bitcoin price analysis on a daily chart: BTC stumbles in the face of a bearish trend

On the daily chart, Bitcoin price analysis indicates BTC is trading inside a descending triangle pattern that has been forming for weeks now. The resistance of this pattern lies at $18,000 and has proven to be quite strong so far. On the other hand, support lies around $16,500 and has held up well, even after several attempts by the bears to break it down.

Bitcoin is currently in a tight range and could be preparing for some major price action soon. If Bitcoin can break out of this pattern, we may see an overdue bullish rally that could test $20K once again in the coming weeks. On the other hand, a breakdown of the $16,500 support would lead to further losses.

The important technical indicators suggest the chances of a potential breakout are higher than the odds of a breakdown. The MACD shows that momentum is starting to build up on the upside and the RSI is above 50, indicating bullishness in the market.

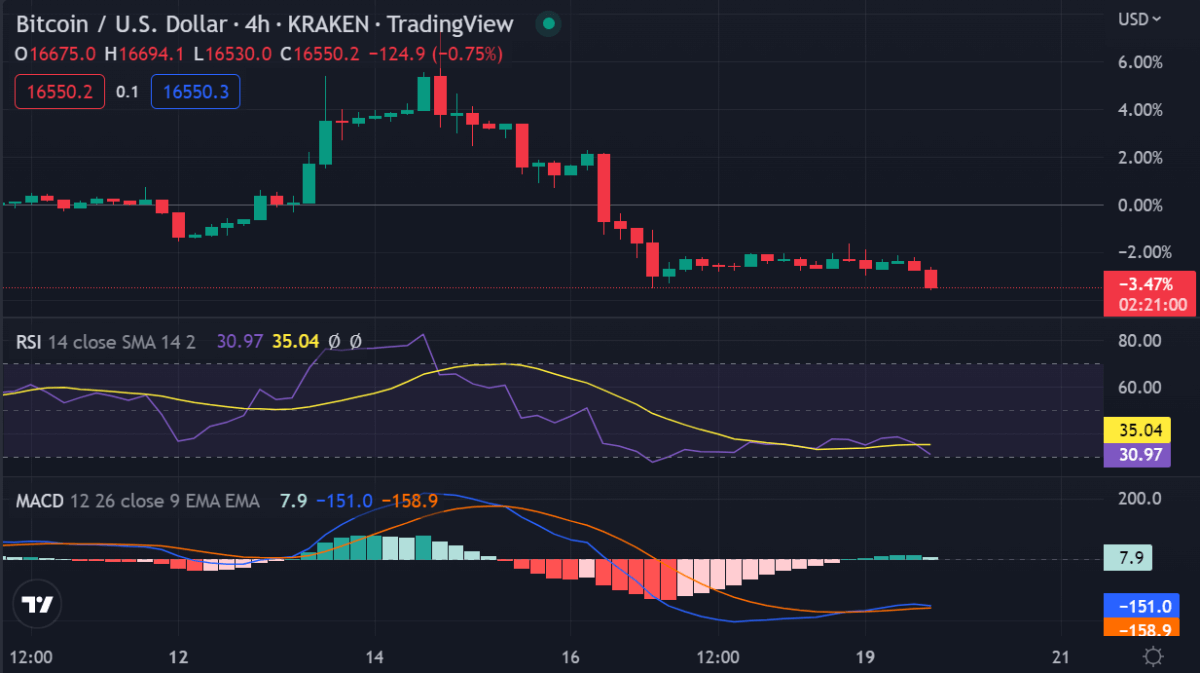

Bitcoin price analysis on a 4-hour chart: BTC rallies higher

On the 4-hour chart, Bitcoin price analysis shows that BTC has been trading in an ascending triangle pattern. This is a bullish reversal figure and suggests that bulls are gathering force for a potential rally to the upside.

The MACD and RSI indicators also show signs of bullishness as both have formed positive divergences suggesting that the upside momentum is gaining traction. The important support for BTC lies at $16,500 and if this can hold up in the coming days, we could see Bitcoin break out of its current range and go on to test higher levels.

Bitcoin price analysis conclusion

In conclusion, Bitcoin price analysis shows that BTC is currently bouncing around between lower highs and higher lows within a falling wedge pattern. The technical indicators suggest the chances of a potential breakout are higher than the odds of a breakdown. If Bitcoin manages to do so, we could see it rally toward $20K in the near future. Furthermore, if BTC fails to break out, it could lead to a breakdown of the $16,500 support and further losses in the coming days.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Cardano, and Curve