Bitcoin price analysis for today reveals Bitcoin has corrected after a short-lived rally toward $28,000. Bitcoin slipped below $27,646.35 and is currently trading at $27,064.90. Bitcoin is down 1.64 percent from the past 24 hours. The market sentiment is bearish, and there’s an increased risk of deeper corrections if BTC fails to find significant buying momentum near the $26,000 support level.

Bitcoin price analysis on a daily chart: BTC likely to break the $27,000 support

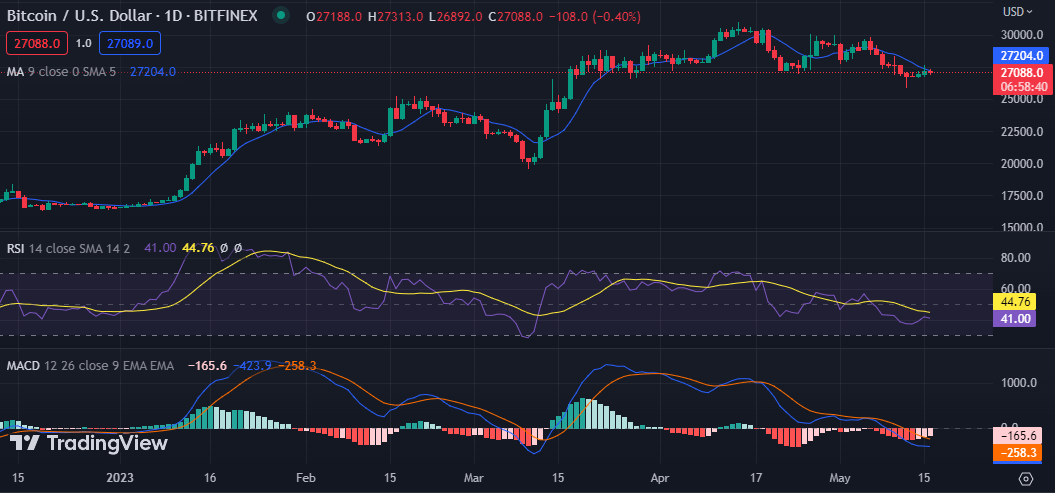

Bitcoin price analysis on a daily chart shows that BTC’s bullish trend has weakened after it failed to break the $28,000 resistance level. The Relative Strength Index (RSI) is below 50, indicating bearish sentiment in the market. The MACD line has crossed below the signal line, further supporting a bearish outlook for Bitcoin. Bitcoin’s price has gradually fallen, forming a lower-high pattern on the daily chart. A bearish trend has developed, and if BTC fails to find support at the $27,000 level, it could break below that level.

A break below the $26,000 support could trigger a sell-off in Bitcoin, leading to further losses in its price. The next major support can be found at the $25,000 level. It could drop even lower if BTC fails to find support near that level.

Looking ahead, Bitcoin will need to regain its bullish momentum and break the $28,000 resistance level for a possible rally toward $30,000. The next major resistance can be found at around $31,000. Bitcoin will likely find support near the EMA20 and EMA50 levels in the short term. Bitcoin price analysis suggests that BTC may remain rangebound in the near term, but further losses are possible if it fails to find strong buying momentum.

BTC/USD price analysis on a 4-hour chart: Bulls need to defend the $27,000 level

The 4-hour chart for BTC/USD shows that Bitcoin is trading between the $27,000 and $28,400 levels. The 50 Moving Average (MA) has crossed below the 100 MA, indicating the bearish sentiment in the market. The MACD line is also below the signal line, showing a bearish trend.

The bulls must defend the $27,000 level for Bitcoin to remain rangebound. A break below that level could lead to further losses in its price. If Bitcoin finds support near the $26,000 mark and breaks above the $28,400 resistance level, it could test the $30,000 level in the near term.

Bitcoin price analysis conclusion

Bitcoin price analysis shows BTC price failed to break higher after testing the $28,000 resistance level. The market sentiment is bear, and BTC could experience further losses if it fails to build strong buying momentum near the $27,000 support level. In the short term, Bitcoin will likely remain rangebound between the $27,000 and $28,400 levels. If BTC breaks above the $28,400 resistance level, it could test the $30,000 mark.

While waiting for Bitcoin to move further, see our long-term price predictions on Chainlink, VeChain, and Axie Infinity.