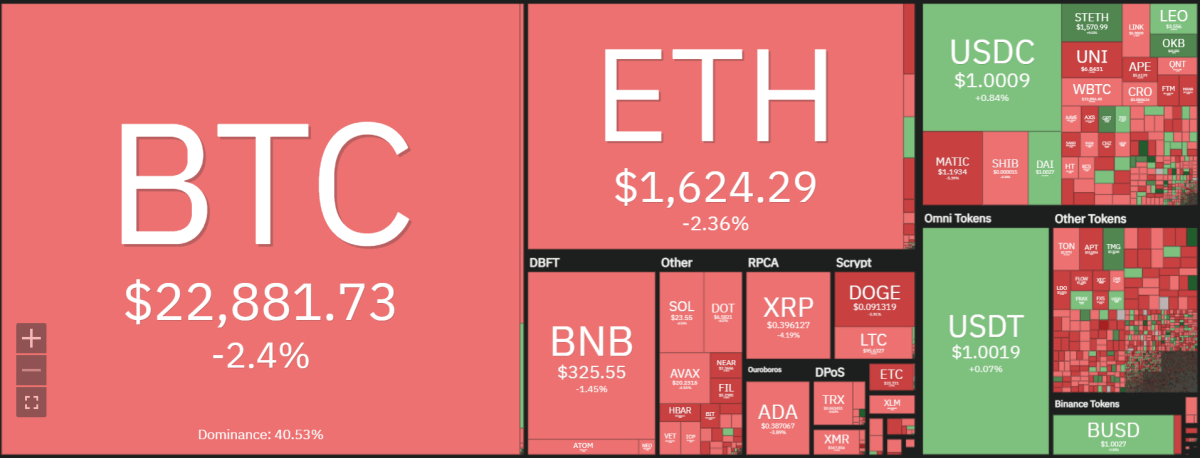

Bitcoin price analysis shows a downtrend has been in play since the start of today’s trading session. After hitting a high of $23,460, BTC/USD has been on a steady decline and is currently trading at the $22,886 mark. The digital has lost more than 2.35% in the past 24 hours.

BTC/USD for today shows a negative market sentiment revealed after BTC prices broke off downwards from a sideways trend that had been present for the past few days. The total trading volume for BTC is nearly $442 million and the market capitalization for BTC is currently $18 billion. The digital asset is occupying the first position on the coin market cap’s list of cryptocurrencies by market capitalization. Meanwhile, there is a strong outflow from the exchanges, which could be indicative of more selling pressure in the near future.

Bitcoin price action on a 1-day price chart: Bears adamant as they push prices below $23,000

The 1-day Bitcoin price analysis shows that since the beginning of trading today, BTC prices have been on a downward trend as market conditions turned bearish. The price has been struggling to break out of the $23,460 resistance level for the past few days, and as a result, the token has begun to fall.

The one-day technical chart of the Bitcoin price suggests a downside trend for the future. Meanwhile, Bitcoin is currently trading below its 50 and 100 Daily Moving Averages. The RSI of Bitcoin is at 75.52 suggesting a consolidated trend in price. There is a negative slope in the RSI hinting at a downside trend in price. The overall sentiment of the RSI is bearish. The MACD of Bitcoin is currently in the negative region below the signal line indicating a bearish market sentiment.

Bitcoin price analysis 4-hour chart: Selling pressure mounts as BTC continues to fall

The 4-hour chart of Bitcoin reveals that the digital currency is currently trading in a tight range between $22,878 and $23,460. The market sentiment for BTC has turned bearish with strong selling pressure seen on the downward move. The market has made numerous attempts to break above the $23,460 resistance level but has been unsuccessful so far.

The 4-hour technical chart of Bitcoin shows a bearish market sentiment with prices below its 50 and 100 Moving Averages. The moving average on the 4-hour price chart is also suggesting a bearish market trend at $23,289. The MACD for cryptocurrencies is currently below the signal line and has been dropping steadily in the past few hours with the red candlestick in the histogram. The RSI line is also sloped slightly negatively towards the oversold territory.

Bitcoin price analysis conclusion

Overall, Bitcoin price analysis shows that the bearish trend in prices is expected to continue if buyers do not step in soon. Currently, there are no signs of a rebound, so traders need to be cautious and watch for any possible shift in market sentiment. Bulls need to establish a strong foothold above the $23,460 resistance level if they want to push prices higher.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Cardano, and Curve