Today’s Bitcoin price analysis reveals BTC price lacked enough momentum to extend yesterday’s gains towards $28,000 after breaching the $27,000 level held since last week. The Bitcoin price analysis also shows that many altcoins have seen similar corrections over the past several days, suggesting that the entire cryptocurrency market may be entering a period of consolidation.

This trend continues for the foreseeable future as traders and investors take profits or seek to limit their exposure in anticipation of further downside risks. If Bitcoin can remain above $27,000, it could potentially form a base to recover and resume its uptrend. However, the Bitcoin price analysis suggests that the correction could deepen further if it fails to sustain above this level.

BTC/USD analysis on the daily chart: Bears are in control

The daily chart reveals that Bitcoin is trading below the 21-day moving average, a level it has not broken since April. This suggests that bears are in control of the market and that the uptrend remains vulnerable to further losses. In addition, BTCUSD has formed a bearish head and shoulders pattern, which could potentially signal a further downside.

Given the current technical setup, it is likely that BTC/USD will remain in consolidation for the near term until its next significant move. The technical indicators indicate a negative market sentiment. The Relative Strength Index resides in the oversold regions, while the Aroon indicator has turned bearish. The MACD is also in the negative territory, and the Stochastic RSI is trending lower, reflecting a bearish outlook.

Bitcoin price analysis shows Bitcoin opened the daily trading session above $27,000 and rallied toward an intra-day high of $27,223.07. However, the BTCUSD pair failed to maintain these gains and later fell back toward the $26,800 level. Currently, BTCUSD is trading near this region, and to break past this area, buyers need to build momentum beyond the current resistance levels.

If Bitcoin can hold above $27,000 support, it could potentially form a base to recover and extend the uptrend. However, if it fails to sustain above this level, further downside risks could be on the horizon.

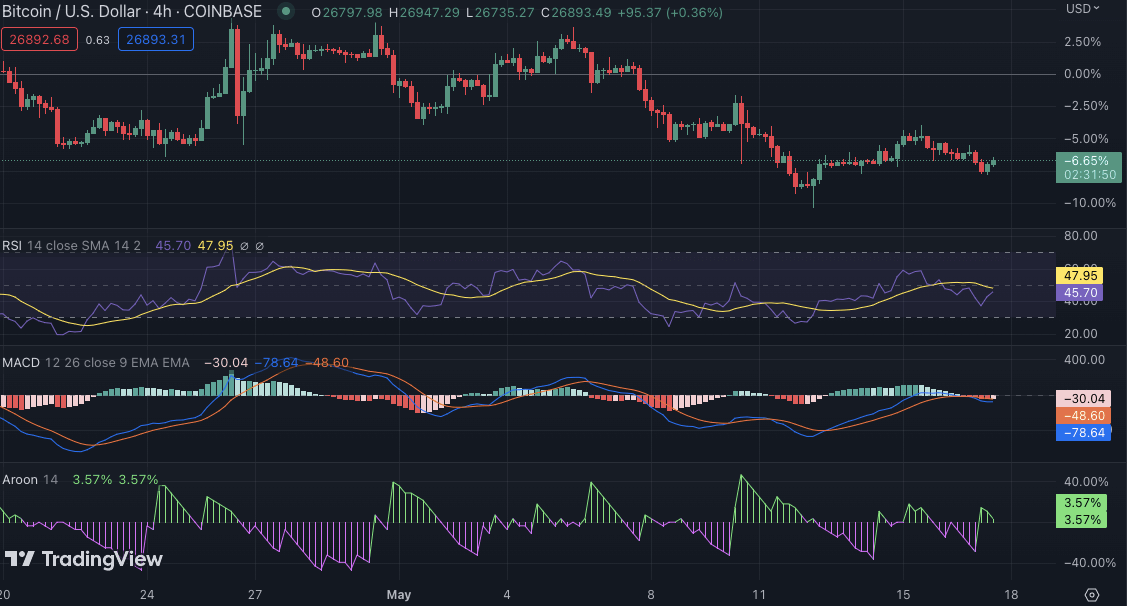

Bitcoin price analysis on a 4-hour chart: Bulls defend $26,600

On a 4-hour chart, the bulls are defending the $27,000 support level. The relative strength index (RSI) is still in the oversold region and has not crossed back above 50 yet, indicating that bears are still in control. The MACD line is below zero and trending lower, indicating further losses. The Stochastic RSI is also trending lower, suggesting that bearish momentum remains intact.

In conclusion, the Bitcoin price analysis suggests that BTCUSD could remain in consolidation for the near term until it breaks past the current resistance levels. If Bitcoin holds above $27,800 support, it could potentially form a base to recover and resume the uptrend.

Bitcoin price analysis conclusion

Bitcoin price analysis shows BTC failed to break out higher, and the bears remain in control. The Bitcoin price analysis also shows that many altcoins have seen similar corrections over the past several days, suggesting that the entire cryptocurrency market may be entering a period of consolidation.

In other news, On Monday morning, a significant movement of Bitcoin (BTC) occurred as Coinbase, a leading US crypto exchange, transferred over $627 million worth of BTC to two unknown wallets. The transfers, one amounting to $316.3 million and the other to nearly $311.2 million, happened simultaneously, indicating the potential involvement of a single whale.