The latest Bitcoin price analysis reveals that the price has been following a downward movement for the past few days, as the bears have constantly been striving for lead, and the bearish pressure weighs on the price function. The short-term trending line is also descending as a regular decline in price has been taking place for the past three days. The price has been lowered down to the $16,706 level as a result of the latest bearish strike. Further downfall in price is to be expected in the approaching hours as well.

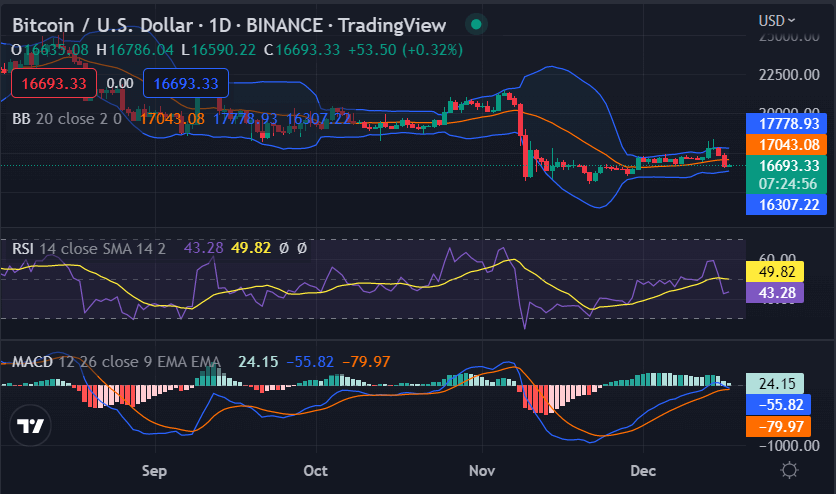

BTC/USD 1-day price chart: Cryptocurrency value depreciates up to $16,706 degree

From the Bitcoin price analysis on an intraday chart, it can be observed that the BTC prices have been consolidating between $16,584 and $16,985 over the last few hours. The digital asset is presently trading at $16,706 and is likely to remain range-bound for some time. From the Bitcoin price analysis on a daily chart, it can be observed that the BTC price has been in a continuous downward trend. The digital asset opened today’s daily trading session at $16,905 but the bears came in to push the prices down to $16,706.

The RSI (relative strength index) indicator on the intraday chart is presently at 49.82 and it indicates that the digital asset is in the oversold zone. The MACD (moving average convergence divergence) indicator on the intraday chart is presently in the bearish zone but it is close to the centerline.

The Bollinger bands indicate that the BTC prices are likely to remain range-bound for some time. The upper Bollinger band is at $16,985 and the lower Bollinger band is at $16,584.These levels are likely to act as immediate resistance and support levels for the digital asset.

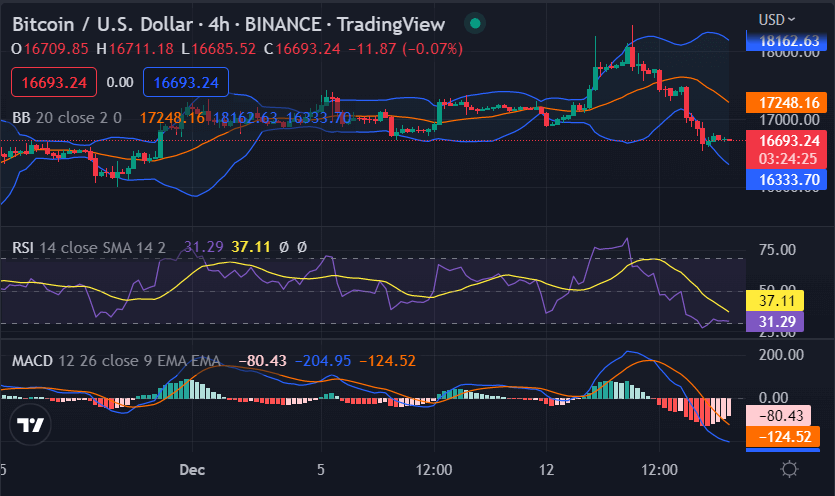

Bitcoin price analysis on a 4-hour price chart: Bearish trendline intact

The Bitcoin price analysis on a 4-hour time frame reveals that the bears are increasing their grip on the market. The digital asset has formed a bearish trendline on this chart and it is presently trading below this trendline. The price is below the 200-day moving average ($17,248) and the 50-day moving average ($16,693).

Most of the indicators are showing a declining trend. The RSI (relative strength index) indicator on the 4-hour time frame is presently at 37.11 and it indicates that the digital asset is in the oversold zone. Now the Bollinger band’s average is at $16,705 point, whereas the upper Bollinger band is resting at $17,248, and the lower Bollinger band is at $16,333. Meanwhile, the moving average convergence divergence (MACD) curve can be seen forming a deep bearish divergence over the current price action

Bitcoin price analysis conclusion

Bitcoin price analysis confirms that the price has undergone a severe decline during the day. The BTC/USD price is now touching the $16,706 mark, which is the lowest, and it can be expected that it will move down to further lows in the approaching hours. However, the price has reached the support zone, and there are chances that the price may bounce back from here if buyers’ support comes into play.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Cardano, and Curve.