Coinspeaker

Bitcoin Price Below $60K as US Spot BTC ETFs Registered Second Day of Consecutive Cash Outflow

Bitcoin (BTC) price has continued to interchange between bullish and bearish sentiments in the recent past amid the midterm economic outlook. Despite the recent drop from $65K to retest the support level above $58K, the flagship coin has gradually risen since the August 5 market crash. However, Bitcoin price is still trapped in a macro correction that began earlier this year after reaching an all-time high (ATH) of about $73.7K.

From a technical standpoint, Bitcoin price has been forming an inverted triangle, which is often followed by a major bullish uproar.

Moreover, the weekly Relative Strength Index (RSI) has been consolidating above 50 percent in the past two months, despite the notable bearish sentiment.

If Bitcoin price action in the 2024/2025 bull market mirrors that of the previous cycles, then the fourth quarter and the first half of next year will be characterized by a bullish trend.

Meanwhile, Bitcoin price could retrace below $55K in the coming weeks before rebounding towards a new ATH in the coming months. Moreover, Bitcoin’s fear and greed index has dropped below 30 percent, indicating that more investors are very worried about possible crypto capitulation in September.

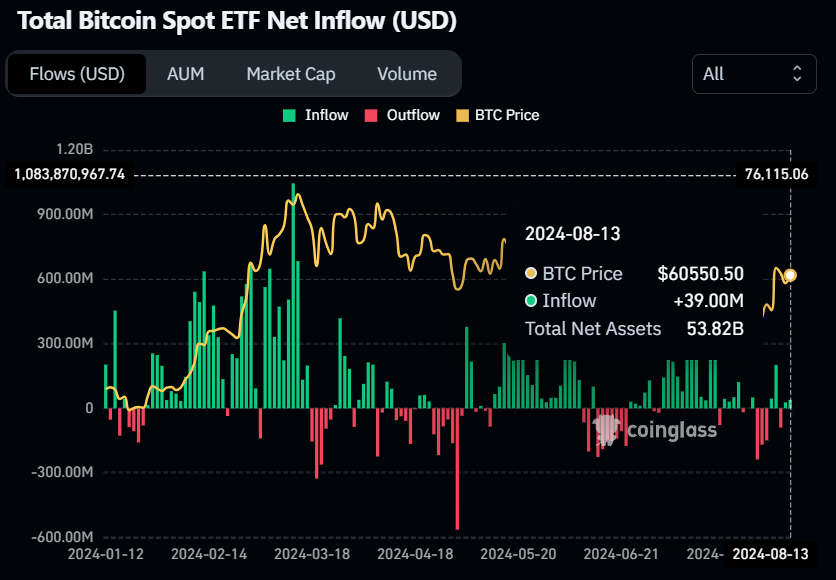

Spot Bitcoin ETFs Continue to Bleed

After registering notable cash inflows last week, the US-based spot Bitcoin ETFs have registered two consecutive days of cash outflows in the last two days. As Coinspeaker pointed out, the US spot Bitcoin ETFs ended an eight-day cash inflow on Tuesday after reporting $127 million in cash outflows, majorly influenced by ARK 21Shares Bitcoin ETF (ARKB).

On Wednesday, ARKB led other spot BTC ETF issuers, with a cash outflow of about $105 million. Interestingly, BlackRock’s IBIT did not register any cash flow on Wednesday. As a result, the US-based spot BTC ETFs have net assets under management of about $54.32 billion.

Similarly, the Hong Kong spot Bitcoin ETFs have not registered any notable cash inflow since August 22.

As a result, it is safe to assume that the liquidity flow to Bitcoin products has significantly decreased compared to earlier this year.

Moreover, on-chain data shows that more short-term Bitcoin holders have accelerated profit-taking in the recent past. Nonetheless, the supply of Bitcoin at centralized exchanges (CEXs) remains at a multi-year low, suggesting long-term investors continue to hold in anticipation of bullish sentiments ahead.

Market Picture

Bitcoin price has shown a positive correlation with the altcoin market, following the approval of spot ETH and Solana ETFs in the US and Brazil respectively. The anticipated interest rate cuts in the United States, following the dovish outlook from the Fed last week, in addition to the upcoming US elections will likely trigger bullish sentiment for the entire crypto space in the subsequent months.

Bitcoin Price Below $60K as US Spot BTC ETFs Registered Second Day of Consecutive Cash Outflow