The Bitcoin price having an outstanding Q4 to close the year 2024 has been one of the most prominent narratives in the cryptocurrency market in recent weeks. Interestingly, a popular blockchain firm has weighed in with unique on-chain insights into the BTC’s price trajectory.

Can Bitcoin Price Reach $100,000 By December 2024?

In a new report, CryptoQuant revealed that the price of Bitcoin is entering a period of positive seasonal performance with the historically bullish Q4 yet to take its usual course. The on-chain analytics firm highlighted that the premier cryptocurrency usually performs well in the last three months of a halving year.

According to data from CryptoQuant, the Bitcoin price increased by 9%, 59%, and 171% in 2012, 2016, and 2020 (the first three halving years), respectively. Meanwhile, the value of the premier cryptocurrency is up by 46.79% so far in 2024.

Interestingly, CryptoQuant put forward an end-of-the-year target of between $85,000 to $100,000 for the Bitcoin price. It is worth noting that the Q4 rally to this new price high would place the coin’s yearly performance between 100% and 138%.

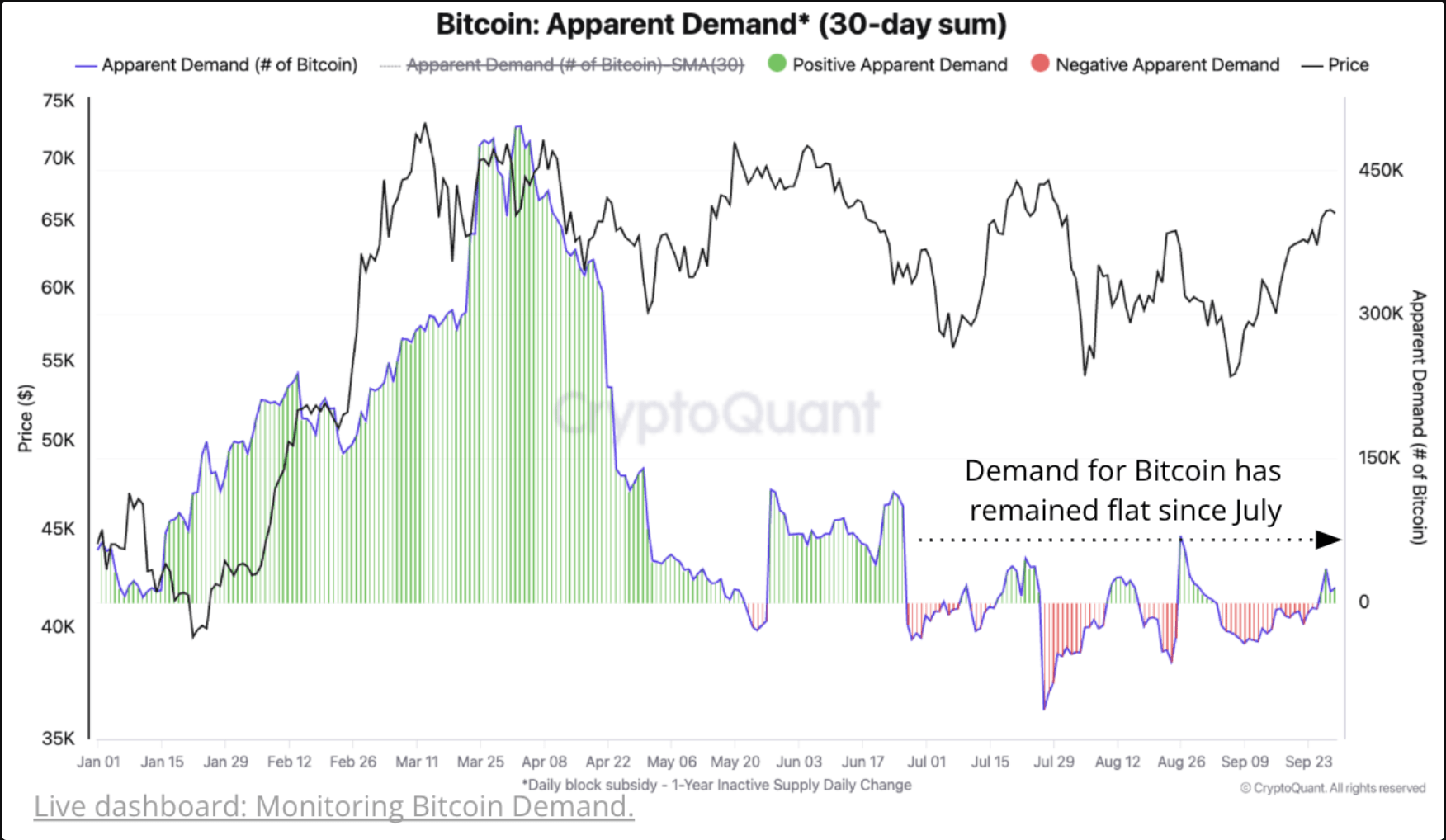

However, the blockchain firm has identified certain factors that need to align for the Bitcoin price to resume its bull run and potentially reach a new record high. One of these critical factors is demand, which has been mostly stagnant over the last few months.

CryptoQuant data shows that Bitcoin demand growth has been swinging between -23,000 to +69,000 BTC since July. For context, demand soared as high as a staggering 498,000 BTC in April when the market leader danced around the $70,000 price level. Ultimately, this suggests burgeoning demand could have a positive impact on the Bitcoin price in the latter part of 2024.

BTC Demand From US Spot ETFs On The Rise

Propitiously, demand for Bitcoin from spot exchange-traded funds (ETFs) in the United States has been picking up in recent weeks. According to CryptoQuant data, the Bitcoin funds went from net selling 5,000 BTC in early September to net buying 7,000 BTC by the month’s end.

In comparison, the US spot ETF market purchased nearly 9,000 BTC daily in 2024’s first quarter, catapulting the premier cryptocurrency to the current all-time high of $73,737 by mid-March. If this positive trend continues, investors could see the Bitcoin price revisit its all-time high or even higher before the year is out.

As of this writing, the price of Bitcoin sits just above the $62,000 mark, reflecting a 2.3% increase in the last 24 hours.