Some traders say Germany’s Bitcoin selling is behind this week’s drop, but a negative reaction to concerning macroeconomic data is the likely culprit.

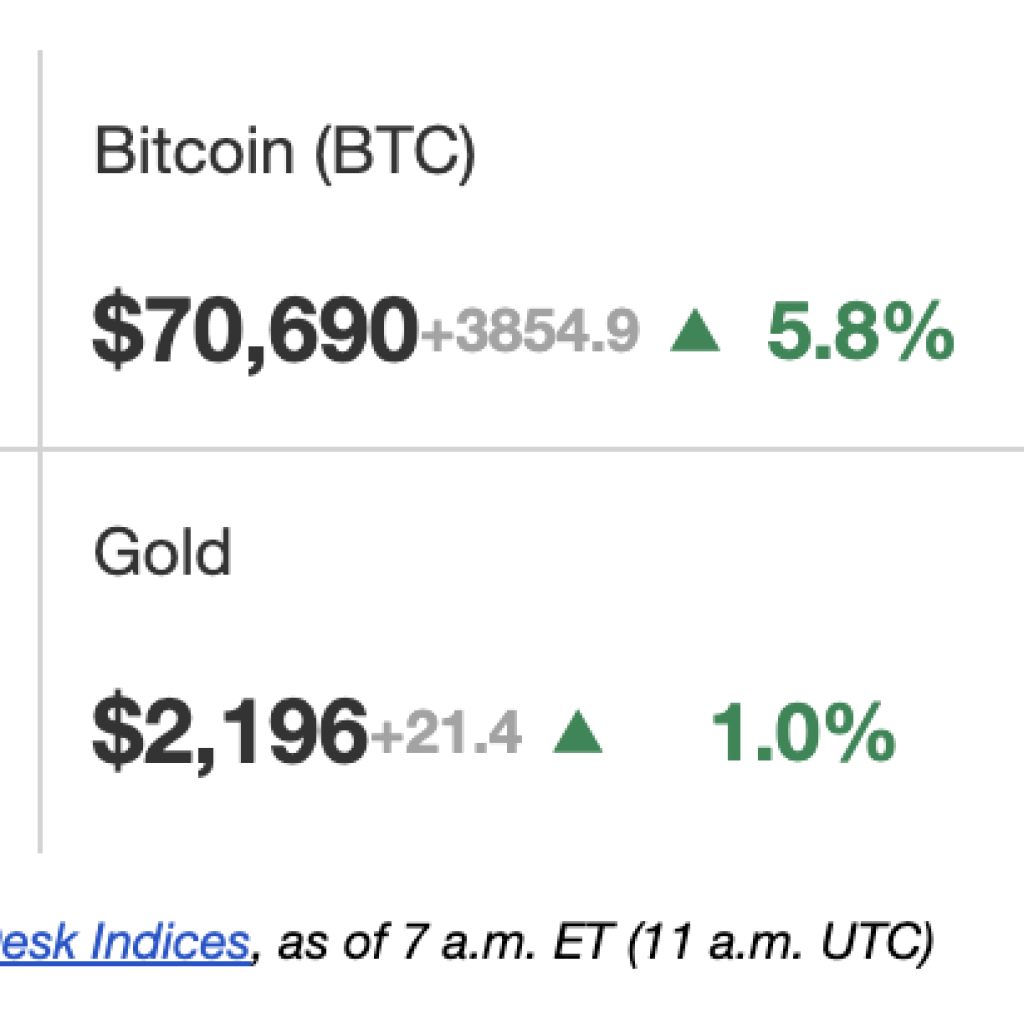

The total cryptocurrency market capitalization plummeted 3.9% between June 20 and June 21, approaching its lowest level in five weeks at $2.34 trillion. This decline affected every top-10 coin, with Bitcoin (BTC) dropping 4.2%, Ether (ETH) experiencing a 4% loss, and BNB (BNB) facing a 4.2% correction. Despite some recovery of intraday losses, the market remains in a bearish mood.

Some analysts suggested that a large sale of Bitcoin by the German government caused the crypto market downturn. However, this explanation overlooks the fact that traditional finance investors reacted to unfavorable macroeconomic data. Traders are concerned that the stock market may have peaked and that the U.S. fiscal situation is weakening.

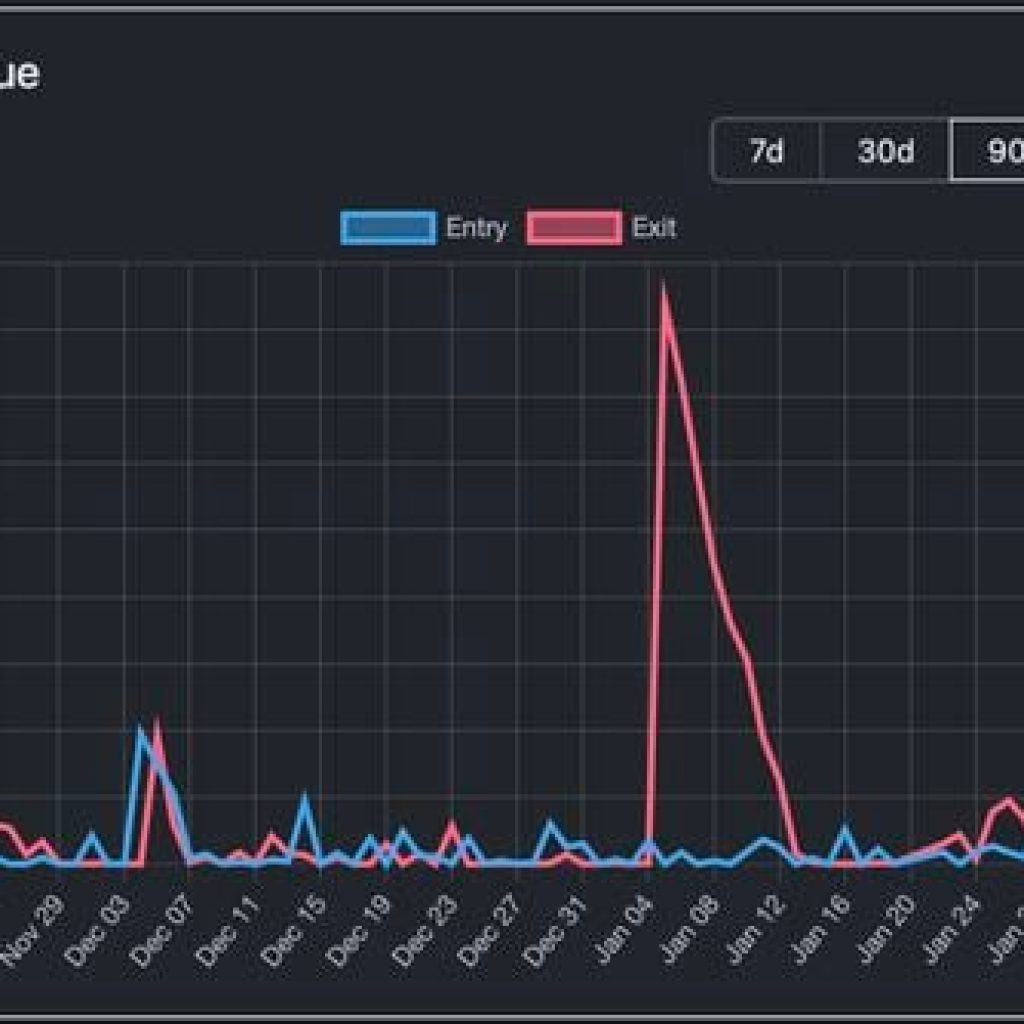

According to the onchain crypto analytics firm Arkham, a wallet linked to the German government transferred 6,500 BTC to exchanges on June 19, worth $425 million at the time. Arkham claims that the wallet held nearly 50,000 Bitcoin, believed to have been seized from the pirated movie website Movie2k, which operated in 2013. The evidence suggests that this entity sent BTC to Kraken, Bitstamp, and Coinbase, leaving little doubt about its origin and effective sale.