Coinspeaker

Bitcoin Price Is Ready for New ATH Fueled by Heightened Whale Demand

Bitcoin (BTC) price pumped over 10 percent last week to retest the resistance level of around $67K in the past few days. The flagship coin has been forming a bullish flag ready to pump towards $69K before retesting the all-time high (ATH) above $73k. Notably, Bitcoin price has consistently closed above the daily 50 Moving Average (MA) in the past six days, thus suggesting the bulls are in control.

Furthermore, the flagship coin has led the altcoin industry in a correction mode for the past two months. Exactly a month since the fourth Bitcoin halving happened and the altcoin industry continues to bleed to Bitcoin as depicted by the falling trend in the ETH/BTC.

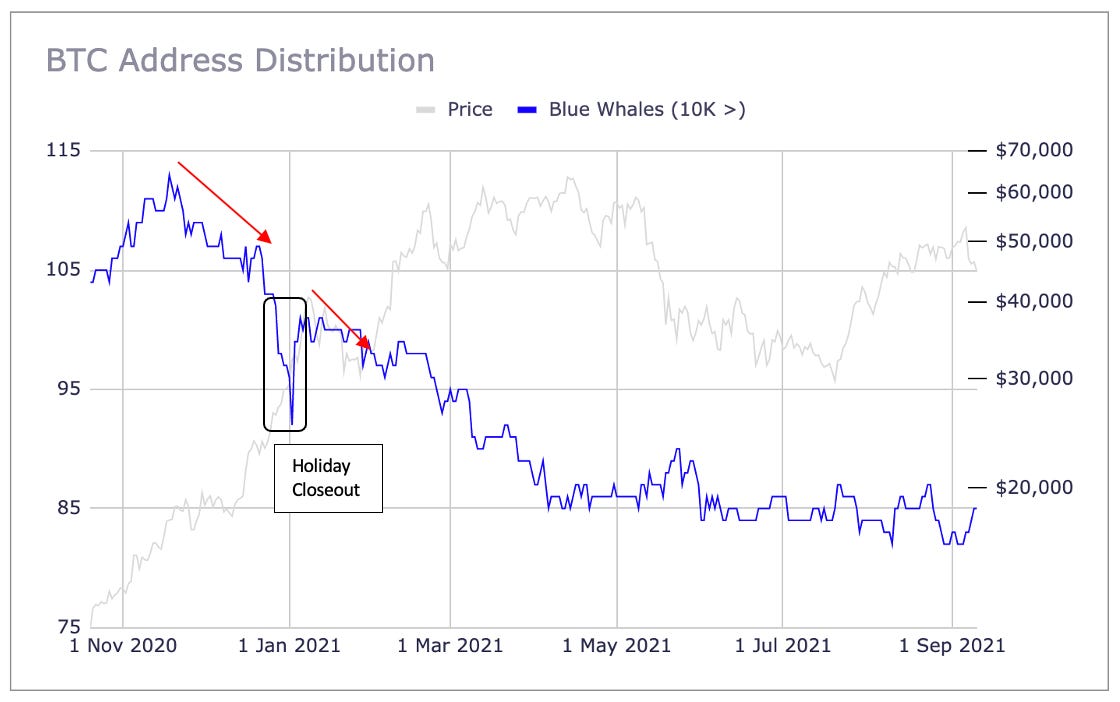

Bitcoin Whales Aggressively Accumulate

According to on-chain data provided by market intelligence platform Santiment, Bitcoin whales have been absorbing the renewed dump from short-term holders. Specifically, small Bitcoin wallets decreased by more than 182k in the past week. However, both Hong Kong and United States-based spot Bitcoin ETFs registered significant cash inflows last week.

While Hong Kong-based spot Bitcoin ETFs saw an inflow to about $244 million in total net assets, US-based spot BTC ETFs accumulated more than 14k Bitcoins last week. Interestingly, Bitcoin miners only created around 520 units last month, thus suggesting heightened demand from institutional investors.

According to on-chain data, a single entity just purchased more than 16,445 Bitcoins, worth more than $1.1 billion, in the past 24 hours. Another crypto whale was spotted aggressively accumulating Bitcoins in the past 24 hours, with more than $106 million.

In this cycle, whales (>1K BTC) exhibit the lowest activity in terms of selling on exchanges. The current 30-day average is 641 BTC.

Whales are unwilling to sell their coins as they anticipate a rise in value. pic.twitter.com/vJyQiyBbKa

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) May 20, 2024

Key Targets for BTC Price Ahead

Bitcoin price rebounded strongly from the recent correction to trade around $67k on Monday during the London session. The flagship coin has confirmed a reversal pattern via an inverted head and shoulder (H&S) formation. A sustained close above $67K in the coming days will guarantee a rally toward a new all-time high of around $74,747, which coincides with the daily 1.618 Fibonacci Extension.

On the weekly time chart, Bitcoin price had the first green candlestick for the past two months, thus suggesting a further uptrend. Moreover, the weekly Relative Strength Index (RSI) has been attempting to rally above the 70 level, which is a popular bullish indicator.

Meanwhile, Bitcoin’s dominance on the weekly chart has been forming a reversal pattern, thus signaling inevitable crypto cash rotation to the altcoin market. Furthermore, Bitcoin dominance has been grinding higher on the weekly timeframe but the RSI has been forming a bearish divergence.

As a result, it is prudent for crypto traders to consider the altcoin industry in the coming months as it will ultimately outshine Bitcoin, which has a market cap of over $1.3 billion.

Bitcoin Price Is Ready for New ATH Fueled by Heightened Whale Demand