A stock market recovery, investors' anticipation of upcoming US inflation data and risks to the US dollar dominance are fuelling Bitcoin’s recent price gains.

Bitcoin (BTC) experienced a 7% drop between Sept. 5 and Sept. 7, but it managed to maintain a daily closing price near $54,000 and later recovered some of its losses, reaching $55,300. This movement mirrored the price action in global stock markets, but several factors, including anticipated inflation data and growing risks to the dominance of the United States dollar, can help explain the rise in Bitcoin’s price.

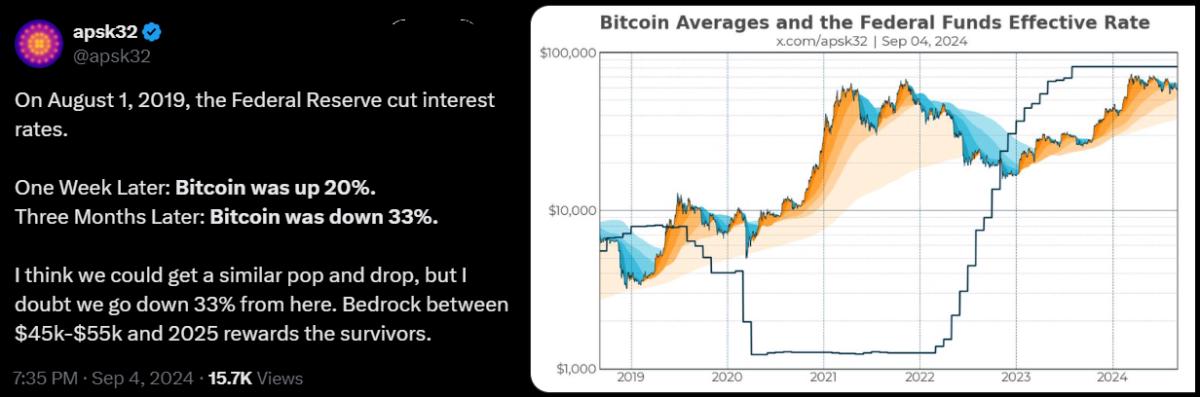

The S&P 500 index futures rose by 1.4% since hitting their low on Sept. 6, as investors grew more confident that the US central bank would cut interest rates to stimulate the economy in the upcoming months. Economists are predicting a slowdown in inflation, which has historically been a hurdle to implementing a less restrictive monetary policy. A 2.6% year-over-year US CPI increase is anticipated for August, with the report due on Sept. 11.

The impact of lower inflation on Bitcoin is not straightforward or entirely clear, given that part of the cryptocurrency’s appeal has been its hedging capability due to its fixed monetary policy. However, some analysts believe that Bitcoin’s price benefits from increased liquidity in the system as businesses and individuals gain access to cheaper capital and yields on fixed-income investments decline.