Coinspeaker

Bitcoin Recouples Its Correlation with US Equities, BTC Index in Extreme Fear

Despite the massive sell-off coming from the German government this week, Bitcoin price has managed to trade in the tight range between $57,000-$58,000. On the other hand, after hitting fresh highs in early trading hours on Thursday, it ended 0.88% in negative during the end of the trading session. While Bitcoin has been showing strong decoupling with the US equities in recent weeks, the gap reduced during Thursday’s trading hours. At midday New York time, the Nasdaq has declined by 1.8%, and the S&P 500 by 0.9%. Bitcoin, which earlier in the session rose above $59,000 following positive US inflation news, is now down 0.6% to $57,500.

Joel Kruger, market strategist at the LMAX Group, said that there could be a further downside to cryptocurrencies if the equity market sees a broader correction ahead. Kruger said:

“Right now, the biggest risk we see to crypto assets is the risk that highly overbought U.S. equities could be on the verge of rolling over. The correlation isn’t absolute by any means, but there is evidence that would suggest a sharp pullback in stocks could weigh on crypto, at least for a moment.”

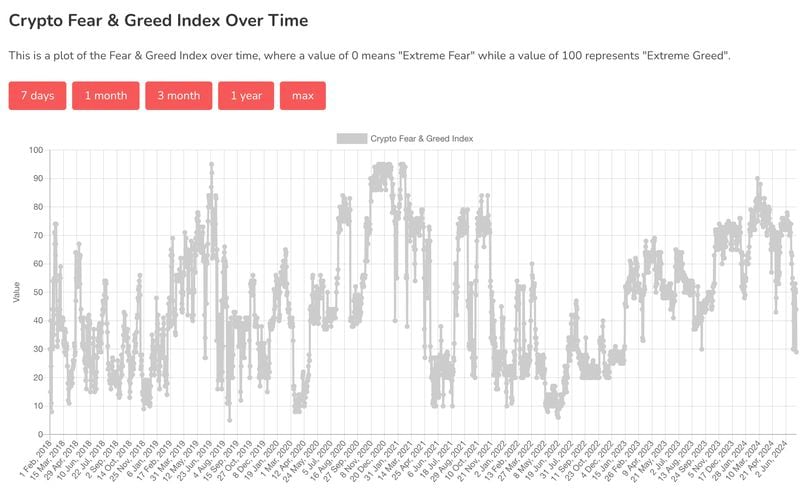

Bitcoin Index in Extreme Fear

Amid the current selling pressure, the Bitcoin Fear and Greed Index has dropped to the “extreme fear” zone. this happened as the price of Bitcoin failed to breach the crucial resistance of $60,000.

Bitcoin Fear and Greed Index is 25 — Fear

Current price: $57,345 pic.twitter.com/efreWqUJz4— Bitcoin Fear and Greed Index (@BitcoinFear) July 12, 2024

In a July 11 post on X, crypto and forex trader Justin Bennett informed his 111,000 followers that Bitcoin price had once again failed to surpass the $60,000 mark. He highlighted the formation of a potential “rising wedge”, indicating a possible decline in the coming days.

On Thursday, the US released the CPI numbers for the month of June with inflation showing signs of slowing down significantly. The US CPI data dropped by 0.1% in May thereby putting the 12-month rate at 3%. This has been the lowest CPI monthly number in nearly three years.

📈📉 The US CPI report came out today with news of a core CPI 3.3% rise vs. 3.5% expected, appearing bullish for crypto. However, with many already anticipating a good report and prices being driven up in the days prior, this was a perfect 'buy the rumor, sell the news' event. pic.twitter.com/RqeE7L2eHv

— Santiment (@santimentfeed) July 11, 2024

Interestingly, both the risk-ON assets – crypto and equity – moved downwards despite the cooling inflation. As on-chain data provider Santiment reported, this turned out to be a sell-the-news event.

Bitcoin Recouples Its Correlation with US Equities, BTC Index in Extreme Fear