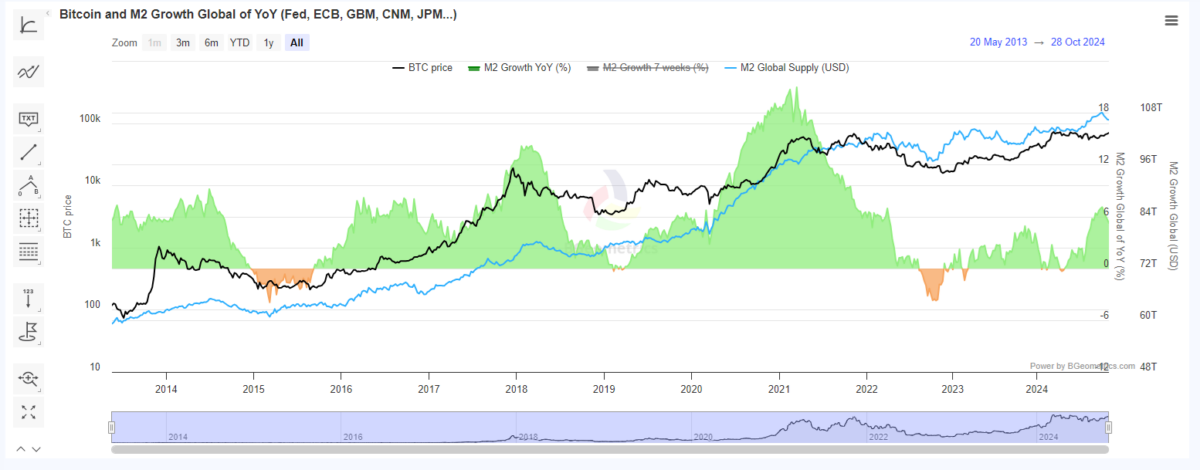

Bitcoin solidified its growth trend in October, climbing above $73,500 for a brief period. The latest rally coincides with a new period of M2 money supply growth, one of the key factors behind the rise of BTC markets.

BTC is still within a small distance of its all-time high. The recent rally still adheres to the trend of rising M2 money supply.

The BTC market price is a lagging indicator of quantitative easing. In the short term, BTC has rallied even during liquidity crunches, but its overall arc coincides with M2 money supply shifts. The M2 indicator took months to recover since a small April crunch, coinciding with Bitcoin’s slow gain to over $70K.

The global M2 supply peaked around September 20 and slid slightly in the last month or so. The price of BTC performed in its usually lagging format, after moving within a relatively small range. Now, the hopes of a bigger BTC rally or a 2025 bull market hinge on decisions about the M2 money supply.

The past decade has seen almost constant M2 expansion for the major central banks, though with occasional backtracks and minor supply crunches. The most influential metric takes into account the world’s largest central banks – The US Fed, the ECB, the Bank of Japan, and the People’s Bank of China.

Will M2 continue to grow?

The M2 landscape may vary regionally, shifting demand for investments. In 2025, the US money supply is expected to grow more conservatively, with some backtracking expected during the year. The Euro Area expects cautious growth, with the exclusion of the German economy.

The M2 money supply predictions are based on hundreds of economic indicators, reflecting the state of regional development. With economic headwinds and uncertainty, M2 growth may remain uneven, creating a disparity in demand for crypto assets.

While crypto aims to go against banking, the M2 supply issued by central banks is also a proxy metric for overall sentiment and prosperity, creating demand for risky investments like BTC. The recent BTC inflows and price action follow similar demand for spot gold and gold ETF.

Despite the inclusion of stablecoins, BTC expansion coincides with periods of economic recovery and growth, while also serving as a hedge against uncertainty. BTC demand is also used as a tool to offset inflation, given the expectation of appreciating to a higher price range.

As a result, BTC rallies often follow cycles of M2 growth with up to six months’ lag. The biggest rallies follow peaks in M2 supply and continue during the liquidity crunch phase.

The recent M2 growth trend may be one of the powerful underlying drivers, as BTC expects a renewed bull market in 2025.

BTC faces predictions of TradFi supercycle

The recent BTC rally follows a year of constant inflows into ETFs. For now, mainstream adoption of BTC is seen more as a novelty and a supplement to the portfolios of the new generation of investors.

BTC is still operating at a much smaller scale, and has not lined up to the size of traditional markets. For now, BTC is still allocated to portfolios on a relatively small scale. At current valuations, BTC has a market cap of around 1.4T, while asset classes like stocks and bonds are valued at $46 trillion each.

BTC makes up nearly 60% of the crypto market, and there are expectations for additional inflows from TradFi. The inflows can come through ETFs as well as through MicroStrategy (MSTR) stock. One of the more extreme predictions is for a $2M per BTC valuation, at a market capitalization of $40T.

Price predictions for BTC range between a supercycle based on macro factors like M2 and short-term corrections due to liquidations. The latest price moves also cause disparate predictions, between a 30% drawdown and a non-stop rally to six-digit prices.

BTC accumulation has already happened over the past year, with both large ETFs and whale holders increasing their wallets. At this stage, the retail supply crunch could cause another FOMO market.

BTC is also seen as having meme potential, causing renewed irrational inflows. The FOMO scenario breaks away from the other possible price direction, trading in a range as in the past few years.