Bitcoin is currently facing its worst week since August as demand for exchange-traded funds (ETFs) linked to the cryptocurrency has faltered. The price of Bitcoin has declined by more than 10% from its recent all-time high amid moderating appetite for spot Bitcoin ETFs.

This downturn comes as dedicated US ETF demand dries up, prompting concerns among investors. Despite the setback, industry experts like Ark Invest CEO Cathie Wood continue to highlight Bitcoin’s significance, referring to it as a “financial super highway” with important use cases.

Bitcoin’s negative weekend sentiment kicks in

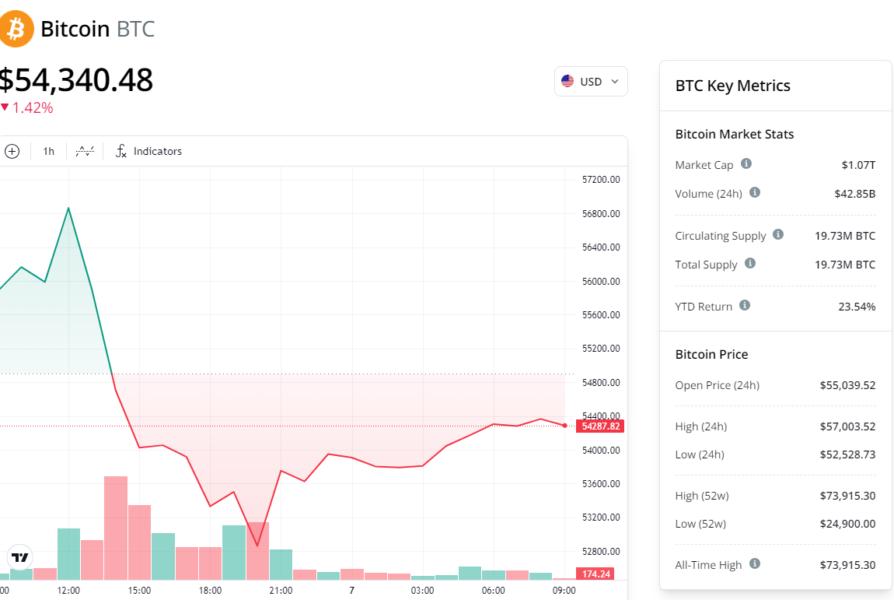

Currently, the value of Bitcoin (BTC) stands at $64,338.62, showing a slight decrease of 0.4% in the past hour and 0.5% since yesterday. The current value of BTC is 5.9% lower than its value 7 days ago.

Currently, the global cryptocurrency market cap stands at $2.58 Trillion, with a slight decrease of -1.51% in the past 24 hours and a significant increase of 109.63% compared to one year ago.

Currently, the market capitalization of BTC stands at $1.27 Trillion, indicating a Bitcoin dominance of 49.18%. Meanwhile, Stablecoins’ market cap stands at $150 billion, representing a 5.82% share of the overall cryptocurrency market cap.

BTC has experienced a decline of over 10% from its all-time high, as the demand for new spot BTC exchange-traded funds decreases. This has resulted in the cryptocurrency having its worst week since August.

The group of 10 spot Bitcoin ETFs is set to experience its largest weekly outflow since the products were introduced on Jan. 11. Meanwhile, the largest crypto is experiencing one of its most challenging weeks of the year with a decline of approximately 6.5%. The token experienced a 2.5% decrease, reaching $63,820 on Friday.

One crypto market analyst asserts that BTC is nearing the 60K mark due to decreasing ETF flows, liquidations, and rumors of delays in an Ether ETF. The markets are eagerly looking for a positive catalyst to bolster any upward movements.

According to JPMorgan Chase and Co. strategists, BTC is showing signs of being overbought. They are cautioning against further declines leading up to April’s highly-anticipated halving event, which will reduce the supply of newly minted BTC from miners.

According to another market analyst, the sustained open interest in CME Bitcoin futures and the declining ETF flows are indicating bearish signals for the price of BTC.

BTC ETF inflow in the market

The rate at which net inflows are entering spot BTC ETFs has significantly decreased, as there has been a notable outflow in the past week,” the strategists noted. This questions the idea that one-way net inflows will consistently characterize the flow picture of spot Bitcoin ETF.

Given the upcoming halving event, it is probable that profit-taking will persist, especially considering the current overbought positioning despite the recent correction.

Last month, the bank made a prediction that the price of Bitcoin would decrease to around $42,000 after April as the excitement caused by the BTC halving event fades away.

Investors withdrew a significant $836 million from ETFs between Monday and Thursday, as outflows were observed from the Grayscale Bitcoin Trust and a decrease in subscriptions for similar offerings from companies such as BlackRock Inc. and Fidelity Investments.

According to data compiled by Bloomberg, the funds have attracted net inflows of $11.3 billion so far. This makes it one of the most successful debuts for an ETF category. The Grayscale Bitcoin Trust, which has been converted into an ETF, has experienced outflows totaling $13.6 billion.

This past week, there has been a slowdown in those inflows, suggesting that interest in BTC ETFs may be leveling off, at least for now. Although Bitcoin reached a new high of nearly $73,798 on March 14, there are signs that retail traders may be losing some of their excitement,

The rally’s failure to gain momentum from the all-time high raised concerns about its strength. If this event fails to maintain momentum, there is a possibility of a significant retracement, potentially causing the price to drop below $50,000.