Almost $180 million in short positions in Bitcoin have been wiped as it hit a new all-time high, with an analyst saying it is “meaningful” that it is driven by spot demand.

Bitcoin traders who bet on an election-induced price decline have been liquidated to the tune of $180 million as the cryptocurrency shattered its previous all-time high and briefly hit $75,000.

“The spot market is flying, and shorts are getting rekt,” Pav Hundal, lead analyst at crypto exchange Swftyx told Cointelegraph. “Traders are betting that the crypto summer is back, and it’s almost all buy action on our order books right now.”

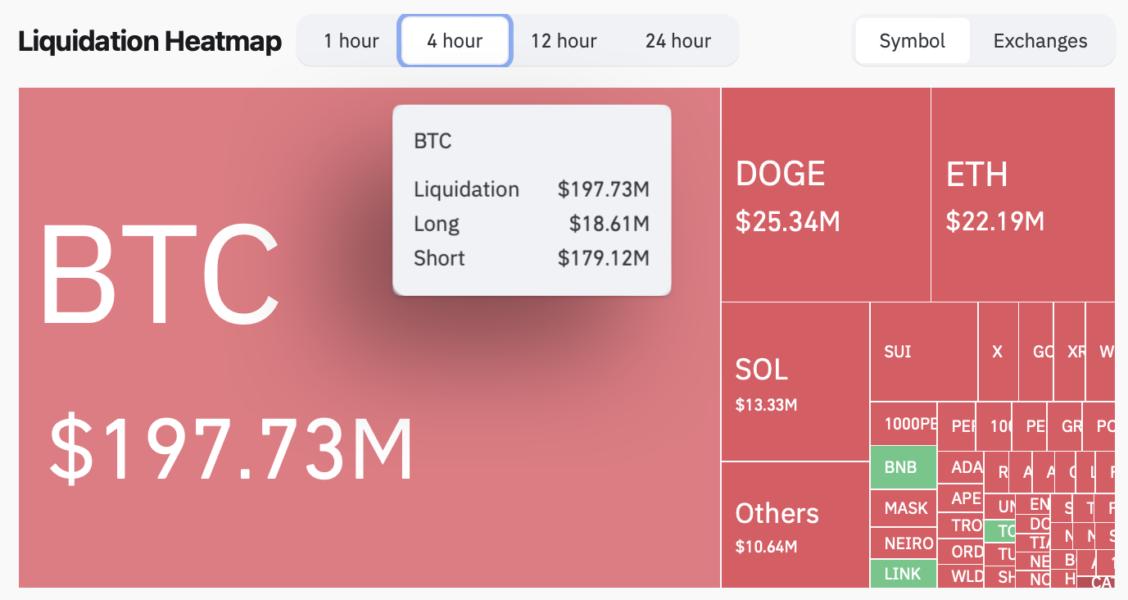

On Nov. 6, Bitcoin (BTC) hit a new high of $75,000.85 on Coinbase, breaking through its prior peak of $73,679 set on March 13, which liquidated roughly $179.12 million in Bitcoin short positions in the following 4 hours, according to CoinGlass data.