Bitcoin is having a rough day. The price of the world’s most well-known cryptocurrency took a nosedive, losing 3.20% and dropping to under $60,000 after its iconic recovery from the August 5th plunge.

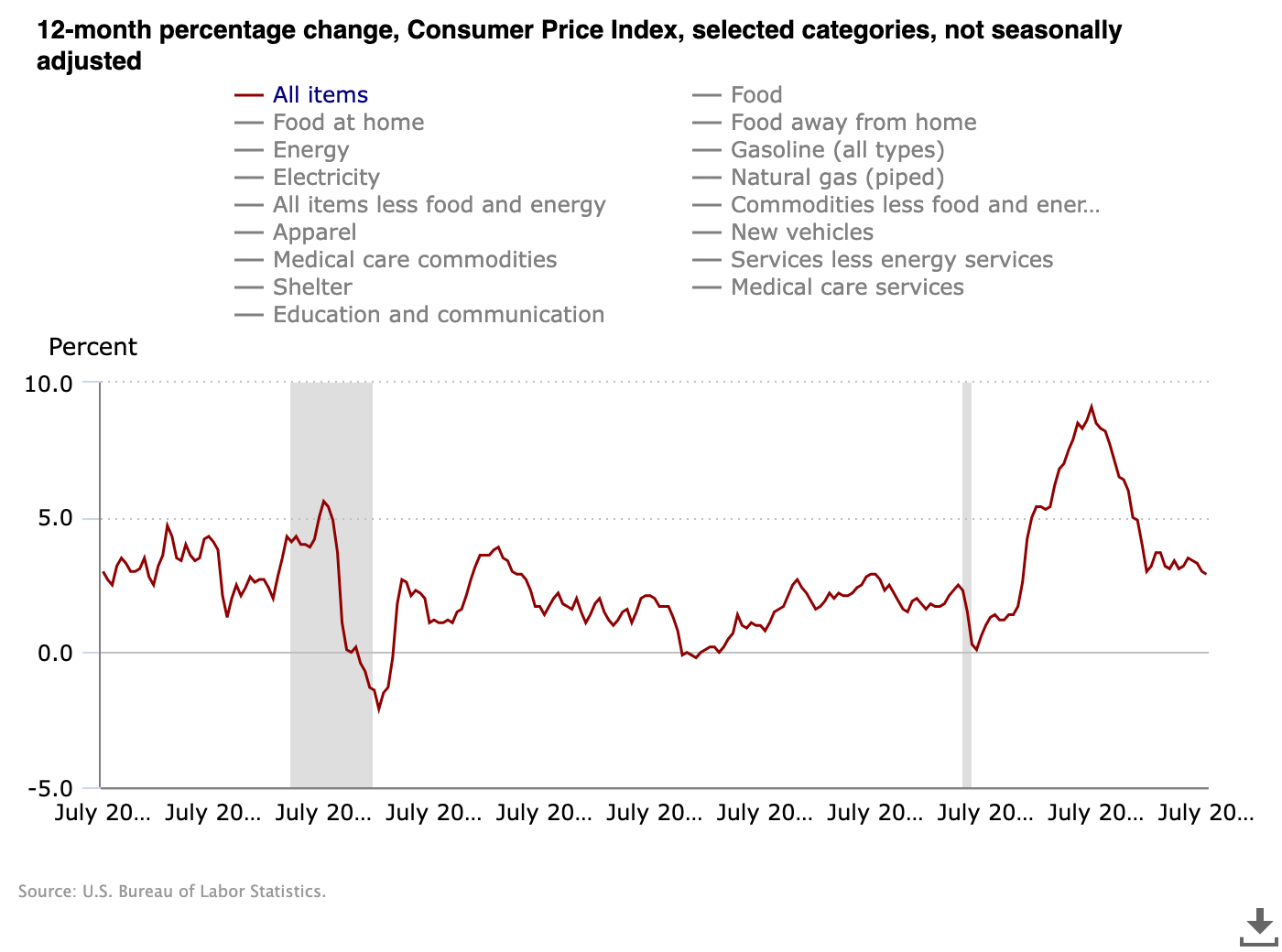

So, what exactly happened today that sent Bitcoin tumbling? We’ve got several factors at play, each one throwing fuel on the fire. First off, the U.S. consumer price index (CPI) data just dropped, and it’s a big one.

The latest reading shows that both headline and core CPI increased by 0.2%. Sounds tiny, but in the world of finance, this is big news. It means that inflation is still cooling off, which might lead to the Federal Reserve cutting interest rates in September.

Now, you’d think this would be good for Bitcoin, right? Lower rates usually mean more money flowing into risky assets like crypto. But not so fast—things aren’t always that simple.

The liquidation nightmare

Over $1 billion in leveraged long positions got wiped out as Bitcoin tried to hold on above $50,000. When leveraged positions get liquidated, it creates a domino effect, triggering more selling pressure, which keeps prices down.

And it’s not just crypto—stocks are getting hammered too. The S&P 500 and Nasdaq both recorded losses today.

Before today’s inflation data, the U.S. just released some disappointing employment data, reviving fears that we might be heading into a recession.

When people start worrying about a recession, they tend to pull their money out of riskier assets, like Bitcoin, and stash it somewhere safer. That’s bad news for crypto investors who are already on edge.

To make things worse, there’s a lot of uncertainty around regulation. There have been some big moves in the market, like Jump Crypto transferring large amounts of assets.

This has people speculating about potential liquidations, especially since there are ongoing regulatory investigations. No one likes uncertainty, especially not in a market as volatile as crypto.

And then there’s the upcoming U.S. presidential election. Crypto investors are sweating bullets over the possibility of Kamala Harris beating Donald Trump, who’s seen as more pro-crypto.

On-chain chaos and ETF woes

On-chain liquidations are another big factor contributing to today’s decline. Over $350 million in assets got liquidated across various DeFi protocols. That includes major players like Ether, wrapped staked ETH (wstETH), and wrapped Bitcoin (wBTC).

And centralized exchanges aren’t doing any better. The latest CPI data might make it more likely for the Fed to cut rates in September, but that’s not helping Bitcoin right now. In fact, it might be making things worse.

According to analysts at Bitfinex, the CPI being in line with expectations is a sign that the Fed will probably go ahead with a rate cut. They say this could lead to a bullish trend for Bitcoin, but only if the market calms down.

Right now, we’re seeing the opposite—whales are selling as the price approaches key resistance levels between $64K and $65K, which is only adding to the selling pressure.

Aurelie Barthere, a Principal Research Analyst at Nansen, also chimed in. She pointed out that the disinflation trend, which has been going on since Q2, is still intact.

This gives the Fed some breathing room to cut rates without worrying too much about inflation. But for Bitcoin and other cryptos to recover, we need more good news about the U.S. economy, especially from the consumer side.

So, what about ETFs? You’d think that with all this talk of rate cuts, we’d see more money flowing into spot Bitcoin and Ethereum ETFs. And you’d be right—sort of.

We did see positive inflows earlier this week, with a net inflow of $38.94 million as of August 13th. But the favorable CPI data hasn’t exactly started a buying frenzy.

Instead, we’re seeing investors sitting on the sidelines, waiting for more clarity before they jump back in.

The analysts at Bitfinex are optimistic, though. They think that as we get closer to the September rate cut, we might see a sustained rally in the crypto market.