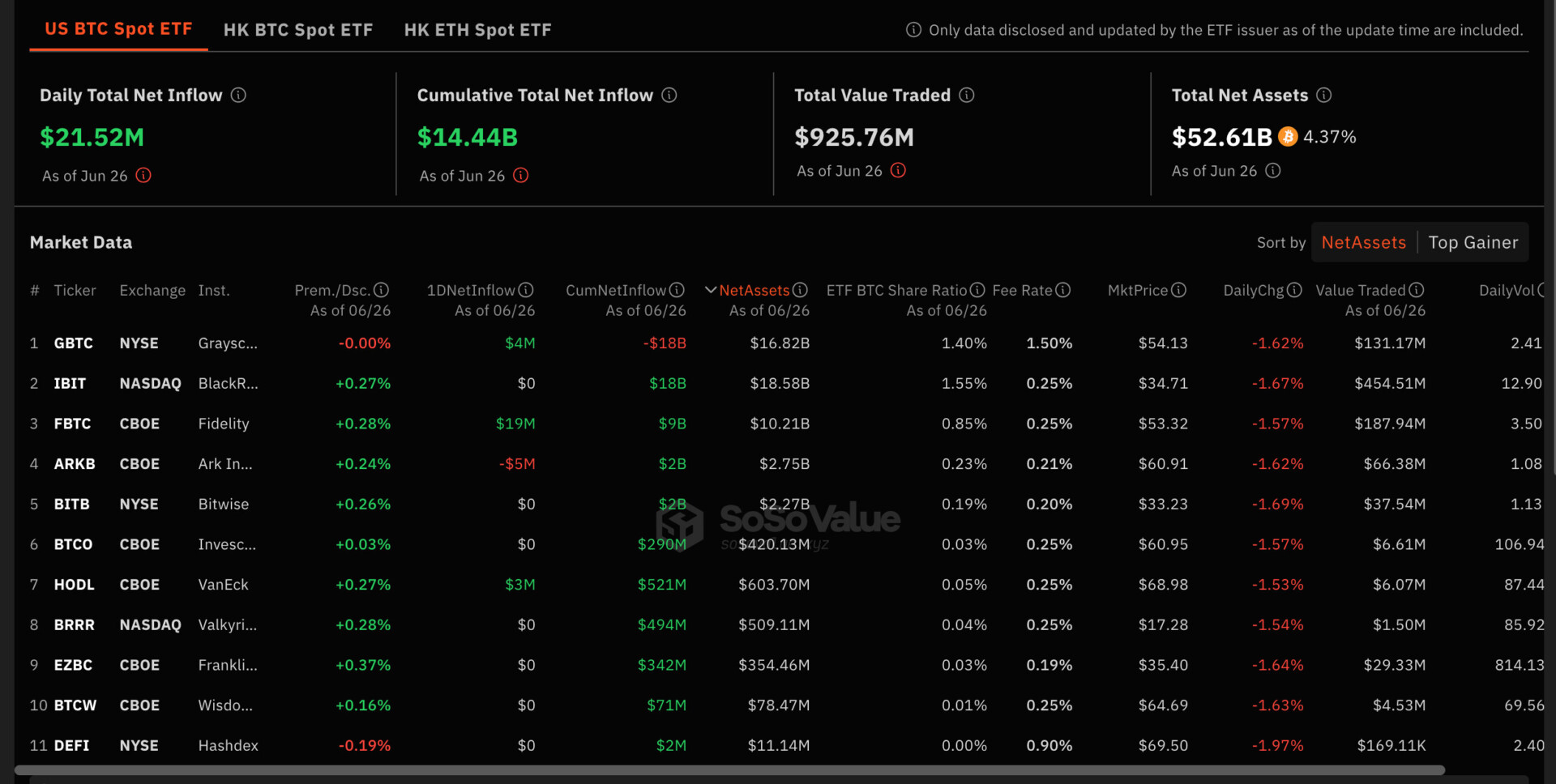

On June 26, Bitcoin spot ETFs witnessed an influx of $21.5187 million. The big players in this financial theater, Grayscale ETF (GBTC) and Fidelity ETF (FBTC), were the main characters, with GBTC raking in $4.3306 million and FBTC pulling a whopping $18.6093 million in a single day.

Fidelity’s total net inflow for FBTC has now reached an impressive $9.185 billion. The total net assets for GBTC stood at a staggering $16.82 billion, despite a slight daily change of -1.62% in market price.

GBTC has a fee rate of 1.50% with a market price of $54.13. The ETF’s daily trading volume was 2.41 million, generating a value traded of $131.17 million.

On the other side, Fidelity’s FBTC trades on the CBOE with a fee rate of 0.25% and a market price of $53.32. The ETF saw a daily change of -1.57%, with a daily volume of 3.50 million and a value traded of $187.94 million. FBTC’s cumulative net inflow has reached $9.185 billion.

Comparing the competition

BlackRock’s IBIT, trading on NASDAQ, showed a premium of +0.27% but did not report any net inflow for the day. Its cumulative net inflow stands strong at $18 billion, with net assets amounting to $18.58 billion. IBIT has a fee rate of 0.25%.

Ark Invest and 21Shares’ ARKB saw a negative net inflow of $5 million. Despite this, its net assets are valued at $2.75 billion. Bitwise also saw no net inflow for the day but has cumulative net inflows of $2 billion.

Invesco and Galaxy Digital’s BTCO also showed no net inflow but has cumulative net assets of $420.13 million. Its market price decreased by 1.57%, with a daily volume of 106.94K.

Meanwhile, Ethereum ETFs are also making waves, even though they aren’t even trading yet. According to Galaxy Research, once approved, Ether spot ETFs could see net inflows of up to $1 billion per month.

“We expect the net inflows into ETH ETFs to be 20-50% of the net inflows into BTC ETFs over the first five months, with 30% as our target, implying $1 billion/month of net inflows.”

Galaxy Research

Ether ETFs are anticipated to be highly sensitive to inflows due to the huge amount of ETH locked in staking, bridges, and smart contracts, coupled with the lower amount of ETH held on centralized exchanges.

However, Galaxy Research cautions that Ether ETF demand might be tempered by the lack of staking rewards. Additionally, outflows from the Grayscale Ethereum Trust (ETHE) could create a challenge, with an estimated 319,000 ETH, or $1.1 billion, potentially going out each month.

Despite this, the impact on ETH prices is expected to be less severe than that on Bitcoin, primarily due to the absence of forced selling pressures from bankruptcy-related issues, which have plagued Bitcoin trusts.

Jai Hamid