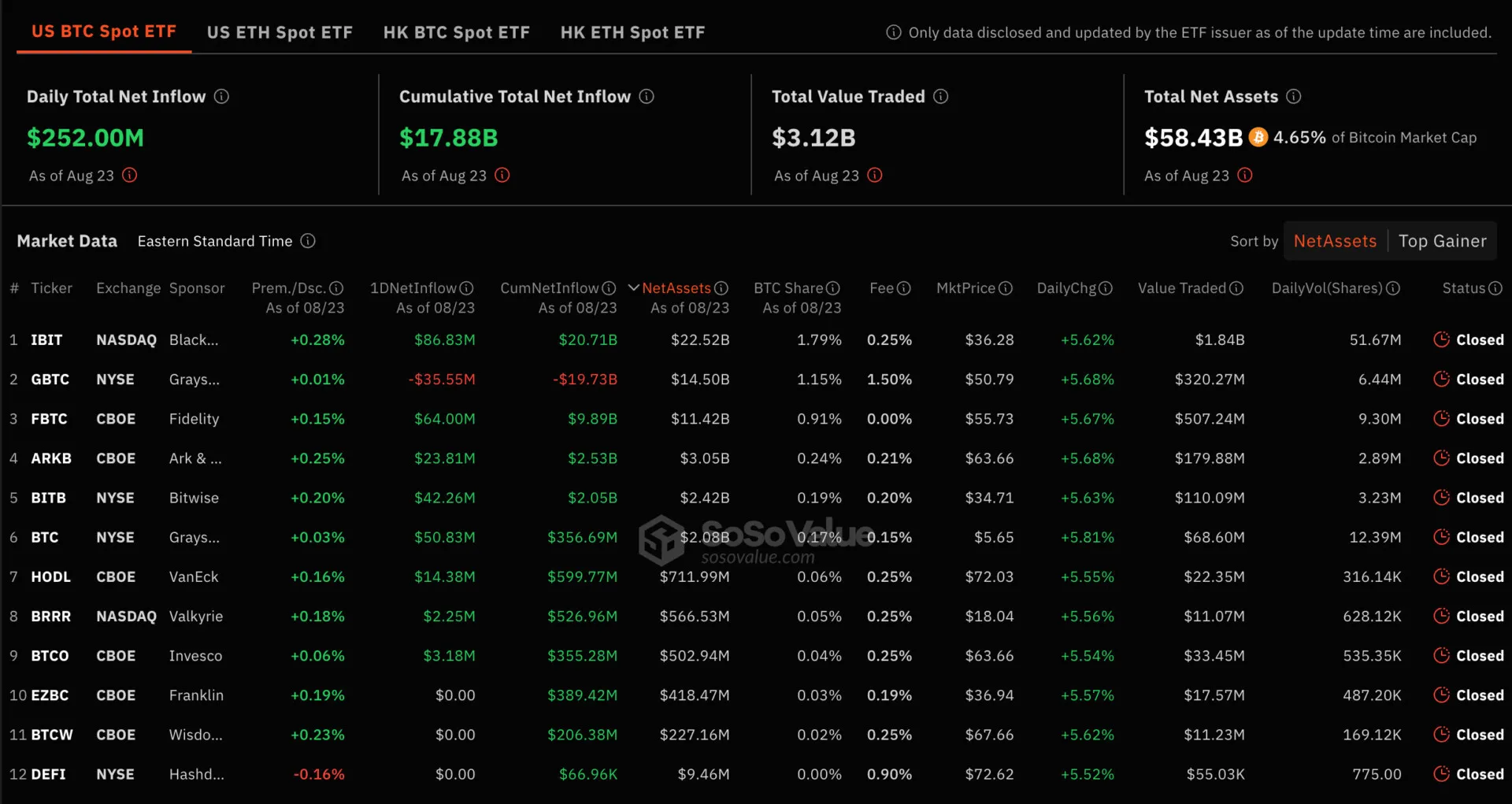

Bitcoin spot ETFs are seeing some serious action. On August 23, they brought in a massive $252 million in net inflows—the highest single-day amount since July 23. The funds have been on a hot streak with net inflows for seven straight days.

But Grayscale’s GBTC had an outflow of $35.55 million, showing not every player is having a good time. Meanwhile, its smaller ETF, the BTC mini, saw a positive inflow of $50.83 million.

Over at BlackRock, their IBIT ETF had a strong showing with an $86.83 million inflow, and Fidelity’s FBTC ETF wasn’t far behind, pulling in $63.99 million.

At press time, the top five spot Bitcoin ETFs by assets under management (AUM) are led by Grayscale Bitcoin Trust (GBTC) with $21.4 billion in AUM.

BlackRock’s iShares Bitcoin Trust (IBIT) follows with $2.2 billion. Fidelity’s Wise Origin Bitcoin Fund (FBTC) comes next at $1.34 billion, ARK’s 21Shares Bitcoin ETF (ARKB) with $637 million, and Invesco Galaxy Bitcoin ETF (BTCO) rounding out the list with $295 million.