Bitcoin’s resilience was tested yet again this Thursday, as it momentarily dipped below the $63,000 mark. This drop is tied closely to the latest U.S. economic figures which have caused a stir among cryptocurrency enthusiasts and investors alike.

With the U.S. reporting a lower than anticipated GDP growth and a spike in inflation rates, the financial markets are feeling the heat, and cryptocurrencies, including Bitcoin, are not spared.

The initial GDP report for the first quarter of 2024 has thrown a curveball with a growth of just 1.6%, a noticeable decline from the previous quarter’s 3.4%, and well below the analyst expectations of 2.5%.

This was coupled with an increase in the GDP price index to 3.1% from 1.6% in the last quarter, signaling higher inflation than many hoped for. The combination of slowing growth and rising inflation is a cocktail that typically does not sit well with investors, as it suggests stagflationary tendencies that could complicate monetary policies.

Market Reaction and Immediate Impact

The effect of the unsettling economic data was immediate across various asset classes. Traditional stock markets took a hit right at the opening bell, with major U.S. indexes like the S&P 500 and Nasdaq tumbling nearly 2%.

The bond market wasn’t left out, as yields on the 10-year U.S. Treasury notes climbed 8 basis points, reaching 4.73%, a peak not seen since last November. This surge in yields reflects a drop in bond prices, underpinning the investors’ shift towards safer assets amid growing economic uncertainty.

Cryptocurrencies felt the shockwaves with Bitcoin sliding over 4% to touch a low of $62,800 before making a modest comeback to $63,700. Ethereum mirrored this decline, also dropping by about 4%.

The altcoin market experienced even steeper falls, with notable cryptocurrencies like Solana, Avalanche, and Aptos registering losses between 8% and 9% before recouping some of these losses later in the day.

Implications for Bitcoin and Cryptocurrencies

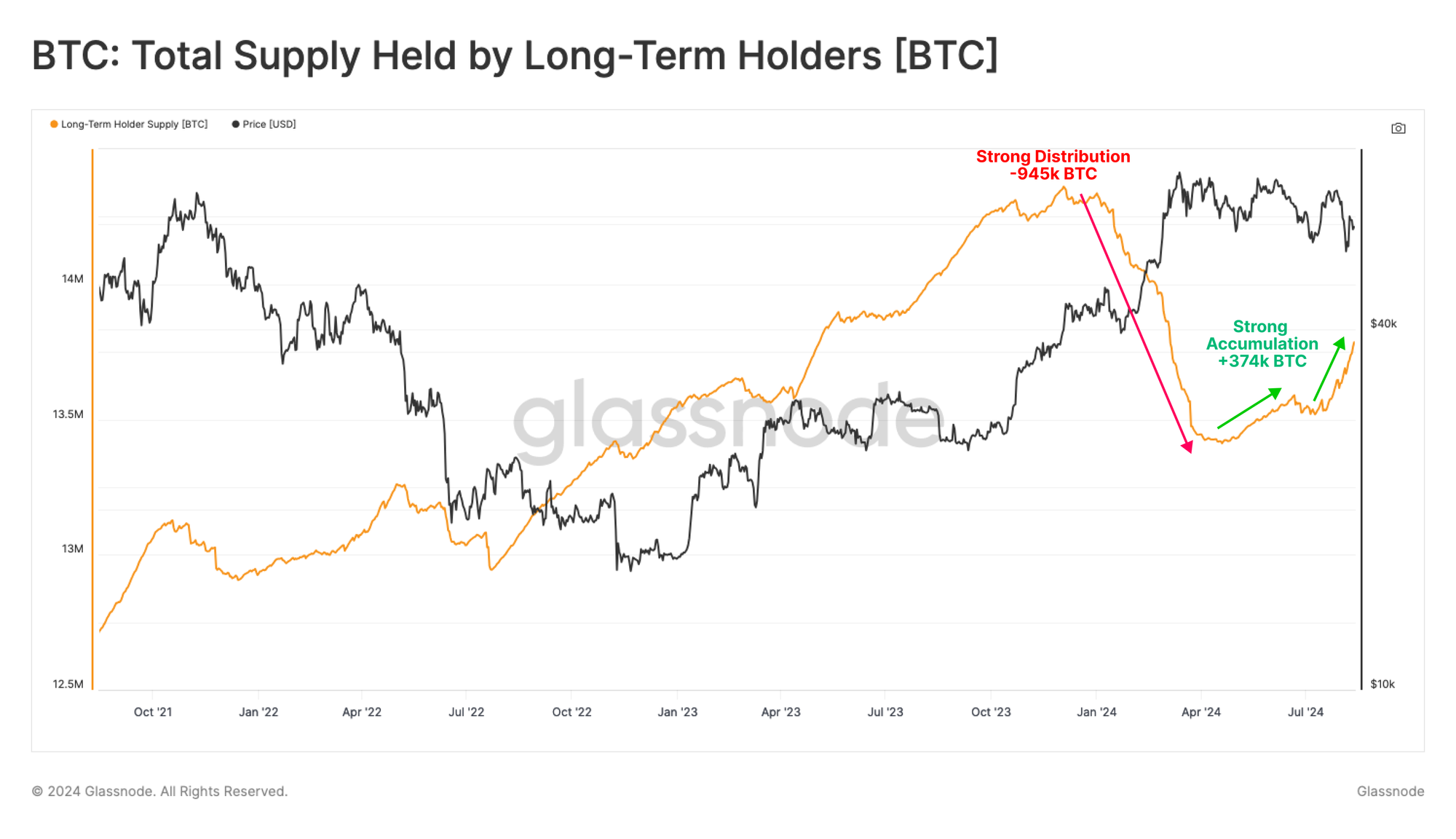

The broader market dynamics have also thrown light on the liquidity aspects within the cryptocurrency exchanges. On the day of the report, liquidity saw a significant shift with an increase on both sides of the Bitcoin spot price.

A notable buildup of sell orders starting at around $75 million at the price point of $64,765 and up to $67,700 indicated a strong resistance level forming. On the flip side, there was less aggressive buying interest, with bids concentrating around the $63,500 mark, roughly aligning with the day’s low.

Amid these market turbulences, Bitcoin managed to fill one of the two gaps left by the recent futures trading on the CME Group, indicating a potentially stabilizing effect in the short term. This points to a subtle yet significant signal that despite the immediate knee-jerk reactions, there might be underlying strengths in the cryptocurrency market that could support gradual recovery.

Furthermore, the market’s response to the U.S. economic data has cast doubts on the Federal Reserve’s ability to cut interest rates in the near future. With rate cuts typically serving as a boost to risk assets, the postponement or scaling back of such financial easing measures could prolong the recovery phase for assets like Bitcoin.

In the midst of these developments, the trading sentiment as captured by the crypto trading firms suggests a cautious approach in the immediate term. The expectation is for a capped upside potential for Bitcoin, with a likely consolidation around the current levels as the market digests the full impact of the economic indicators.