Coinspeaker

Bitcoin Traders Hedge Downside as Put-Call Ratio Rises Above One

A recent price correction in the Bitcoin (BTC) market has shocked the options trading space. Analysts report a significant increase in downside bets. Traders are showing growing concerns about Bitcoin’s near-term price trajectory, which is evident in the rising open interest for put options and the surging implied volatility.

Options Data Indicates Bearish Sentiment

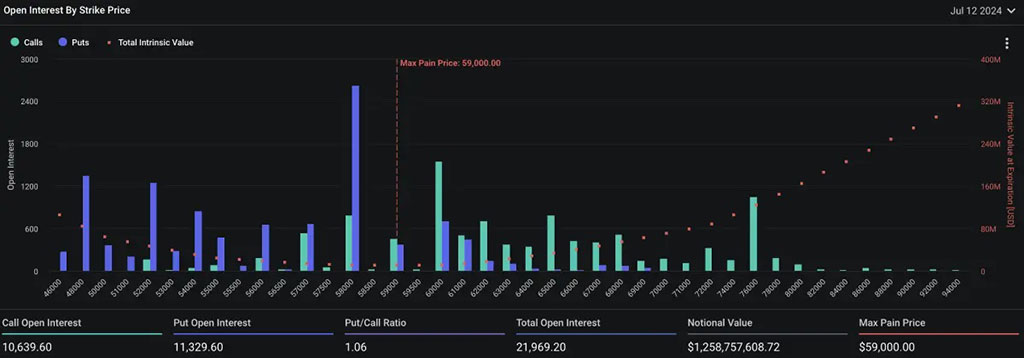

Deribit, a leading cryptocurrency derivatives exchange, shows that the put-call ratio for Bitcoin options open interest has surpassed one as we approach this Friday’s weekly expiry. This increase indicates a bearish sentiment in the market because traders are engaging in significantly more put options, which profit if the price falls, compared to call options that benefit from price increases.

Photo: Deribit

Deribit’s data highlights that traders are concentrating on put options at strike prices of $58,000, $52,000, and $48,000. This behavior suggests that traders either anticipate potential support at these price levels or are actively hedging against a decline.

ETC Group, a leading provider of digital asset investment solutions, elaborated on this trend in its Monday report. They stated:

“An increase in bitcoin options open interest is largely driven by an increase in relative put open interest, consistent with the asset’s recent price correction, as bitcoin options traders increase their downside bets and hedges. A spike in put-call volume ratios as well as one-month 25-delta option skew signalled a significant increase in demand for downside protection.”

Bitcoin’s Implied Volatility Surges

The ETC Group report highlights a significant increase in Bitcoin’s implied volatility. This metric, which measures market expectations of future price swings, has risen to around 50.5% for one-month at-the-money options. Traders are paying a premium for options with higher implied volatility, indicating their willingness to pay more for protection against potential price movements.

Furthermore, the report points to an “inverted term structure of volatility”, a scenario where short-dated options have significantly higher implied volatilities than longer-dated ones. This, according to ETC Group analysts, “can be a sign of overextended bearishness in the options market”.

At the time of writing, Bitcoin is trading at $56,129, marking a 1.20% decline in the last 24 hours. The cryptocurrency has gone down 8.70% in the last week. Despite Bitcoin’s downward trend, the trading volume for Bitcoin has remarkably surged to $33.96 billion, marking a 69% rise in the last 24 hours.

Bitcoin Traders Hedge Downside as Put-Call Ratio Rises Above One