10x Research’s founder Markus Thielen said the Federal Reserve’s decisions remain Bitcoin’s “primary risk,” slowing it from another price surge.

A Trump-led Bitcoin rally — expected to occur in the days leading up to his Jan. 20 inauguration — could wane toward the end of the month as the Federal Reserve publishes its first interest rate decision of the new year.

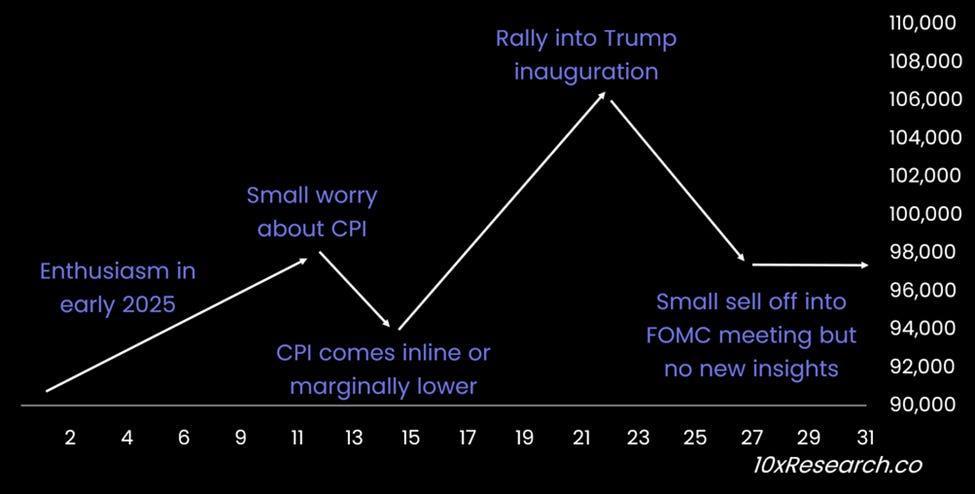

In a Jan. 5 report, 10x Research’s founder Markus Thielen predicted a “positive start” in early January would be followed by a slight pullback ahead of Consumer Price Index inflation data on Jan. 15 before rallying again ahead of Trump’s inauguration.

“A favorable inflation print could reignite optimism, fueling a rally into the Trump inauguration,” Thielen said of a potentially positive CPI result.