Cryptocurrency markets experienced a weekend of narrowing volatility as traders awaited the United States’ first spot Bitcoin exchange-traded fund (ETF) decision, scheduled for January 10. The anticipation surrounding this landmark event has left the market in suspense, with differing opinions on how it will affect BTC/USD prices.

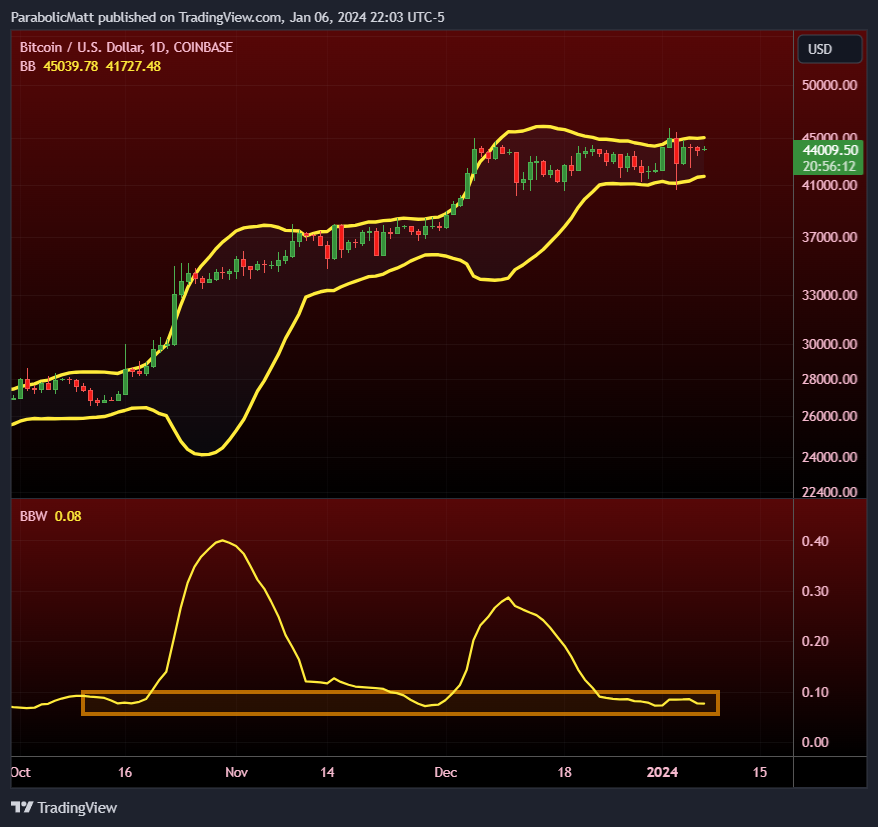

Analysts suggest that a breakout from the narrow intraday range is imminent by examining key indicators like the Bollinger Bands volatility indicator.

Narrowing volatility signals imminent breakout

Over the weekend, data from TradingView revealed a decrease in Bitcoin’s price volatility. This tightening of price ranges has sparked speculation among traders and analysts about how BTC/USD will move next. The imminent decision on the first spot Bitcoin ETF in the United States is at the forefront of these discussions.

The ETF decision looms large

The cryptocurrency community is closely watching the decision on the United States’ first spot Bitcoin ETF, set to be announced on January 10. This decision is a pivotal moment that could temporarily impact Bitcoin’s price trajectory.

Some believe it may result in a “sell the news” event, causing a retracement in Bitcoin’s price. In contrast, others anticipate the possibility of a knee-jerk upside move challenging key psychological levels.

Regardless of the outcome, several indicators suggest that a breakout from the current narrow intraday range is on the horizon. One such indicator is the Bollinger Bands volatility indicator, which is narrowing on daily timeframes. This tightening typically precedes a range expansion, indicating that a significant price move may be imminent.

Market sentiment remains divided as traders grapple with the uncertainty of the ETF decision. The so-called “spot premium” is active in Bitcoin markets again, suggesting that derivatives traders are cautious about taking long or short positions. This caution stems from last week’s snap liquidations, which have left traders wary of potential price swings.

As Bitcoin continues to trade within a relatively narrow price range, the accumulation of positions with stop losses and liquidations above and below the current price is expected to increase. This accumulation could contribute to heightened volatility once a decisive move occurs.

Macroeconomic hurdles on the horizon

While all eyes are on the ETF decision, macroeconomic factors lurk in the background. U.S. inflation data, specifically the December prints of the Consumer Price Index (CPI) and Producer Price Index (PPI), are set to be released in the coming days. These data releases have historically caused short-term volatility in cryptocurrency and other risk assets.

For the cryptocurrency market to remain relatively stable, the inflation data must show a continued decline in inflation rates. Any unexpected inflationary pressure could add uncertainty to the already volatile market.