Digital asset investments see significant inflows of $441 million, driven by Bitcoin price weakness, Mt. Gox activity, and German government sell-off, according to a CoinShares report.

A new report from CoinShares revealed a market buying opportunity amounting to $441 million in inflows for digital asset investment products in the last week.

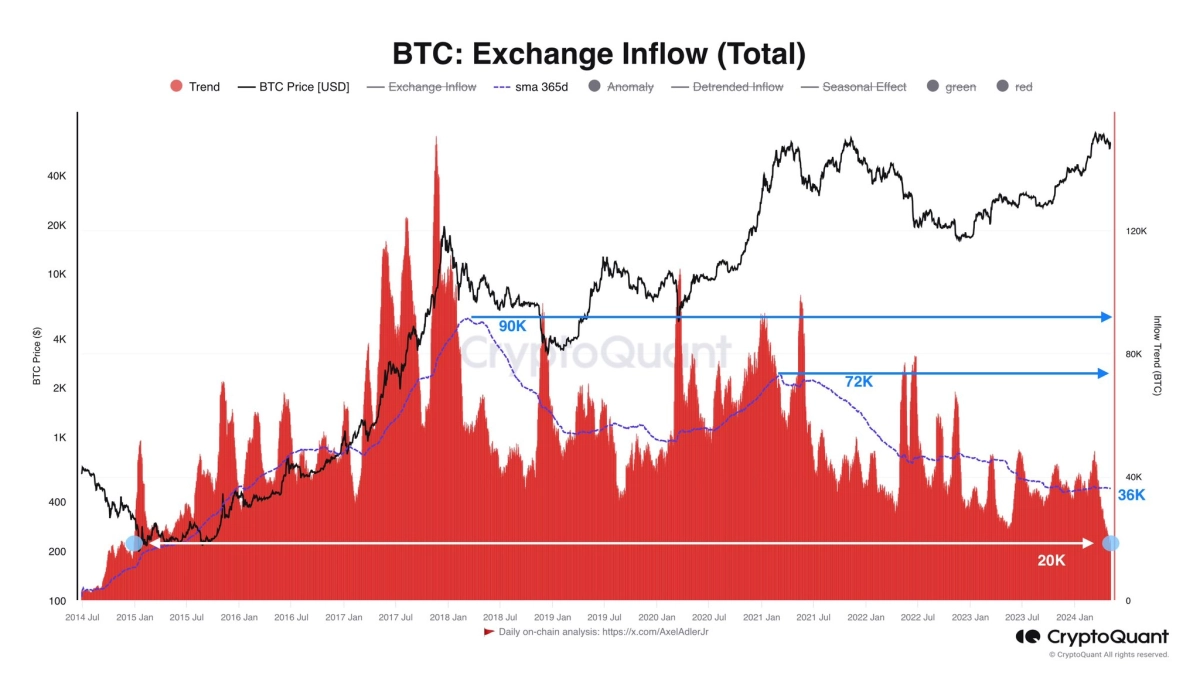

The report on July 8 also highlighted an inflow into Bitcoin (BTC) amounting to $398 million. According to CoinShares, the weakness of Bitcoin prices, alongside activity from Mt. Gox and selling pressure from the German government, were likely the causes of investors’ buying sprees.

Inflows were primarily seen in the United States with $384 million, followed by Hong Kong ($32 million), Switzerland ($24 million) and Canada ($12 million), whereas Germany saw $23 million in outflows.