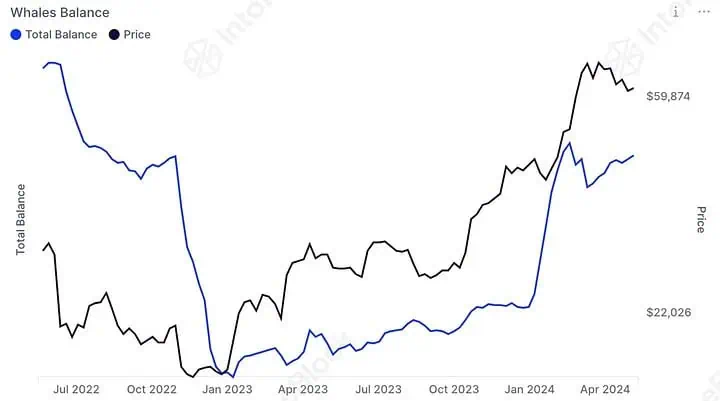

Once again, Bitcoin is strutting its stuff on the financial runway, dazzling investors with a flashy comeback. After a dismal plunge in 2022, where it shed over 60% of its value, Bitcoin has made a dramatic u-turn, skyrocketing to $42,000. That’s a 150% hike this year alone.

And it’s not just Bitcoin; its crypto cousins – Ethereum, Dogecoin, Solana, and Cardano – are also basking in double-digit gains. But let’s not pop the champagne just yet. Is this rally a solid investment or just another round of musical chairs in the unpredictable world of cryptocurrencies?

The Enigmatic Surge of Bitcoin

Bitcoin’s revival has sent waves of excitement across the crypto market. Industry veterans, with their crystal balls polished, are now predicting Bitcoin’s value could soar to $100,000 by the end of 2024 and perhaps reach a staggering $750,000 by 2026.

Let’s be real: predicting Bitcoin’s future is more like reading tea leaves than analyzing financial markets. Why? Because Bitcoin, as alluring as it is, lacks intrinsic value and isn’t backed by anything tangible.

It’s not alone in this; gold also shares this characteristic. But unlike Bitcoin, gold has a millennia-long track record as a reliable wealth store, even in turbulent times.

Bitcoin, on the other hand, is the poster child for volatility. Its journey has been a rollercoaster of dramatic ups and downs. Investing in Bitcoin is akin to betting on the mood swings of the market.

It’s a gamble, not an investment. And yet, Bitcoin enthusiasts are spinning a tantalizing narrative to lure investors back in.

A Threefold Sales Pitch

The current pro-Bitcoin pitch is a three-pronged affair. First, there’s the renewed “risk-on” mood in financial markets. Investors, sensing the end of the Federal Reserve’s interest rate hikes, are turning their eyes to more speculative ventures.

The allure of rising Bitcoin prices tends to create a buying frenzy, which often ends as abruptly as it begins. Second, the Bitcoin bulls argue that recent legal victories in the crypto world signify a cleansing wave.

The prosecution of Sam Bankman-Fried, ex-CEO of FTX, for fraud, and Binance’s guilty plea to money laundering charges are seen as ridding the market of its bad elements. This is supposed to be a reassurance, but let’s face it, it’s more of a band-aid on a bullet wound.

Third, there’s the anticipation of U.S. regulatory approval for spot Bitcoin ETFs from big players like BlackRock. The theory goes that mainstream asset managers jumping into the crypto pool adds legitimacy to cryptocurrencies.

But this is a double-edged sword. It might attract more investors, but it doesn’t cushion the inherent volatility of cryptocurrencies. However, the holes in the buy-and-hold strategy for Bitcoin are glaring.

The industry is still young and grappling with legal and regulatory challenges. Gary Gensler, chair of the U.S. Securities and Exchange Commission, recently highlighted the rampant issues of fraud, scams, and money laundering in the sector.

The potential approval of Bitcoin ETFs might bring in more investors, but it’s no safety net against the wild swings of the crypto market. As for mainstream asset managers, let’s not kid ourselves; they’re in it for the fees, not necessarily because they believe in cryptocurrencies.

In the end, the bullish case for Bitcoin is a precarious one. It hinges on the hope that there’s always someone ready to buy at a higher price – the classic “greater fool theory.”

But as history has shown, Bitcoin is no stranger to spectacular crashes. It’s a game of speculation, where the rules are as fickle as the market itself. So, before jumping on the Bitcoin bandwagon, remember: in the crypto casino, the house always wins.