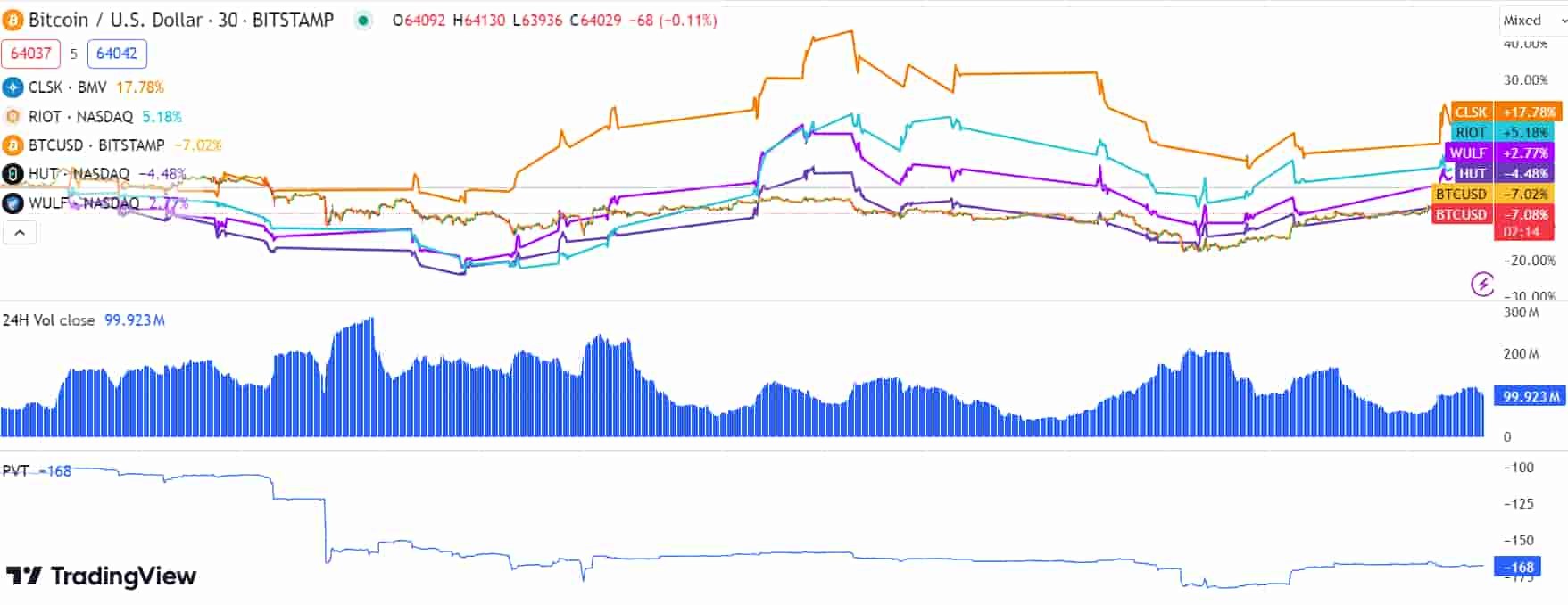

Bitcoin’s connection to the stock market is making a comeback. A recent lower-than-expected inflation reading from the US has revived hopes for a rate cut in September. This news triggered a rally in equities and other risk assets.

The data could bring back Bitcoin’s positive correlation with the equity markets, which had been disrupted recently by unique factors affecting the crypto market.

With traders now reevaluating the Federal Reserve’s rate path, Bitcoin might just join the rally lifting US stocks. Jag Kooner, Head of Derivatives at Bitfinex, told Cryptopolitan that:

“The CPI has reinforced the market’s expectation of a rate cut in September, where Fed Fund futures puts the probability at 70% currently, boosting both equities and cryptocurrencies by increasing liquidity and risk appetite.”

The Federal Reserve might cut interest rates in September. The CPI plus comments from Jerome Powell have put this expectation back in the spotlight. Labor market numbers have softened, and inflation seems to be under control, according to him.

“The Federal Reserve remains focused on our dual mandate to promote maximum employment and stable prices for the benefit of the American people.”

Over the past two years, America’s inflation has moved toward Powell’s 2% goal. Powell believes the economy is still strong and expanding at a good pace, though this year’s growth has been less than in 2023.

Private domestic demand remains strong, but consumer spending and capital investment have slowed a bit. Residential investment has picked up this year, though.

The unemployment rate rose slightly to 4.1% in June, with payroll job gains averaging 222,000 jobs per month for the first half of 2024, thanks to higher labor force participation and strong immigration.

Personal consumption expenditures (PCE) prices increased by 2.6% during the 12 months before May. Core PCE prices, which exclude food and energy, are also up by around 2.6%. However, the monthly readings show unimpressive progress.

Powell mentioned that he has maintained the target range at 5-1/4 to 5-1/2 percent since last July. He added that the Fed has reduced its securities holdings by a long margin.

Investors are closely watching Fed communications and market reactions to the recent CPI release and upcoming Fed meetings. Kooner told us:

“This could indeed tip BTC into moving along with risk assets, as it would support the narrative of slowing inflation and a potential rate cut. However, I believe that a single inflation print would not undo the supply overhang concerns for Bitcoin which would take some more time for the market to price in completely.”

The Fed continues to make decisions meeting by meeting. Powell warned that cutting rates too soon or too much could stall or even reverse the progress on inflation.

On the other hand, reducing rates too late or too little could weaken economic activity and employment.