Bitcoin’s recent rally is stirring up the market with a blend of anticipation and trepidation, reminding everyone that when it comes to cryptocurrency, the more things change, the more they stay the same. With BTC’s value bouncing back from recent lows, whispers of a new all-time high in 2024 are growing louder. However, the journey there is expected to be anything but smooth, with a significant event on the horizon set to test the mettle of every bull in the market: the Bitcoin halving.

The Bitcoin Halving Horizon: A Prelude to Turbulence

DecenTrader, a name that rings bells in trading suites, has thrown its prediction into the ring, suggesting that Bitcoin is about to enter a phase that’s all too familiar to veterans of the crypto wars. Before enthusiasts can dream of new heights, they’ll first have to weather the storm of the halving—a periodic event that reduces the reward for mining Bitcoin transactions by half. This event, expected around mid-April 2024, isn’t just a technical footnote; it’s a market mover that historically has led to significant price volatility.

In the lead-up to this pivotal moment, buying frenzy and speculative trades are anticipated to push Bitcoin’s price up, echoing the market’s response to previous catalysts like the launch of Bitcoin ETFs. However, this surge is expected to be followed by a sharp pullback as the market takes a “sell the news” approach, a pattern familiar to those who’ve watched BTC navigate its cyclical booms and busts.

DecenTrader’s analysis suggests we’re looking at a tight timeline, with a window of opportunity for bulls to make their move before the market dynamics shift in response to the halving. The expectation is for Bitcoin to reach, and possibly surpass, its two-year highs before taking a dive in a sell-off event. Yet, this isn’t the end of the road; it’s merely the setup for a potential rally to new all-time highs by the end of 2024, echoing the aftermath of the last halving event.

Between Optimism and Reality

The road to Bitcoin’s next peak is fraught with uncertainties, not least of which are the macroeconomic and geopolitical factors that sway the broader risk asset markets. With shadows of instability looming over the U.S. banking system and a global economy that remains unpredictable, Bitcoin’s trajectory is anything but guaranteed.

Adding to the complexity is the market’s emotional attachment to Bitcoin, leading many to speculate that this time around, things will be different. However, DecenTrader’s analysis urges caution, suggesting that the emotional rollercoaster investors are strapped into is far from over. The cyclical nature of Bitcoin’s market, driven by investor sentiment and speculative trading, is expected to continue its pattern, challenging the notion that the path ahead will diverge from historical trends.

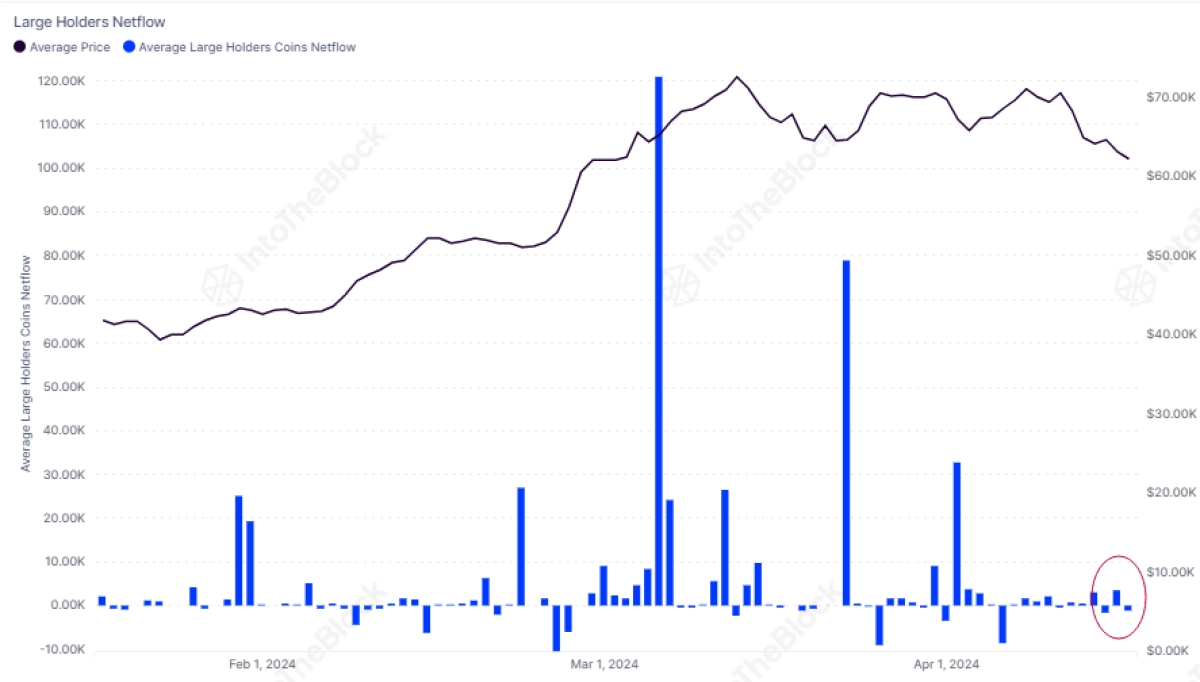

Despite these warnings, the underlying demand for Bitcoin remains robust. Indicators of market health, such as stablecoin liquidity and the activities of whales, signal that interest in BTC is far from waning, and it reflects a market that, while cautious, is still fundamentally bullish on the long-term prospects of this digital asset.