As 2024 approaches, the cryptocurrency community has its eyes set on Bitcoin’s trajectory. With significant events like the potential approval of a spot Bitcoin ETF and the much-anticipated Bitcoin halving, there’s a blend of excitement and realism in the air. These events are likely to shape Bitcoin’s journey in the coming year, posing both opportunities and challenges for investors and enthusiasts alike.

The ETF Expectation: A Catalyst for Growth?

The cryptocurrency market is abuzz with the potential approval of a spot Bitcoin ETF. This event is seen as a major milestone for Bitcoin, potentially unlocking a new realm of mainstream investment. The approval of multiple applications for a spot Bitcoin ETF by the Securities and Exchange Commission could be a pivotal moment, propelling Bitcoin’s price and increasing its adoption among a broader investor base.

However, market dynamics suggest a cautious approach. The anticipation has already led to a notable price increase, and any further positive developments might see a mix of profit-taking and new investments. This scenario could lead to price volatility in the short term, followed by a more stable growth trajectory as the market absorbs the new reality.

The Halving Effect: A Reset for Bitcoin’s Supply Dynamics

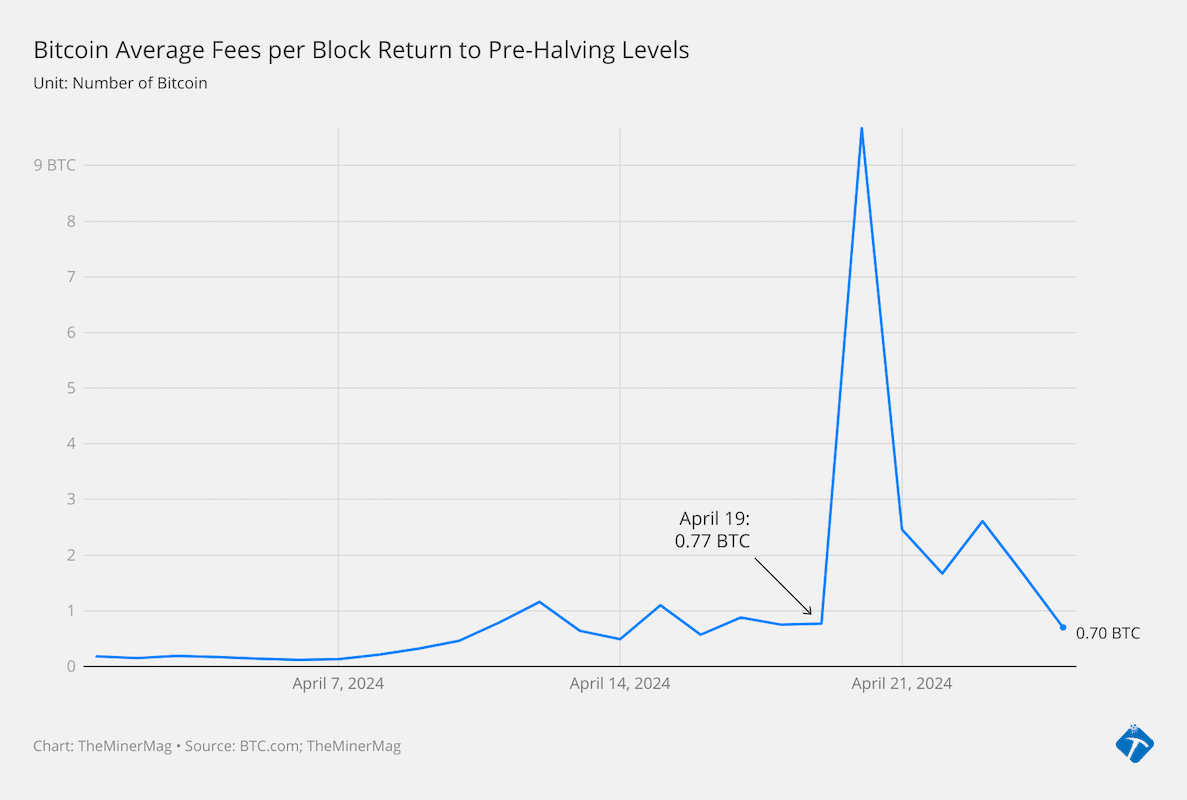

2024 will witness another significant event in Bitcoin’s timeline: the halving. Historically, halving events, which reduce the reward for mining new blocks and consequently slow down the rate of new Bitcoin entering circulation, have signaled the start of new bull runs.

The upcoming halving is expected to follow this pattern, albeit with a more matured market and a possibly less dramatic impact compared to previous cycles. The scarcity effect induced by the halving is likely to play a crucial role in Bitcoin’s price movement, especially in a market that’s increasingly sensitive to supply dynamics.

Institutional Influence and Market Sentiments

The narrative surrounding Bitcoin in 2024 is also heavily influenced by institutional interest. With key financial players and investment firms showing a growing appetite for cryptocurrency, their role in shaping market sentiments can’t be overstated.

The launch of a spot Bitcoin ETF, coupled with the halving event, is poised to create an attractive environment for institutional investments. However, it’s important to temper expectations with the recognition that the cryptocurrency market remains unpredictable, and institutional involvement doesn’t always translate to immediate market shifts.

Looking Ahead: A Balanced View

As we move into 2024, it’s crucial for Bitcoin enthusiasts and investors to maintain a balanced perspective. The year holds promise, marked by key events that could significantly influence Bitcoin’s value and adoption.

However, the cryptocurrency market is known for its volatility, and external factors such as regulatory changes and macroeconomic developments could impact the projected trajectory. In this context, a blend of optimism and realism will be essential for navigating the year ahead.

Bitcoin’s roadmap for 2024 is marked by potential highs and cautious optimism. The cryptocurrency community awaits key developments with bated breath, ready to adapt to the dynamic landscape of the digital currency world. As always, the journey of Bitcoin continues to be a fascinating saga of innovation, speculation, and evolution.