Digital asset custodian BitGo announced the launch of its 1:1 USD-backed USDS stablecoin. BitGo referred to its USDS as the first “open-participation stablecoin that will redefine financial freedom.”

Publicly available data on Coingecko shows that the USDS will join a stablecoin market dominated by Tether’s USDT, with a market cap of $118B, and Circle’s USDC, with a market cap of $35.6B.

BitGo disclosed that the USDS was fully backed by short-term T-bills, “overnight repos,” and cash to ensure low risk and high liquidity. According to the digital assets custodian, the rewarding scheme considered only institutions that provided liquidity to the ecosystem.

BitGo to enter the stablecoin market with its ‘high yield’ USDS

Introducing $USDS

The first open-participation stablecoin to redefine financial freedom.

Built on a foundation of transparency, USDS empowers the community by democratizing the stablecoin experience and putting the power back in your hands.

1:1 USD Backing: USDS is fully… pic.twitter.com/pfzXWGZ1ze

— BitGo (@BitGo) September 18, 2024

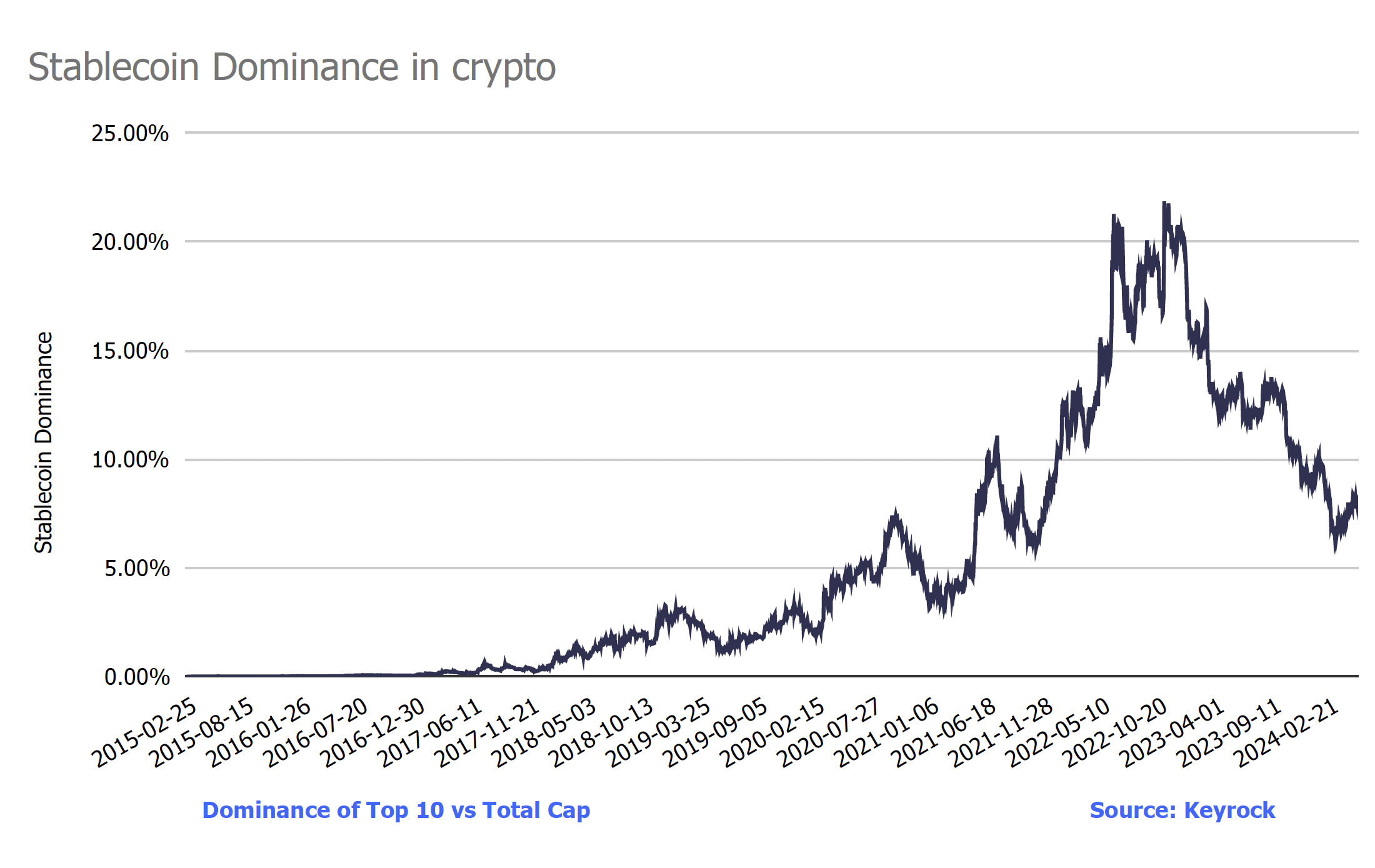

BitGo said in a statement released on September 18 that it plans to launch the fully backed and regulatory-compliant USDS stablecoin in Q1 of 2025. The statement added that the USDS’s design challenged the existing dynamics of the stablecoin market to specifically target the dominance of major single-issuers like Tether and Circle.

BitGo’s official website confirmed that the ecosystem’s participants will get up to 98% of the rewards from their assets. It said its approach is different from traditional stablecoin issuers who earn interest on their reserves and retain 100% of the accrued interest or funnel it to exchanges, leaving participants with nothing.

The digital asset custodian also mentioned that transparency will be at the core of the USDS stablecoin. It stated that top-tier accounting firms will conduct monthly audits and usdstandard.com will publish real-time proof-of-reserves. BitGo added that the stablecoin will be available to institutions, DeFi participants, and individuals worldwide, providing easy onramps from USDT, USDC, and USD without conversion fees.

BitGo’s reward offering differs from traditional stablecoins

BitGo claimed that the stablecoin market had long been dominated by players who prioritized profits over the growth of the ecosystem.

According to BitGo’s statement, its offering will differ from that of competing stablecoins with its reward-based approach.

BitGo explained that while this sounded like it was treading dangerously close to being a “dividend,” the whole operation was classified as an investment contract. The statement declared that the rewards earned would be calculated based on contributions to the USDS ecosystem.

Notably, BitGo claimed that the stablecoin would offer higher distribution rewards and wider global access compared to other leading stablecoins.

BitGo revealed that it was launching the USDS stablecoin mainly to create a more open and fair system that promoted innovation and rewarded those who built and supported the network. BitGo believes this approach fosters a more balanced and inclusive ecosystem by incentivizing exchanges, eligible institutions, users, and liquidity providers to grow and support the USDS network.