According to the latest Coingecko report, during the second quarter (Q2) of 2023, the U.S. dollar value of BTC grew by nearly 7% while that of the entire crypto market capitalization only went up by 0.14%. In contrast, BTC’s average daily trading volume during the period fell by 58.7% from the $33.4 billion seen in Q1 to $13.8 billion.

Effect of Blackrock’s Bitcoin ETF Filing Announcement

During the second quarter of 2023, the fiat price of bitcoin (BTC) grew from $28,517 to $30,481, a gain of 6.9%, data from the latest Coingecko Crypto Industry Report has shown. The top crypto asset’s Q2 gain dwarfs the entire crypto market’s marginal growth of 0.14%. According to the industry report, the June 15 announcement by giant asset management Blackrock that it had filed a spot bitcoin exchange-traded fund (ETF) was a key factor behind BTC’s surge.

However, despite trending upward for much of that quarter, the crypto asset’s traded volumes in U.S. dollar terms were significantly lower.

“Average daily trading volume declined 58.7% on a quarterly basis, from $33.4 billion in Q1 to $13.8 billion in Q2. This is despite the fact that BTC prices trended upwards throughout Q2,” the report said.

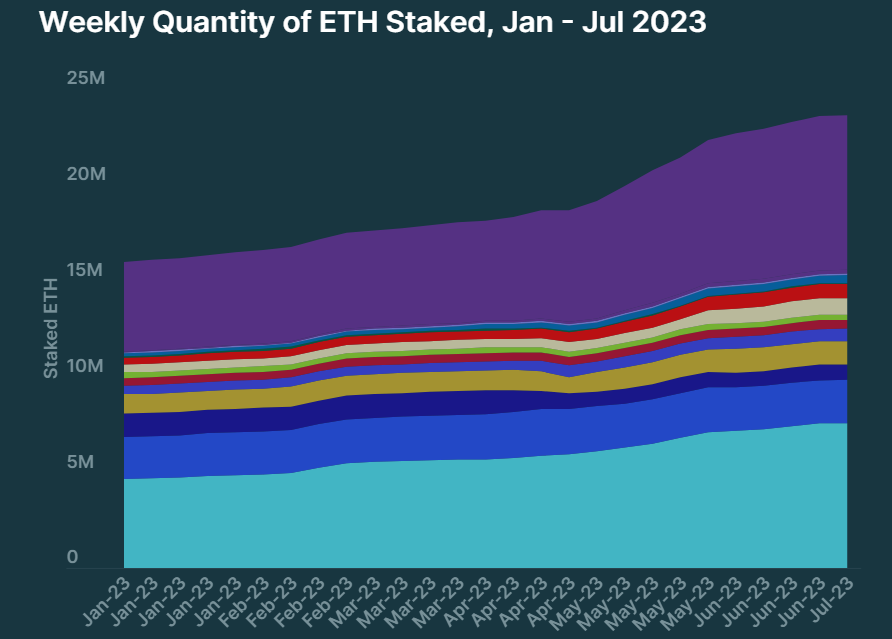

Contrasting Fortunes of ETH Staking Providers

Meanwhile, unlike BTC and the entire crypto market which trended upwards, the market capitalization of stablecoins shrank by $4.6 billion. USD Coin (USDC) and Binance USD (BUSD) lost $5.18 billion (-15.9%) and $3.43 billion (-45.4%) in market cap respectively. In contrast, USDT, which is the most dominant stablecoin, saw its market cap grow by $3.48 billion during the same period. Other stablecoins that registered gains include True USD which added $1.02 billion to its market cap. Gemini Dollar, Flex USD and Paxos all their respective market caps grow by double-digit figures.

In the same period, the total staked ethereum (ETH) increased by 5.6 million to end the quarter at 23.6 million. As noted in the report, staking providers like Lido and Kraken had contrasting fortunes during the period. The report explained:

Lido remained the dominant staking provider, with 31.9% of all staked ETH. This represents a slight increase from its 31.4% market share in Q1. Meanwhile, Kraken’s dominance fell to 3.4% as it winds down its staking product in the U.S. following a settlement with the SEC. The exchange had a -36.2% drop in staked ETH QoQ [quarter-on-quarter]. Coinbase’s dominance also fell by -3.5% in Q2, ending the quarter with a 9.6% market share.

Concerning non-fungible token (NFT) traded volumes, the data in the report indicates that Bitcoin ordinals accounted for just over 20% of May’s volumes. However, Ethereum was still the most dominant platform for NFT trading during that month and over the entire period.

What are your thoughts on this story? Let us know what you think in the comments section below.