On-chain analyst William Clemente says that US investors have been piling into Bitcoin (BTC) ever since the news about BlackRock’s exchange-traded fund (ETF) bid took center stage.

In a new interview with BTC bull Anthony Pompliano, Clemente says that there are three pieces of evidence suggesting that US-based institutions have been actively accumulating the crypto king since BlackRock announced its application for a spot-based Bitcoin ETF.

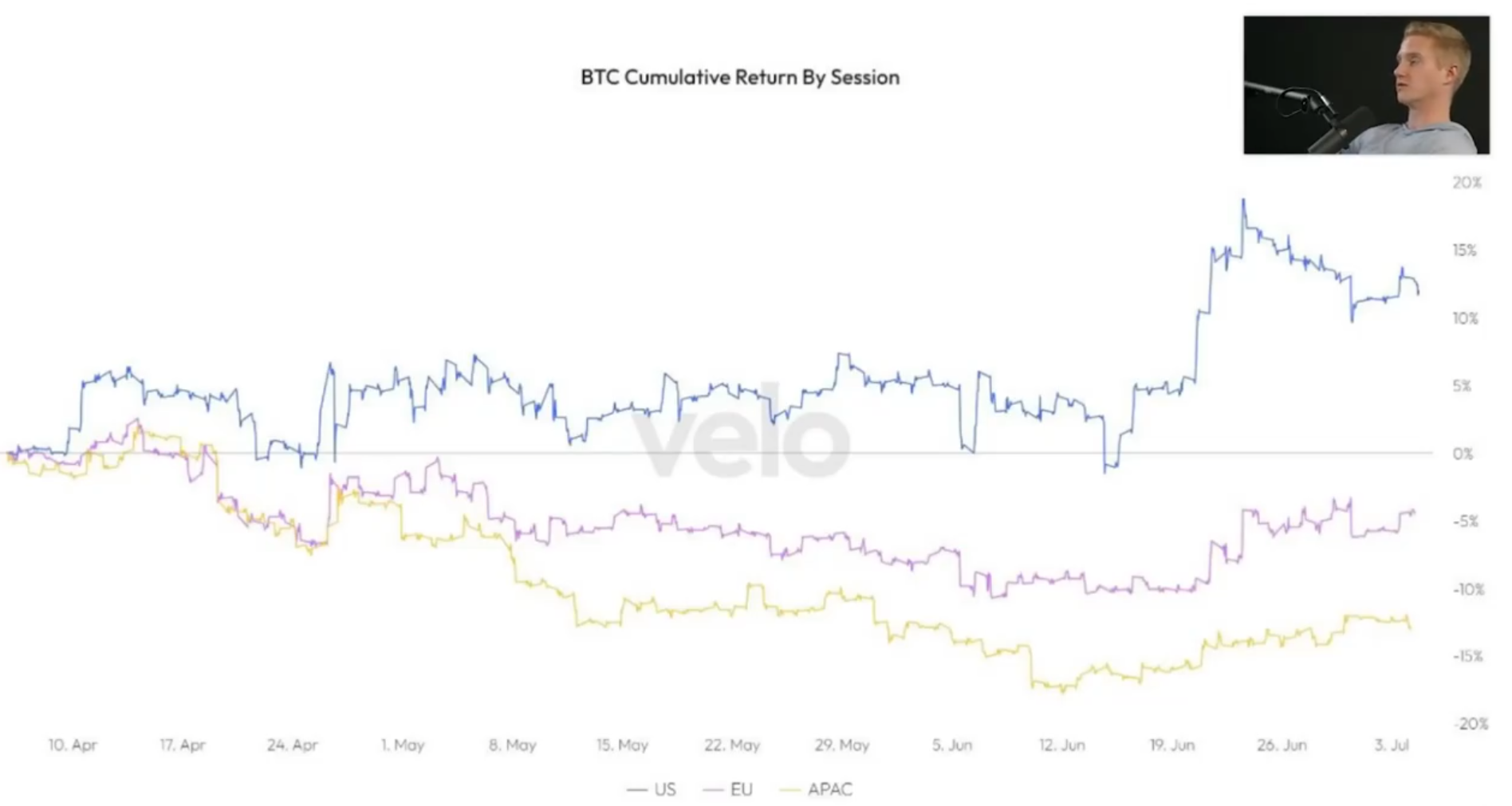

Clemente looks at the various trading sessions throughout the day and points at the heightened activity of market participants in the US.

“We can see that the ETF trade has been in full effect across several different things. But who’s been primarily putting that trade on? It appears that it is US-based entities…

There are two things that I look at as evidence of that. The first is what’s called cumulative return by session that we can look at from Velo data… We have it broken down into the EU, APAC and then US trading sessions. What we can see is that, especially since the BlackRock filing but even slightly beforehand, we can see that the US has been more actively bidding BTC relative to those other trading sessions.“

Clemente also says that Bitcoin has been trading “marginally higher” on Coinbase compared to other exchanges, pointing to the increased involvement of US-based firms.

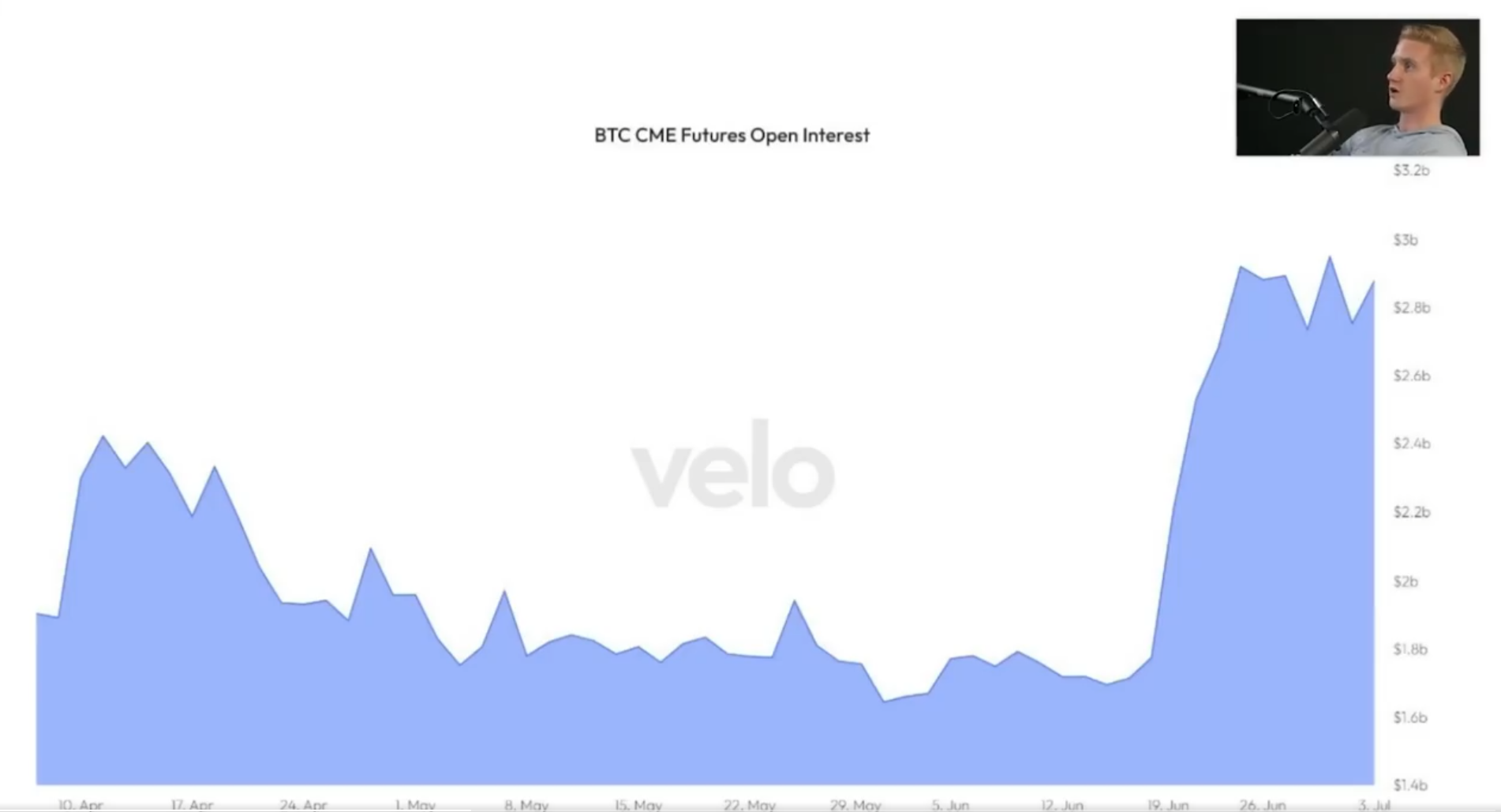

Lastly, the on-chain analyst is also keeping a close watch on the Chicago Mercantile Exchange (CME) futures open interest for BTC. According to Clemente, the Bitcoin futures open interest on the global derivatives marketplace has skyrocketed since BlackRock’s ETF application, indicating that US institutions are getting more exposure to BTC.

“The last piece of evidence as well is looking at CME futures open interest. So this looks at the total number of futures contracts outstanding on the CME. Who usually trades on the CME? It’s not crypto degenerates that are looking to punt on leverage. It’s US-based traditional type firms. We can see a clear jump in CME futures open interest following the BlackRock ETF (application), about a billion dollars (worth) of open interest was added in that time period.”

At time of writing, Bitcoin is trading for $30,357.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post BlackRock ETF Trade in Full Effect for Bitcoin as US Investors Actively Accumulating BTC, Says On-Chain Analyst appeared first on The Daily Hodl.