Bitcoin's future is overwhelmingly bright, and short-term price pressures should not distract investors from a future global asset class, says the Capriole Investments founder.

Bitcoin (BTC) stands to win big thanks to the BlackRock exchange-traded fund (ETF), investor and analyst Charles Edwards believes.

In his latest interview with Cointelegraph, Edwards, who is founder of quantitative Bitcoin and digital asset fund Capriole Investments, goes deep into the current state of BTC price action.

With his previous bullish statements continuing to stand the test of time, and after an eventful few months, Edwards does not see the need to alter the long-term perspective.

Bitcoin, he argues, may be less of a sure bet on shorter timeframes, but the overarching narrative of crypto becoming a recognized global asset class undoubtedly remains.

Cointelegraph (CT): When we last spoke in February, Bitcoin price was around $25,000. BTC is not only 20% higher today, but Bitcoin’s NVT ratio is also at its highest levels in a decade. Does this suggest more upside?

Charles Edwards (CE): NVT is currently trading at a normal level. At 202, it is trading in the middle of the dynamic range band, well below the 2021 highs. Given its normalized reading today, it doesn't tell us much; just that Bitcoin is fairly valued according to this metric alone.

CT: At the time, you described Bitcoin as being in a “new regime” but forecast up to 12 months’ upward grind to come. How has your thinking evolved since?

CE: That thinking mostly remains today. Bitcoin has steadily grinded up about 30% since February. The difference today is that the relative value opportunity is slightly less as a result, and we are now trading into major price resistance at $32,000, which represents the bottom of the 2021 bull market range and confluence with major weekly and monthly order blocks.

My outlook today over the short term is mixed, with a bias towards cash until one of three things occurs:

- Price clears $32,000 on daily/weekly timeframes, or

- Price mean-reverts to the mid-$20,000s, or

- On-chain fundamentals return to a regime of growth.

CT: At $30,000, miners have begun to send BTC to exchanges en masse at levels rarely seen. Poolin, in particular, has moved a record amount in recent weeks. To what extent will miners’ purported selling impact price moving forward?

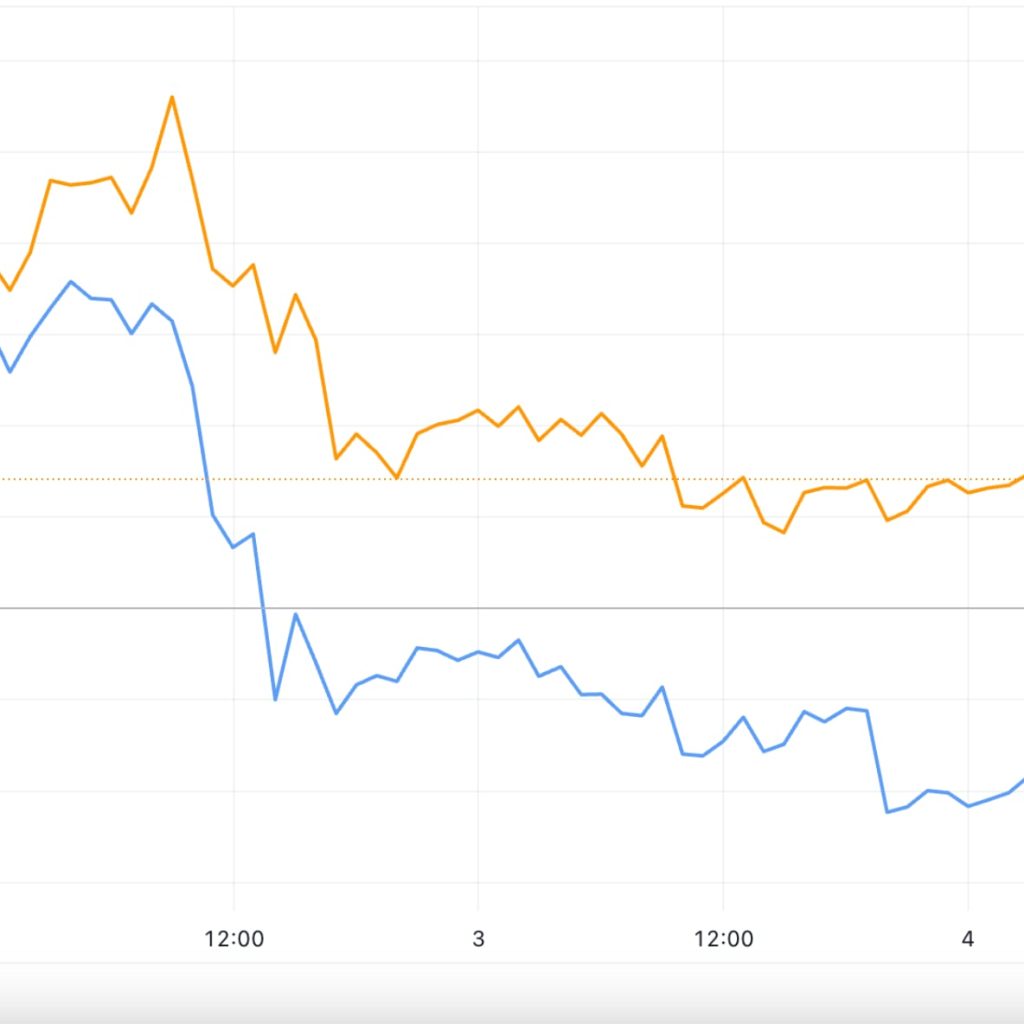

CE: It’s true that relative Bitcoin miner sell pressure has stepped up. We can see that in the two below on-chain metrics; Miner Sell Pressure and Hash Ribbons. Bitcoin’s hash rate is up 50% since January — that’s over 100% annualized growth rate.

This rapid rate of growth is not sustainable long term. Hence we can expect any slowdown will trigger the typical Hash Ribbon capitulation. This rapid growth in hash rate also can only mean one thing; an extraordinary amount of new mining rigs have joined the network.

It’s 50% harder to mine Bitcoin, there's 50% more competition and as a result 33% less relative BTC revenue for miners.

Through 2022 there were delays and backlogs in global mining hardware shipping for many months; we likely have seen that backlog flush out in the first half of the year with the large hash rate uptick. New mining hardware is costly, so it makes sense that miners would want to sell a bit more at relatively higher prices today to help cover operational costs and take advantage of the 100% price rally we have seen in the last 7 months.

Miners are large Bitcoin stakeholders so if they are selling at a rapid rate it can impact prices. Though given their relative share of the network is diminishing, that risk factor is not what it once was.

CT: When it comes to U.S. macro policy, how do you see the Fed approaching inflation for the second half of the year? Are further hikes coming past July?

CE: The market is pricing in a 91% chance of rate hikes through the rest of this year. There’s a 99.8% chance that the Fed will raise rates at next week's meeting, according to the CME Group FedWatch Tool. So it's probable we see one or two more rate hikes in 2023. That seems quite excessive given inflation (CPI) has consistently been trending down since April 2022, and is now well below the Fed funds rate of 5%.

Of course things could change quite a bit over the next months, but if we take two more rate hikes as the base case, my expectation that any net change in the Fed’s plan would be toward a pause. We’ve already seen the considerable stress building in the banking system, with multiple bank collapses just a couple of months ago. 2023 was the biggest banking failure of all time in dollar value; more than 2008, so things could change considerably over the next six months.

Regardless, the Fed has implemented the vast majority of its rate hike plan. 90% of the tightening is complete. It's now a game of wait and see — will inflation continue to decline as anticipated? And will that occur before or after the economy takes a turn?

CT: Bitcoin’s correlation with risk assets and inverse correlation with U.S. dollar strength has been declining of late. What’s the reason for this? Is this part of a longer-term trend?

CE: Bitcoin has historically spent most of its life “uncorrelated” with risk markets, oscillating from periods of positive to negative correlation. Correlation comes in waves. The last cycle happened to see a very strong correlation with risk assets. This began with the Corona crash on March 12, 2020. When fear peaks, all markets go risk-off (into cash) in unison, and we saw a huge spike in correlations across asset classes as a result.

Following that crash, a wall of money entered risk markets from the biggest QE of all time. In that regard, the following year was “all one trade” — up and to the right for risk. Then in 2022 we saw the unwinding of all risk assets as bonds repriced following the most aggressive Fed rate hike regime in history.

So it’s been unusual times. But there is no intrinsic need for Bitcoin to have a high correlation to risk assets. It is likely with time that as Bitcoin becomes a multi-trillion-dollar asset, it will be more interconnected with major asset classes and so expect to see a more consistent positive correlation with gold over the next decade, which has a highly negative correlation with the dollar.

CT: How do you think U.S. regulatory pressure will impact Bitcoin and crypto markets going forward? Do you think Binance and Coinbase were the tip of the iceberg?

CE: Impossible to say for sure, but I believe the regulatory fears of early 2023 have been well overblown. Bitcoin was long ago classified as a commodity, and from a regulatory perspective is in the clear. There’s definitely question marks on various altcoins, but the legal outcome of XRP being deemed not a security was definitely an interesting turn of events this month.

Finally, it's pretty clear that industry and government — where it matters — is in support of this asset class and knows it's here to stay.

BlackRock ETFs have a 99.8% success rate and its announcement to launch a Bitcoin ETF was essentially a regulatory and financial industry green light.

We’ve seen half a dozen other leading-tier financial institutions follow suit and, of course, now presidential candidate Kennedy is talking about backing the dollar with Bitcoin. This asset class is here to stay. There will be bumps and hiccups along the way, but the direction is clear to me.

CT: How do you foresee progress of the BlackRock spot ETF and its effect on Bitcoin should it launch?

CE: The BlackRock ETF approval will be huge for the industry.

Related: Bitcoin traders say ‘get ready’ as BTC price preps 2023 bull market

BlackRock is the biggest asset manager in the world, and its (and regulatory) seal of approval will allow a new wave of capital to flow into the market. Many institutions sat on the sidelines last year due to concerns and uncertainty regarding crypto regulation. ETF approval will be a big rubber “yes” stamp for Bitcoin.

ETFs also arguably make it easier for institutions to put Bitcoin on their balance sheet, as they don't need to worry about custody or even entering the crypto space. So it opens a lot of doors. The best comparable we have for this event is the gold ETF launch in 2004. Interestingly it launched when gold was down 50% (much like Bitcoin is today). What followed was a massive +350% return, seven-year bull run.

Essentially the Bitcoin ETF is just another goalpost on the pathway to broad regulatory acceptance and establishment of Bitcoin as a serious asset class. And it has big implications.

Magazine: Should you ‘orange pill’ children? The case for Bitcoin kids books

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.