Bloomberg LP has announced that Polymarket’s U.S. election odds are now part of the Bloomberg Terminal. This shows the increasing interest in blockchain-based prediction markets, especially with the U.S. presidential election around the corner.

Polymarket, built on the Polygon blockchain, lets users bet on various events, including elections, by pooling their judgments to set odds. Michael McDonough, Chief Economist, Financial Products at Bloomberg LP, confirmed the addition, stating:

“We are in the process of adding Polymarket data to WSL ELECTION<Go>!”

Polymarket operates on the concept of the wisdom of the crowd. Users bet on different outcomes, and their combined opinions help set the odds. This market has gained traction, with nearly $760 million in trading volume for the presidential election at press time.

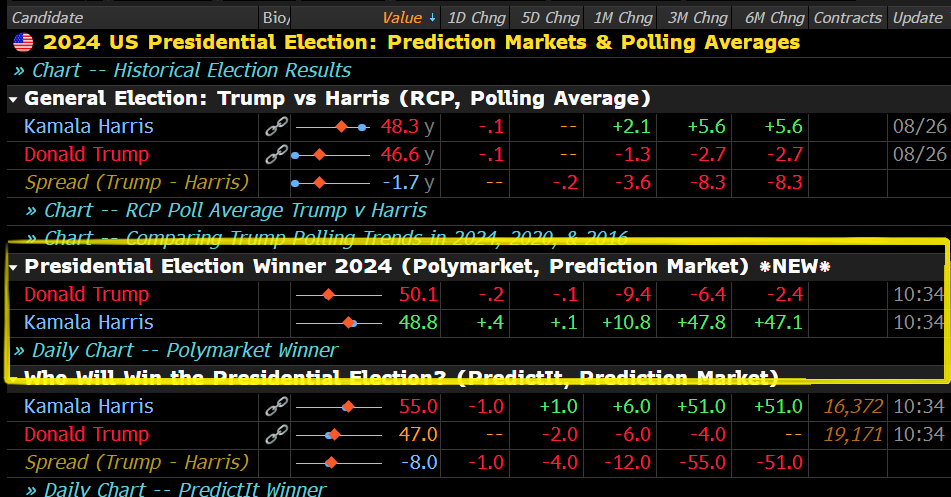

The odds show Donald Trump is slightly ahead of Kamala Harris, with Trump holding a 50% chance of winning, and Harris is close behind at 48%.

These odds change rapidly based on trader sentiment and outside political developments. For instance, Trump’s odds recently jumped, showing bettors’ increased confidence in his chances of returning to the White House.

Polymarket’s ability to update odds in real-time makes it a valuable tool for those who want to stay on top of the latest developments without relying solely on traditional polling.

Bloomberg Terminal is a giant in the financial data world, with around 350,000 subscribers globally. By bringing in Polymarket’s real-time election odds, Bloomberg is offering its users a mix of traditional polling data and crowd-sourced predictions.

This integration is timely, given the heightened interest in the election. With Polymarket’s odds now part of the Terminal, analysts and investors have a new tool to gauge the political outcome in November.

Compared to other prediction markets like PredictIt, Polymarket usually has more liquidity and offers a wider variety of bets. PredictIt often gets flak for limiting how much people can bet and how many can participate, which can tamper with its accuracy.

Polymarket, on the other hand, has higher trading volumes and fewer rules, creating a more flexible market that could lead to better predictions. But Polymarket also had its slip-ups.

In Pennsylvania, for example, the odds for a Republican win tanked from 61% to 0% as the results rolled in, showing a big gap between what the market expected and what actually happened.

Similar mistakes happened in Georgia and Arizona, where the platform kept showing Republican leads until right after the polls closed, only to see those odds crumble as real results started to come in.