Bloomberg Intelligence’s senior macro strategist Mike McGlone is warning that Bitcoin’s (BTC) latest rally above $31,000 is running up against a powerful headwind.

McGlone tells his 58,500 Twitter followers that he believes recessionary pressures are coming that could cause Bitcoin to retest the $20,000 level.

“Bitcoin $20,000 or $40,000? Facing the Fed, Recession, Nasdaq – Potential launch of US ETFs (exchange-traded funds) won’t shield Bitcoin from facing its first US recession, a potential equity bear market and vigilant central banks. Lessons of risk-assets vs. negative liquidity and economic contraction.”

McGlone believes that liquidity is continuing to drain out of the markets with many central banks outside of the US increasing interest rates this month.

“Bitcoin’s key pivot point has been around $30,000 since 2021, when most risk assets appreciated on the back of the biggest money-supply surge in history. That liquidity rug-pull is still happening, with most central banks continuing to tighten in June, could be a headwind, even as risk assets have bounced on hopes for a mild US recession and easing by the Fed.”

He also warns that rallying stocks may have reached a near-term peak with no sign of increasing market liquidity.

“Our graphic shows Bitcoin trailing the recent Nasdaq 100 Stock Index gains, which may have peaked. Federal funds futures in one year (FF13) show little potential for additional liquidity fuel.”

The Bloomberg analyst also says that BlackRock’s spot Bitcoin ETF application, news of which coincided with Bitcoin’s latest rally, is not likely to receive approval in 2023.

He warns that there are economic signals that a recession is going to arrive within months.

“Physical Bitcoin ETFs in the US are a matter of time, we believe. BlackRock’s application to start such a fund appears to have expedited this process, but a launch may not come in 2023, and Bloomberg Economics expects the US to tilt toward recession in coming months.”

However, a different top crypto analyst is taking a more bullish view.

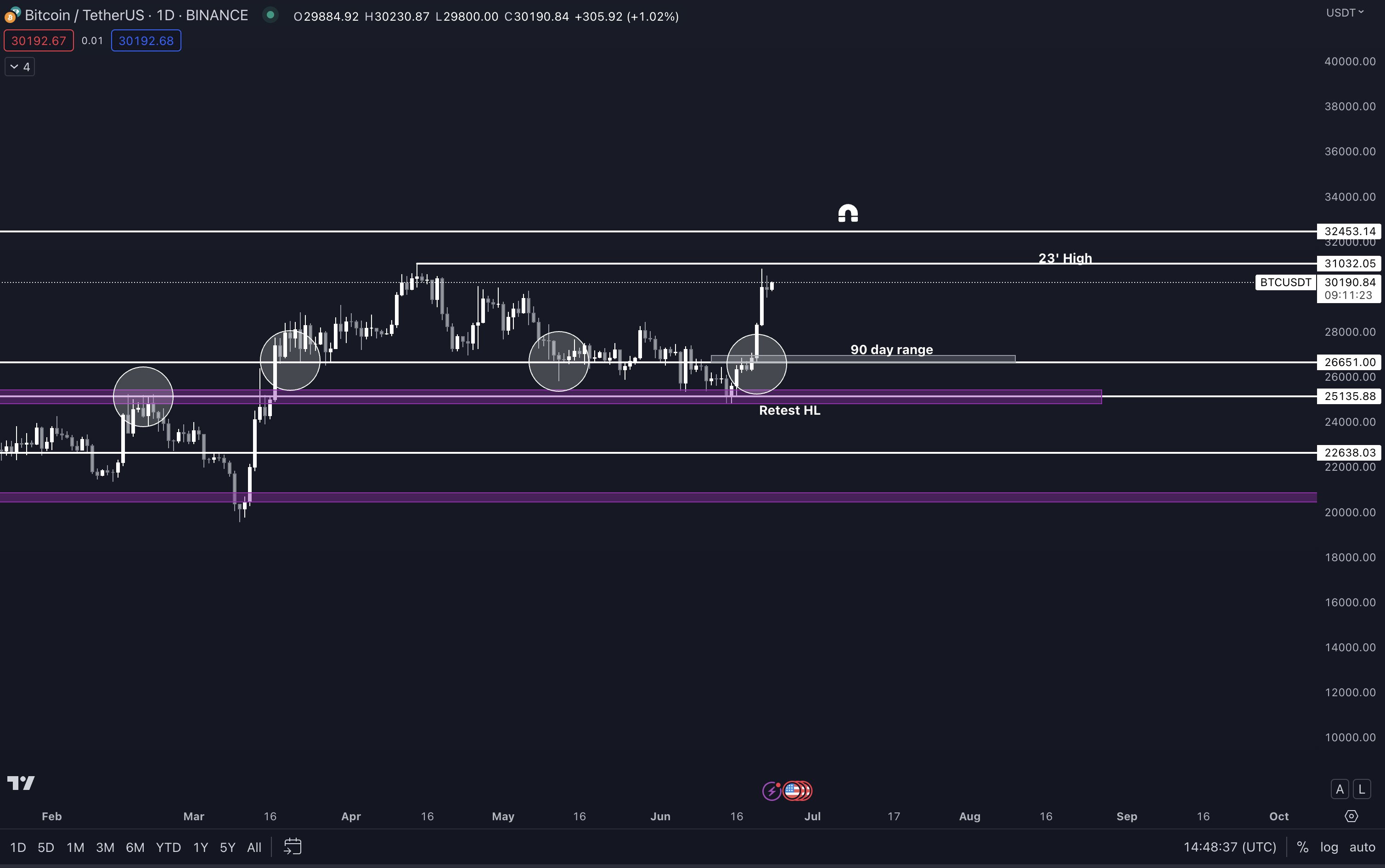

Pseudonymous analyst Pentoshi tells his 693,200 Twitter followers that Bitcoin is likely to soon print new 2023 highs at the $32,453 level.

“Yearly high next imo (in my opinion).”

The crypto trader says key support levels for Bitcoin held up last week including a higher low at the $25,000 level, setting the stage for a big bounce up.

“BTC to $32,500 on HTF’s (high timeframe).

HL (Higher Low) at must hold level $25,000

Reclaimed and then retested $26,700.”

Bitcoin is trading for $30,891 at time of writing, up 2.4% during the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Sensvector/EB Adventure Photography

The post Bloomberg Analyst Mike McGlone Says Bitcoin (BTC) Facing One Massive Headwind As It Hovers Above $30,000 appeared first on The Daily Hodl.