Bitcoin price action could remain sideways for longer, but BNB, AR, XMR, and TIA may see some short-term gains.

Bitcoin (BTC) is facing resistance above the psychological barrier at $70,000, but a positive sign is that the bulls have not ceded much ground to the bears. Bitcoin is down marginally by just under one percent this week.

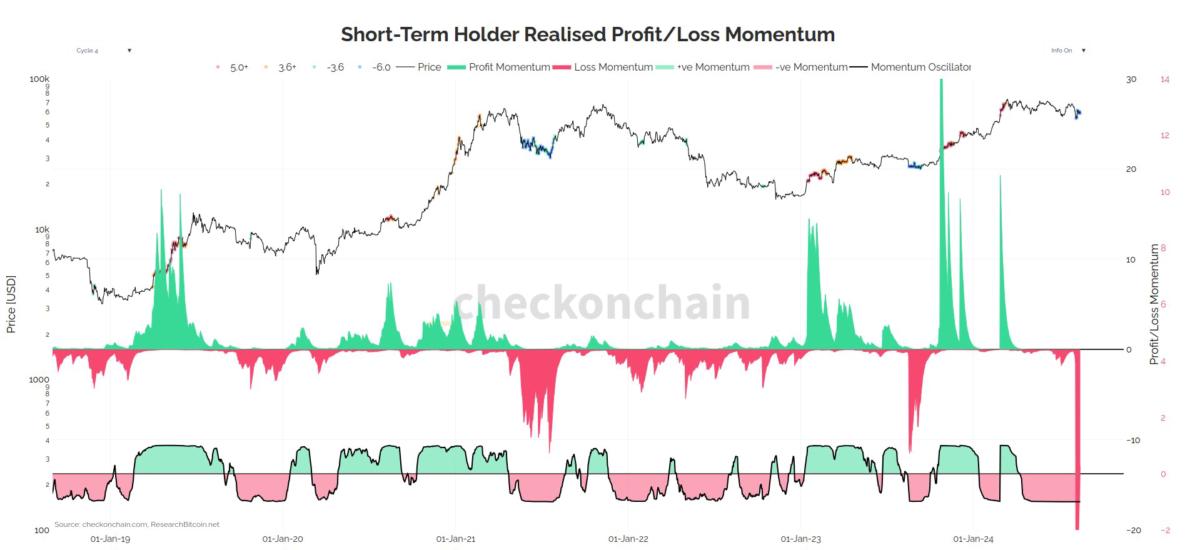

Bitcoin’s range-bound action over the past few days has not hampered investments into the spot Bitcoin exchange-traded funds. Farside Investors data shows more than $2.1 billion in net inflows into the Bitcoin ETFs since May 14. This suggests that the investors are accumulating Bitcoin, anticipating a breakout to the upside.

Veteran trader Peter Brandt is bullish on Bitcoin in relation to gold in the long term. In a post on X, Brandt said that the ratio of gold to Bitcoin is likely to remain volatile for another 12-18 months, but after that, the rally could hit a new high where 100 ounces of gold is needed to buy one Bitcoin. Currently, each Bitcoin is worth about 29 ounces of gold.