Bitcoin could face headwinds at $52,000, but BNB, KAS, VET, and RNDR may continue to move higher.

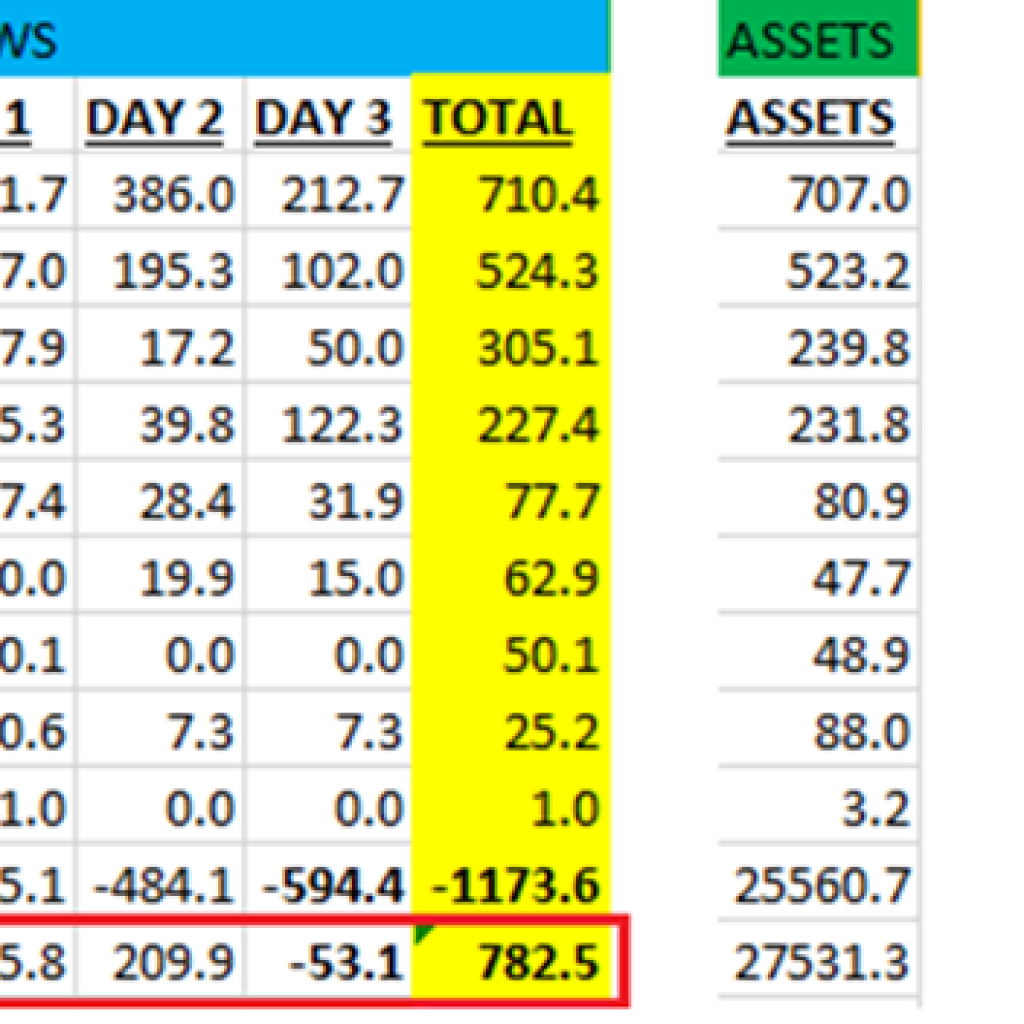

Inflows into the spot Bitcoin (BTC) exchange-traded funds (ETFs) topped $2.2 billion between Feb. 12 and Feb. 16, indicating a strong investor appetite. Bloomberg analyst Eric Balchunas said in a X post that BlackRock’s iShares Bitcoin Trust (IBIT) has attracted year-to-date inflows of $5.2 billion, which is “50% of BlackRock's total net ETF flows, out of 417 ETFs.”

Bitcoin continued its rally this week, rising about 7%, but the bulls are facing stiff resistance near $52,000. One of the near-term concerns is the potential selling of roughly $1.3 billion worth of Grayscale Bitcoin Trust shares by bankrupt crypto lending firm Genesis to reimburse creditors.

If Bitcoin consolidates in the short term, the action may shift to altcoins. Select altcoins that have broken above their respective overhead resistance levels in the past few days are likely to witness a continuation of the rally.