Discover the ins and outs of bonding curves in DeFi and their role in shaping token pricing dynamics and liquidity provision within blockchain ecosystems.

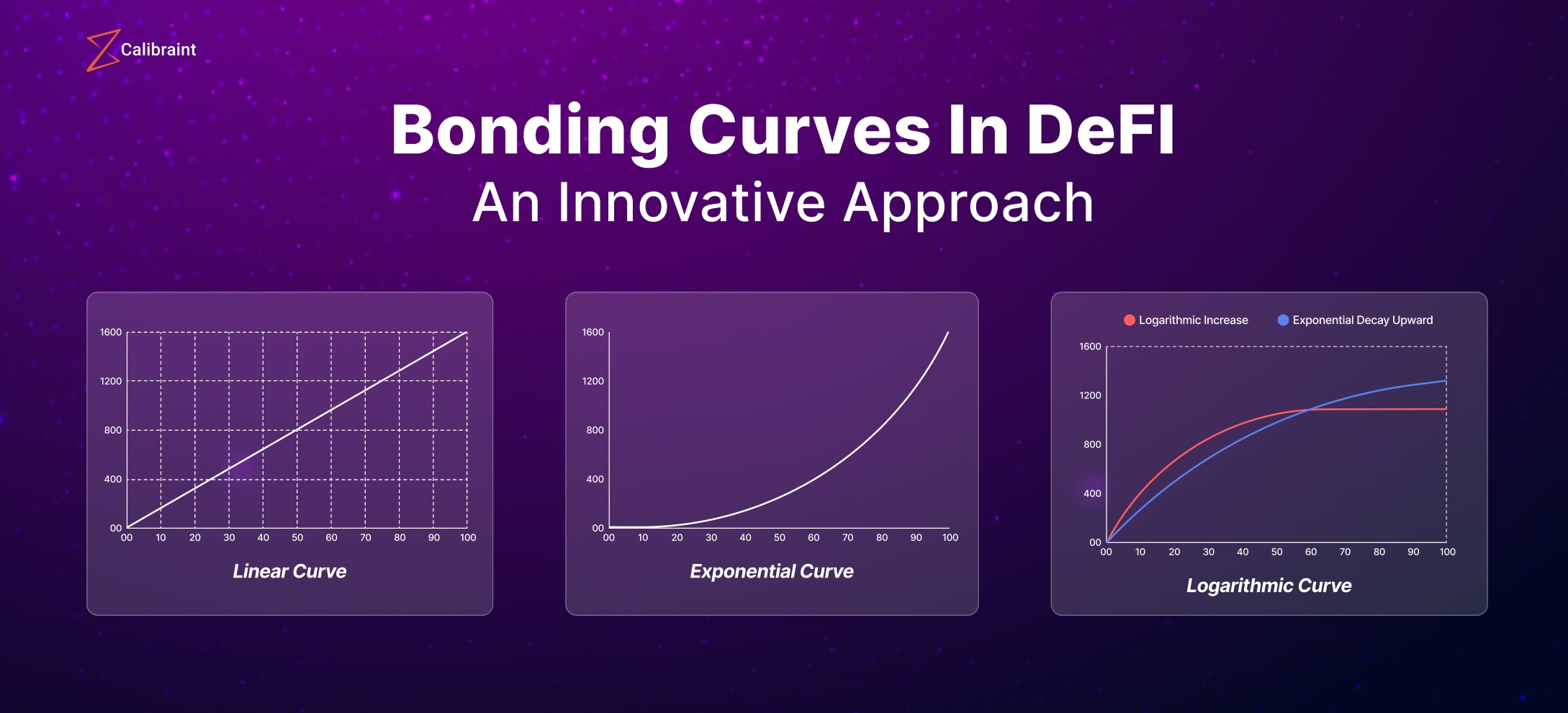

Bonding curves in decentralized finance (DeFi) leverage smart contracts and mathematical formulas to dynamically adjust a token’s price based on its supply.

Bonding curves are smart contracts that algorithmically determine a token’s price based on its circulating supply. As more tokens are purchased, the price adjusts upward, and as tokens are sold or removed from circulation, the price adjusts downward.