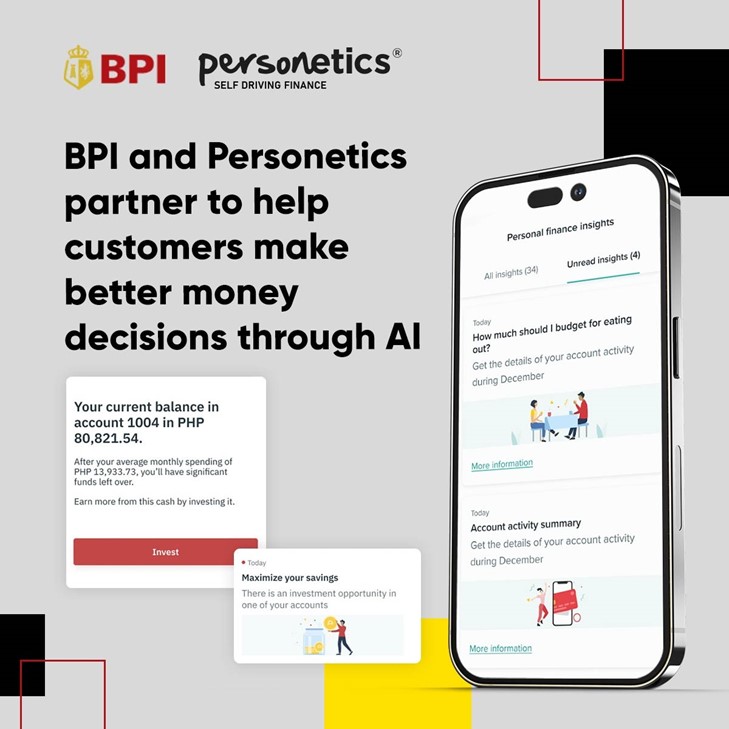

In a strategic alliance aimed at enhancing customer financial management and promoting financial literacy, Bank of Philippine Islands (BPI) has joined forces with Personetics, a global leader in financial data-driven personalization and customer engagement. This partnership introduces cutting-edge hyper-personalized digital experiences for BPI’s customers, leveraging the power of artificial intelligence (AI) and advanced data analytics. BPI’s commitment to digitalization and customer-centricity has led to the launch of the Track and Plan tool on their new app, a revolutionary solution that provides customers with valuable insights into their spending habits and financial well-being.

Empowering customers through AI-powered personalization

BPI’s recent introduction of the Track and Plan tool within its new app reflects its dedication to providing an exceptional digital banking experience. This tool analyzes the financial activities of individual users, offering personalized insights into their spending patterns. This initiative aligns with BPI’s core principles of digitalization, customer-centricity, and sustainability.

To realize its vision of improving customers’ financial well-being and bolstering financial literacy, BPI has harnessed the capabilities of Personetics’ AI-powered and advanced data analytics solution. This collaboration aims to provide personalized recommendations to over four million active digital customers, utilizing their transactional data as the foundation for tailor-made financial advice.

Empowering customers with self-service banking

With the introduction of the new BPI app and the Track and Plan tool, the bank has empowered customers with self-service options for various financial transactions, including depositing funds and bill payments. However, the partnership with Personetics takes this empowerment to the next level. BPI’s focus now extends beyond transactional convenience to value-added advisory services, delivering 20 pre-configured hyper-personalized insights to help customers effectively manage their finances, make informed decisions, and save intelligently.

The role of personetics’ engagement platform

Personetics’ Engagement Platform plays a pivotal role in this collaboration by enriching personal savings and debit card data. It categorizes this data in ways that are meaningful for BPI’s customers, creating a foundation for AI, machine learning, and natural language programming (NLP) models to generate actionable insights and recommendations. This technology ensures that the advice provided is easy to understand and tailored to the specific sensitivities, behaviors, and concerns of BPI’s diverse customer base.

Fitzgerald Chee, Head of Consumer Platforms at BPI, expressed his pride in providing customers with rich, personalized recommendations and insights, making BPI a trailblazer in this aspect. He emphasized Personetics’ role as an ideal partner in empowering customers to shape their own financial futures actively.

David Sosna, CEO, and Co-founder of Personetics echoed these sentiments, highlighting the opportunity to address consumers’ unique banking issues and financial concerns. Personetics is committed to supporting BPI’s mission to advance financial literacy and well-being.

Future enhancements and sustainability

The partnership between BPI and Personetics envisions further enhancements, including the integration of credit card data. This addition will provide customers with additional tools to bolster their personal financial management and well-being. Moreover, plans are in place to introduce ACT auto-savings and sustainability insights, enabling customers to set and achieve their savings goals while contributing to sustainability efforts.

BPI’s long history of innovation

As a leading provider of financial services with over six million retail customers, BPI has a storied history of innovation and industry leadership. The bank continues to play a pivotal role in shaping the economic landscape of the Philippines by financing private and public sector initiatives. BPI’s commitment to digital banking innovations and sustainability aligns with its goal of building a better, more inclusive Philippines.

About personetics

Personetics is a global leader in financial data-driven personalization, customer engagement, and advanced money management capabilities for financial services. The company is pioneering the future of “Self-Driving Finance,” where banks proactively act on behalf of customers to improve their financial wellness and achieve their financial goals. Personetics’ data analytics solutions provide actionable insights, personalized recommendations, financial advice, and automated financial wellness programs. The company serves over 130 financial institutions in 34 global markets, reaching 135 million customers.

About BPI

The Bank of the Philippine Islands (BPI), established 172 years ago, is the first bank in the Philippines and Southeast Asia. BPI operates as a universal bank, offering a diverse range of financial services, including deposit-taking, cash management, payments, lending, asset management, bancassurance, investment banking, securities brokerage, and foreign exchange. The bank has a strong financial position, robust Tier 1 capital adequacy ratios, and a commitment to compliance and risk management.

The partnership between BPI and Personetics represents a pivotal moment in the world of digital banking. By harnessing the power of AI, advanced data analytics, and personalized insights, BPI is not only empowering its customers but also advancing financial literacy and well-being in the Philippines. As BPI continues to innovate and redefine the banking landscape, it stands as a shining example of how technology can drive positive change and enhance customer experiences in the financial industry.