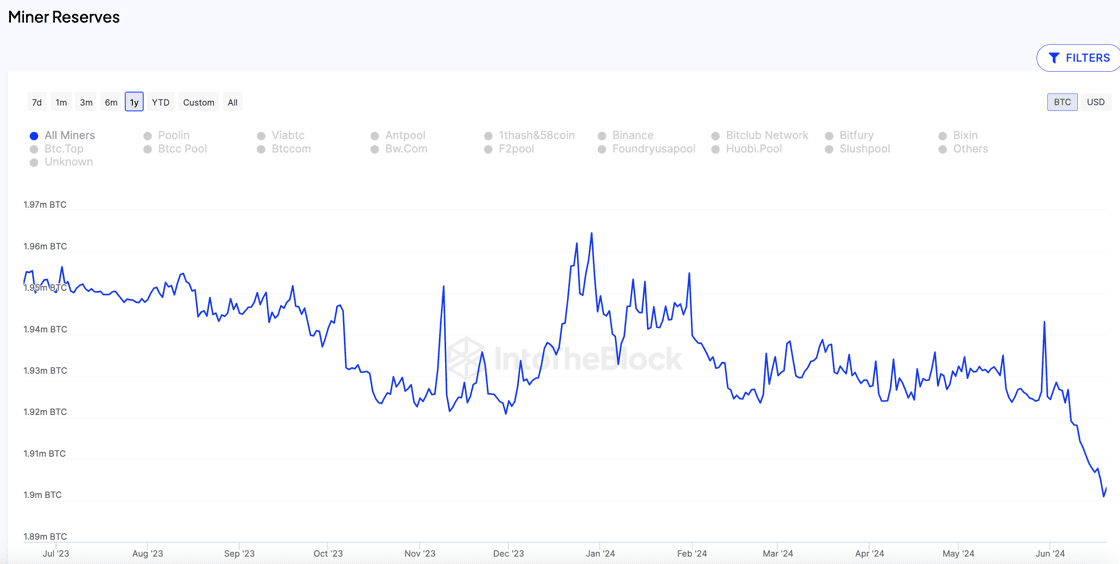

Bitcoin miners have offloaded a staggering $2 billion worth of Bitcoin since June, marking the fastest sell-off in over a year. The dramatic drop in Bitcoin mining holdings to a 14-year low has sent ripples through the market, raising questions about the future of Bitcoin’s price action in the near term.

The miners’ mass exodus of BTC can be attributed to various factors, including the recent Bitcoin halving and a huge decline in profitability. Bitcoin miners have faced increasing pressure to sell due to the higher breakeven prices that have emerged post-halving.

Several other elements have compounded the situation. Despite positive news in the Bitcoin space, such as Microstrategy’s purchase of nearly 12,000 BTC (approximately $786 million), Arthur Hayes’ bullish macro outlook, and Michael Dell’s endorsement of Bitcoin, the price action has remained weak, with Bitcoin trading as low as $63,000.

Miners’ wallets have seen a drastic reduction, with total reserves dropping by 50,000 BTC from the beginning of the year. This significant sell-off reflects the financial strain miners are under.

Related: Bitcoin at risk of plunging to $60,000 as traders abandon it

Additionally, the market has been shaken by the German government’s recent sale of around 3,000 BTC, with an additional 47,000 BTC reportedly still to be sold. This influx of Bitcoin into the market has added to the downward pressure on prices.

Moreover, the volatility market whispers indicate a cap on Bitcoin prices in the short term, but an explosively bullish trend is expected as we approach the year-end.

Large selling of call options with expiries under one month and aggressive buying for September to December highlight market expectations of a summer consolidation followed by a significant rally, potentially tied to the US elections.

Ethereum (ETH) remains a focal point of bullish sentiment, with ETH volatility trading at an 18% premium to Bitcoin, driven by the anticipation of an imminent ETH spot ETF launch.

Traders are positioning themselves to capitalize on this bullish sentiment by monetizing the premium in ETH volatility to earn a high yield as ETH trends higher throughout the summer.

A notable trade idea circulating involves ETH CFCC (Coupon Forward Contract), which offers a coupon payment of 55% per annum every Friday as long as the spot price remains above $3,500.

The contract expires on September 13, with a strike price of $3,000 and protection at $2,500. If the spot price falls below $2,500 at expiry, the USD deployed is converted to ETH at the $3,000 price point.

Jai Hamid